For eight years, Swiss savers faced negative interest rates, which meant that their money earned them nothing or even cost them. This situation was due to the 2008 crisis, which led central banks to cut interest rates to stimulate the economy. In Switzerland, the Swiss franc strengthened, raising concerns for the export industry and prompting the Swiss National Bank (SNB) to introduce negative interest rates to encourage spending rather than investment. saving.

But the situation has changed recently due to the current inflationary environment. Since 2022, the US and European central banks have started to raise their interest rates and the SNB did the same last September. As a result, since the beginning of this year, Swiss banks have resumed recommending the savings accounts of their customers.

In 2023, neobanks and online banks reacted quickly by offering better interest rates to attract new customers.How to take advantage of higher interest rates in Switzerland

Here are the possible options to take advantage of the higher interest rates in Switzerland:

- Private online account: neobanks (online banks) in Switzerland can offer competitive interest rates on their private accounts, this is the case of Zak Bank for example. See the charts below for rates.

- Traditional savings accounts: Swiss banks have raised interest rates on their traditional savings accounts, offering better yield opportunities.

- Online savings accounts: Neobanks in Switzerland can also offer more competitive interest rates on their savings accounts.

- Cooperative banks: The cooperative banks in Switzerland have also increased the interest rates on their savings accounts.

It is important to note that interest rates may vary from bank to bank and may be subject to specific conditions.

Changing banks for a better interest rate?

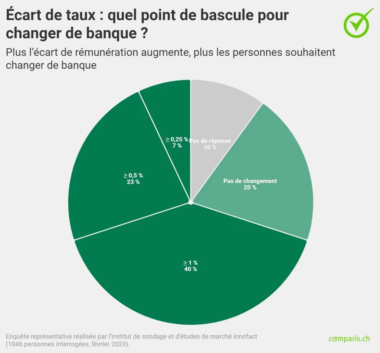

According to a survey carried out by comparator Comparis, around a quarter of Swiss savers plan to transfer their money to another bank because of interest rates. This dissatisfaction is mainly linked to the fact that more than half of savers (54%) only receive an interest rate of 0.25% or less on their deposits.

Source: Comparis. 40% of savers would leave their bank if another bank’s interest rate were at least 1% higher

Those aged 18-35 are the most likely to switch banks: with 33% planning to transfer their funds elsewhere. The 36 to 55 age groups follow closely with 26%, while only 17% of people over 56 expect to change their financial institution.

Romands are more determined to switch banks, with 33% planning to close their savings account this year and switch to a bank offering more attractive interest rates, compared to 24% % for German-speaking Switzerland (German-speaking region) and 10% for Ticino. City dwellers are also more inclined to change than rural dwellers, at 30% versus 18%.

Interest rates for private accounts and savings accounts in Switzerland

Here is an overview of the different banks and their interest rates:

Interest rates for private accounts

In July 2024, only Swiss neobanks offer interests on private accounts:

| 0 – 25000 CHF | - 100 000 CHF | Condition | Withdrawal limit | |

|---|---|---|---|---|

| Alpian | 1,00 % | 1,25 % | - | - |

| CSX Crédit Suisse | 0,00 % | - | - | - |

| Neon Bank | 0,75 % | 0,50 % | Spaces | 50 000/mo. |

| Radicant | 1,25 % | 1,25 % | 1.00% above CHF 250,000 | - |

| Zak Bank Cler | 1,00 % | - | - | - |

| Yapeal | 0,00 % | - | - | - |

| Yuh Bank | 1,00 % | 1,00 % | 0,75% for EUR & USD | - |

Savings account interest rates

| 0 – 25000 CHF | - 50 000 CHF | - 100 000 CHF | - 250 000 CHF | Withdrawal limit | |

|---|---|---|---|---|---|

| Crédit Suisse | 0,75 % | 0,75 % | 0,25 % | 0,25 % | 50,000/year |

| PostFinance | 0,70 % | 0,70 % | 0,48 % | 0,34 % | 100 000/year |

| CIC (Switzerland) | 0,60 % | 0,60 % | 0,60 % | 0,60 % | 25 000/year |

| Banque Cantonale de Bâle (BLKB) | 0,60 % | 0,60 % | 0,60 % | 0,48 % | 100 000/year |

| UBS | 0,50 % | 0,50 % | 0,38 % | 0,30 % | 50 000/year |

| Raiffeisen | 0,50 % | 0,50 % | 0,50 % | 0,50 % | 30 000/mo. |

| Valiant | 0,50 % | 0,30 % | 0,20 % | 0,14 % | 25 000/year |

| Banque cantonale de Genève (BCGE) | 0,50 % | 0,34 % | 0,22 % | 0,15 % | 50 000/year |

| Banque Cantonale Vaudoise (BCV) | 0,50 % | 0,38 % | 0,31 % | 0,19 % | 10 000/mo. |

| Migros Bank | 0,40 % | 0,40 % | 0,40 % | 0,16 % | 50 000/mo. |

| Bank Cler | 0,45 % | 0,45 % | 0,45 % | 0,45 % | 100 000/year |

| Banque Cantonale du Valais (BCVS) | 0,30 % | 0,30 % | 0,25 % | 0,22 % | 50 000/year |

Interestingly, some banks stand out by offering attractive interest rates for small savers. Credit Suisse offers an interest rate of 1.00% for amounts up to CHF 50,000, which is comparatively high.

However, for larger assets, the interest rate offered by Credit Suisse is less competitive. Similarly, UBS and PostFinance offer less attractive interest rates as the amount saved increases. On the other hand, some banks offer the same interest rate regardless of the amount saved, which can be advantageous for savers with higher amounts.

Some banks adopt t special strategies to attract deposits, such as interest bonuses for new deposits or online savings accounts with higher interest rates.

Private account or savings account?

Savings accounts have higher interest rates than private accounts, although interest rates may vary each month.

However, it is important to take into account the costs associated with savings accounts, such as the annual maintenance fee or the closing fee account strong>. In addition, the maximum interest rates on savings accounts are often applicable up to a certain capped amount. Beyond this amount, the interest rate may be lower, or even zero.

Some neobanks stand out with comparatively high rates on private accounts of up to 1.00%, while – in May 2023 – the average interest rate on business accounts savings was 0.50%.

We therefore wanted to take a closer look at what one of them offers: Zak

A private account interest rate of 1.00% at Zak

Several neobanks have already raised interest rates on their private accounts.

This is the case of Zak, which currently offers you a interest rate of 1.00% on your Zak private account., up to CHF 25,000.

This means that it is not necessary to block your money in Savings pots to benefit from interest of 1.00%. You continue to have your money while being paid.

This flexibility offered by Zak is not available from the major Swiss banks: you can therefore consider using Zak as a private account and PostFinance or a cantonal bank for your savings greater than CHF 25,000, for example.

ZAK Bank Promo Code

ZAK Bank Promo Code

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before 31 July 2024 to get CHF 50 for FREE 🙌

Get CHF 50 Free with ZAK ➡️