In July 2024, there are 7 neobanks in Switzerland with their headquarters in Switzerland and offering Swiss IBAN starting with CH: Alpian, CSX (Crédit Suisse), Neon Bank, Radicant Bank, Yapeal, Yuh and ZAK Bank.

Then comes 2 other neobanks active in Switzerland: N26 and Revolut. We can also add to the list Wise (TransferWise), a peer-to-peer currency exchange platform that competes with other neobanks with their Borderless multi-currency account.

FlowBank is not in this ranking because it is a trading platform that does not offer traditional banking services.

So how do you choose the neobank that suits you best knowing that – for now – all are free and smartphone-based? We evaluated 20 criteria to help you choose the best Mobile Banking App or neobank in Switzerland and have obtained the following ranking:

Ranking of the Best Mobile Banking Apps in Switzerland in July 2024

| RANKING | NEOBANK | TOTAL |

|---|---|---|

| 1 | Yuh | 18 points |

| 2 | Neon Bank | 16 points |

| 3 | Zak Bank | 15 points |

| 4 | Radicant Bank | 14 points |

| 5 | Alpian | 13 points |

| 6 | CSX | 13 points |

| 7 | Revolut | 11 points |

| 8 | Wise | 11 points |

| 9 | N26 | 11 points |

| 10 | Yapeal | 10 points |

Feb 3, 2022 update: Neon have launched their new Mastercard that comes with push notifications for each transaction. They gain 1 point and take the lead of this ranking, before Zak Bank.

March 30, 2022 update: Zak has launched eBill. You just need to activate the plugin in the app

April 23, 2022 update: Neon has launched Spaces, to help organise your finance

December 2, 2022 update: Yuh bank offers eBill.

January 30, 2022 update: Yuh bank offers 50 CHF Trading Credit with the code YUHNEO

May 26, 2023 update: Yuh bank now offers Yuh TWINT

January 10, 2024 update: Yuh bank now also offers a free virtual card

January 16, 2024 update: New Neon Bank promo code: NEONEO

January 21, 2024 update: Taking into account interest rates (RATES) and the virtual card offer (VIRTUAL) in the ranking.

January 22, 2024 update: Addition of Alpian and Radicant Bank to the ranking.

May 5, 2024 update: Neon increase the delivery fee of their MasterCard to CHF 20.

June 2nd, 2024 update: added a CSX promo of 25 CHF for July 2024 : PA1289

The Best Mobile Banking Apps and Neobanks in Switzerland

FREE: You want a free online bank account

CSX, Neon, Yuh, N26, Radicant Bank, Revolut, Wise (TransferWise) and ZAK offer free account opening and maintenance (no monthly fee) ✅

Alpian offers you the first 6 months, but then charges between 0 and 45 CHF per month depending on your asset balance 🚫

Yapeal does not offer a free “real bank account” since January 2021: their free Loyalty plan does not allow bank transfers 🚫

Winners: CSX, Neon, Radicant, YUH, ZAK, N26, Revolut and WisePROMO CODE: You want a welcome bonus when opening your account

Alpian offers you CHF 150 Free and 12 months Free 🙌 with the promo code ALPNEO. Get the Alpian app here ➡️YUH offers you 50 CHF of Trading Credits and 250 SWQ (4 CHF) 🙌 with the promo code YUHNEO. Get the Yuh app here ➡️

Neon Bank offers you up to 30 CHF cashback on the trading fees of your first 3 trades and a FREE debit card 🙌 with the promo code NEONEO. Get the Neon app here ➡️

ZAK offers you 50 CHF Free 🙌 with the promo code NEOZAK. Get the ZAK app here ➡️

Yapeal offers you 30 CHF Free 🙌 with the promo code YAPS311WZ4WL. Get the Yapeal app here ➡️

CSX offers you 25 CHF Free 🙌 with the promo code PA1289. Get the CSX app here ➡️

Radicant offers you 5 CHF Free 🙌 with the promo code 20b2e4. Get the Radicant app here ➡️

WISE offers you fee-free transfer of up to 500 GBP 🙌 with our link. Get the WISE app here ➡️

N26 and Revolut have no welcome offer. 🚫

Winners: Alpian, CSX, Neon, Radicant, Yapeal, Yuh and ZAKCARD: You want a free international debit card

