Do you want to build your assets but don’t know where to start? The savings plan from Neon Bank could be the solution you need . This simple and flexible tool allows you to regularly invest in stocks or ETFs (exchange traded funds) without having to worry about stock selection or timing of purchases.

How does the Neon savings plan work?

It is very simple. Simply choose up to three stocks or ETFs from a wide selection available on the Neon platform. Then you define the amount you want to invest each month. You can start with a small amount and gradually increase it over time. Once you have chosen your investments and defined your savings amount, Neon takes care of the rest. Each month, the platform will automatically invest your money in the securities you have chosen.

How to create a Neon savings plan

To create a savings plan, follow these simple steps:

- In the neon application, click on the “Invest” tab.

- Scroll down the page until the savings plan option is visible.

- Click on “Start saving”.

- Choose the stock or ETF you want to invest in.

- Select the amount you want to invest each month.

- Click on “Confirm” to set up your savings plan.

To cancel a savings plan:

- In the savings plan overview, click on the investment you want to change.

- Click “Delete”.

- You can do this at any time, except on the day of execution of the savings plan, where investments are automatically made in the stocks or ETFs you have chosen.

Neon Promo Code: NEONEO

Neon Promo Code: NEONEO

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the promo code NEONEO before 30 September 2024 to receive up to 30 CHF cashback on the trading fees of your first 3 trades + your FREE debit card 🙌

Get CHF 30 Free with Neon ➡️

Examples of investment with the Neon savings plan

Let’s take the example of an investor who wants to invest 300 CHF per month in Apple shares and 200 CHF in ETF Global Stocks (FTSE).

- Selection of investments: The investor chooses two investments from a wide selection of stocks and ETFs available on the neon platform. It is important to diversify investments to reduce risk by spreading money across several securities in different sectors. In this example, the investor chose Apple stocks (representing one company) and a Global Stocks ETF (a basket of stocks from different companies).

- Definition of the savings amount: The investor defines the amount he wishes to invest each month, i.e. 500 CHF in total (300 CHF for Apple and 200 CHF for Global Stocks ETFs) . He can start with a small amount and gradually increase it over time depending on his saving capabilities.

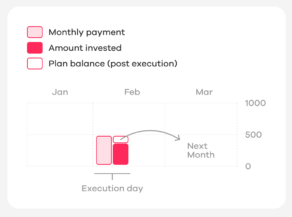

- Automatic execution of investments: Once the investments and savings amount are defined, Neon takes care of the rest. Each month, on the first business day, the platform will automatically deduct 500 CHF from the investor’s account. This money will then be invested in the chosen stocks and ETFs, in proportion to the amount allocated to each investment.

Investment of funds

Let’s take the first month of investment. Neon will purchase as many Apple shares as possible with the 300 CHF allocated for this investment, taking into account brokerage fees. Suppose the price of an Apple share is 160 CHF and the brokerage fee is 0.5%. Neon will be able to buy 1.81 Apple shares (300 CHF / 160 CHF per share + 0.5% fees).

The remaining balance, i.e. 19 CHF (300 CHF – 1.81 shares x 160 CHF per share), will be carried over to the following month and invested in addition to the monthly contribution of 300 CHF.

For Global Stocks ETFs, the process is similar. Neon will purchase as many ETF units as possible with the allocated CHF 200, taking into account brokerage fees.

Subsequent investments

Each subsequent month, the process repeats. Neon will take 500 CHF from the investor’s account and invest them ra in Apple shares and Global Stocks ETFs, in proportion to the amounts initially defined (300 CHF for Apple and 200 CHF for ETFs).

The remaining balance from previous investments, if any, will also be invested. This allows the investor to gradually acquire more shares and ETF units over time, even if security prices fluctuate.

What are the fees of the Neon savings plan

Here are the fees of the Neon Savings Plan

Deposit fees:

- No deposit fees for your wallet.

Transaction fees:

- Swiss stocks and ETFs: 0.5% of the purchase or sale price per transaction. Several ETFs at 0%

- International stocks: 1% of the purchase or sale price per transaction (no additional fees for currency exchange).

List of 0% ETFs with the Neon savings plan

Neon offers – in its savings plan – a list of ETFs with 0% fees, making stock market investing more accessible to everyone. You can invest regularly in ETFs without paying management fees, which allows you to maximize your returns.