Alpian offers a free VISA debit card, with free delivery ✅

CSX and Yuh offer a free Debit Mastercard, with free delivery ✅

Neon charge CHF 20 for delivery fo the debit card but you can get it FREE with the code NEONEO ✅

Neon Bank

Neon Bank

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the promo code NEONEO before 31 July 2024 to receive up to 30 CHF cashback on the trading fees of your first 3 trades + your FREE debit card 🙌

Get CHF 30 Free with Neon ➡️

ZAK Bank have just launched their free Visa Debit card ✅

N26 only offer a virtual Debit MasterCard on their free plan 🚫

Radicant Bank offers a virtual VISA card but charges 10 CHF for the plastic card 🚫

Revolut offer a free Debit MasterCard but charge EUR 5.50 for delivery 🚫

Wise offer a free Debit MasterCard but charge GBP 5 for delivery 🚫

Yapeal offer a free Visa Debit but charge CHD 7 for delivery 🚫

VIRTUAL: You want a virtual bank card

More and more banks are offering virtual cards for your online purchases. This is already the case for several Swiss neo-banks.

N26, Radicant Bank, Revolut, Wise, Yapeal and Yuh ✅

Alpian, CSX, Neon and ZAK do not yet offer a virtual card 🚫

Winners: N26, Radicant Bank, Revolut, Wise, Yapeal and YuhCASH: You want free cash withdrawals

Only a few Swiss neobanks allow you to withdraw cash without any fee, at any Swiss ATM.

Neon offers 2 free cash withdrawals per month ✅

Yuh offers 1 free cash withdrawal per week ✅

Revolut offers free cash withdrawals up to 200 CHF per month ✅

Wise offers free cash withdrawals up to 250 CHF (GBP 200) over a 30-day period ✅

Radicant offers 12 free withdrawals per year, then 2.00 CHF but you must first pay 10 CHF for the plastic VISA card 🚫

Zak charges 2 CHF per cash withdrawal, unless done from a Bank Cler ATM 🚫

Alpian, CSX and Yapeal charges 2 CHF per cash withdrawal 🚫

N26 is a EURO account, that means that cash withdrawal in CHF implies exchange rate 🚫

Winners: Neon, Yuh, Revolut and WiseRATE: You would like to receive interest on your account

With the rise in rates, neobanks now offer interest rates on your account balance, without the need to place them in savings.

Alpian Promo Code

Alpian Promo Code

Don't have a Alpian Bank account yet? Use our referral code to open your free Alpian Bank account!

Use the promo code ALPNEO before 31 July 2024 to receive CHF 150 and 12 months FREE 🙌

A minimum deposit of CHF 500 is required to benefit from this exclusive offer.

Get CHF 150 Free with Alpian ➡️

Alpian offers 1% interest up to CHF 50,000, then 1.5% beyond ✅

Radicant Bank offers 1.5% interest on your account balance ✅

Yuh offers 1% on any cash amount in CHF and 0.75% on EUR and USD ✅

ZAK offers 1% interest on your account balance ✅

Neon offers 0.90% interest on SPACES accounts, which are therefore similar to savings 🚫

CSX, Yapeal, N26, Revolut, Wise do not offer interest rates on accounts 🚫

Winners: Alpian, Radicant, Yuh, ZakFAST: You want to open a bank account in 15 minutes

N26, Revolut and Wise are without a doubt the 3 best examples of neobanks when it comes to opening a free Swiss bank account in 15 minutes ✅

Neon uses online ID verification. As long as you don’t use a foreign phone number when opening your account, it will quick ✅

At Alpian and Radicant, it takes less than 10 minutes to open an account. ✅

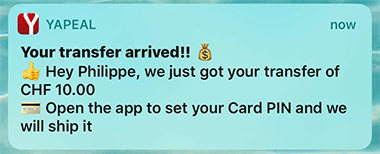

Yapeal has a super-quick opening process: download their apps and upload your ID documents and the account is opened in 5 minutes. ✅

Yuh has a list a 25 questions during the opening process – but you can still make it in 20 minutes ✅

With ZAK, you bank account is opened in 15 minutes and fully activated within 2 hours ✅

CSX has random bugs that can really slow down the opening process. It took us several days 🚫

Winners: Alpian, Neon, Radicant, ZAK, Yapeal, Yuh, N26, Revolut and WiseSMOOTH: You want a very good app