Here is a summary table of the 0% ETFs offered by Neon:

| ETF name | Description | TER (Product Cost) | ISIN |

|---|---|---|---|

| Invesco FTSE All-World | Access to the global equity market | 0,15% | IE000716YHJ7 |

| Invesco MSCI World ESG Climate Paris Aligned | Access to the sustainable global equity market | 0,19% | IE000V93BNU0 |

| FuW Swiss 50 ETP | Tracking the 50 largest Swiss companies | 0,72% | CH1292088809 |

| Xtrackers AI & Big Data | Performance of the Nasdaq Global AI and Big Data Index | 0,35% | IE00BGV5VN51 |

| Xtrackers MSCI Global SDG 7 Affordable and Clean Energy | Companies contributing to the UN Sustainable Development Goals | 0,35% | IE000JZYIUN0 |

| Xtrackers Nasdaq 100 | Performance of the 100 largest non-financial companies on the Nasdaq | 0,20% | IE00BMFKG444 |

Note: this list may change, consult the list of ETFs in the neon app, under the “Invest” tab.

How can the Neon Savings Plan help you achieve your financial goals?

The Neon Savings Plan is a powerful tool that can help you realize your long-term financial dreams. By investing regularly, even small amounts, you can build your wealth and achieve your goals, such as buying a home, preparing for retirement or building up capital for your children.

1. The magic of compound interest

At the heart of the Neon Savings Plan is the concept of compound interest. When you invest your money, it starts earning interest. Over time, this interest is reinvested and generates interest itself, which significantly amplifies the growth of your capital.

Let’s take a concrete example: suppose you invest 100 CHF per month in the Neon savings plan over a period of 20 years, with an average annual return of 5%. Without taking inflation into account, your investment would total approximately CHF 38,643 at the end of the period.

However, this amount only includes the interest earned on your initial contributions. If you reinvest dividends or other gains generated by your investments, the final amount could be even greater.

2. Invest early and regularly

One of the main advantages of the Neon Savings Plan is its flexibility. You can start investing with a small amount, even CHF 50 per month, and gradually increase your contribution over time.

The earlier you start investing, the more time you have for your compound interest to compound. Even small amounts invested regularly can make a big difference in the long run.

3. Diversify your investments

The Neon Savings Plan allows you to diversify your investments by choosing from a wide selection of stocks, ETFs and other securities.

Diversification is essential to reduce the risk of your portfolio. By spreading your money across different types of investments, you minimize the impact of possible drops in value on a specific stock or sector.

4. Take advantage of the cost spreading effect

By investing regularly via the Neon savings plan, you benefit from the cost spreading effect. This means you buy securities at different prices, which helps smooth out the impact of market fluctuations.

If the price of a security falls, you can buy more units for the same investment amount. Conversely, if the price increases, you buy fewer units, but the overall value of your investment remains the same.

5. Achieve your financial goals with discipline

The Neon Savings Plan helps you stay disciplined with your investments. By automating your monthly contributions, you ensure you invest regularly, even when you don’t have the time or inclination to take care of it.

Discipline is essential to achieving your long-term financial goals. By committing to investing regularly, you increase your chances of success.

How is the Neon savings plan different?

By opting for a Neon savings plan, you considerably simplify your financial management. You no longer have to worry about following the markets or making frequent investment decisions. Automating your investments allows you to spare your precious brain cells and focus on other aspects of your financial or personal life.

Plus, by investing automatically each month, you maintain regular investing discipline, which helps you stick to your long-term savings goals, even when markets are volatile or other financial priorities arise. .

Avoiding the trap of market timing is also crucial. By choosing a savings plan, you reduce the risks related to making impulsive or emotional decisions based on short-term market fluctuations. Instead, you focus on regular, strategic investing that minimizes costs and maximizes long-term return potential.

Finally, by investing regularly in a savings plan, you benefit from the average cost effect. This strategy allows you to buy shares at regular intervals, regardless of market price levels. This means you buy more shares when prices are low and fewer shares when prices are high, which can help maximize your portfolio’s performance over the long term.

In summary, opting for a savings plan gives you a simplified, disciplined and strategic approach to investing, eliminating the hassle of market timing and harnessing the benefits of regular investing and cost averaging.

Neon Promo Code: NEONEO

Neon Promo Code: NEONEO

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the promo code NEONEO before 30 September 2024 to receive up to 30 CHF cashback on the trading fees of your first 3 trades + your FREE debit card 🙌

Get CHF 30 Free with Neon ➡️