N26, Revolut and Wise offer very user-friendly mobile app ✅

The most user-friendly app with Swiss neobanks are Neon and Yuh ✅

The Alpian application is very well designed, on a black background in a Private Banking style ✅

Radicant is quite ergonomic. New version coming ✅

Yapeal is kind of dark (sad?) but still user-friendly ✅

CSX didn’t create a new mobile app, they mainly re-used the Crédit Suisse app 🚫

Zak Bank lacks of magic 🚫

Winners: Alpian,neon, Radicant, Yapeal, Yuh, N26, Revolut and WiseSAFE: You feel safer with a neobank that belongs to a large Group

Unlike Neon and Yapeal, Zak Bank is not a start-up. Zak belongs to Bank Cler (previously Bank Coop), which brings extra safety to your deposits. ✅

Alpian has a Swiss banking license ✅

CSX is the neobank of Crédit Suisse ✅

Radicant Bank is the neo-bank of BLKB ✅

Yuh has been created by PostFinance and SwissQuote but does not have a banking licence 🚫

Neon is using the services of Hypothekarbank Lenzburg and Yapeal has a Fintech banking licence 🚫

N26, Revolut and Wise are independant neobanks without Swiss banking licence 🚫

Winners: Alpian, CSX, Radicant and ZakCHF: You want an account in CHF with a Swiss IBAN

All neobanks based in Switzerland offer an account in CHF ✅

ZAK Bank Promo Code

ZAK Bank Promo Code

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before 31 July 2024 to get CHF 50 for FREE 🙌

Get CHF 50 Free with ZAK ➡️

Revolut offers a CHF account, but it’s not under your name 🚫

Wise also offers a CHF account, but it’s not under your name 🚫

N26 only offers EUR bank account 🚫

Winners: Alpian, CSX, Neon, Radicant, Yapeal, Yuh and ZakTRANSFERS: You want free bank transfers in CHF

All neobanks based in Switzerland should offer free bank transfers in CHF.

But it’s not the case of Yapeal that does not allow bank transfers on their free plan 🚫

Winners: Alpian, CSX, Neon, Radicant. Yuh and ZakEUR: You want a free bank account in EUR

Most neobanks based in Switzerland will not offer an account in EUR.

Alpian allows you to have a multi-currency account in CHF, EUR, GBP and USD ✅

Yuh offers a multi-currency bank account with either CHF, EUR or USD as main currency ✅

Then your foreign neobanks will offer EUR account: N26, Revolut and Wise. ✅

Winners: Alpian, Yuh, N26, Revolut and WiseSEPA: You want free SEPA bank transfers in EUR

Alpian, N26 and Wise offer free SEPA bank transfers in EUR ✅

Yuh allows you to make free SEPA bank transfers from your EUR sub-account ✅

YUH Promo Code

YUH Promo Code

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

CSX offer free SEPA bank transfers but applies the Crédit Suisse exchange rate and fees: about 2% 🚫

Neon apply a 0.8% to 1.7% extra-fee on bank transfers 🚫

Yapeal apply a 0.75 – 1.65% fee on foreign bank transfers 🚫

Zak apply a 2.5% surcharge on the exchange rate 🚫

Revolut may charge you some extra fees if the main currency of your account is not in CHF 🚫

Winners: Alpian, Yuh, N26 and WiseTRAVEL: You want to travel with your debit card

Revolut and Wise offer multiple currencies and interbank exchange rates ✅

N26 is only in EUR, so you might need to convert twice depending on your destination. But it’s still the best account if you travel within the EURO zone. ✅

Alpian offers an account in CHF, EUR, GBP and USD but applies exchange fees of 0.2% and 0.5% on weekends 🚫

Yuh offer a multi-currency account that includes CHF, EUR and USD but they apply a 0.95% surchage on the exchange rate. And you can’t change on week-ends 🚫

Neon want you to use their card when you travel or make payments abroad. But they apply a 1.5% fee on cash withdrawals in EUR 🚫

Radicant applies an exchange fee of 0.50% for EUROs at 0.8%. 🚫

Zak do not apply extra fee when using the Visa Debit, but they use Viseca exchange rates that are usually higher than interbank rates 🚫

CSX apply the Credit Suisse exchange, higher than the interbank rate🚫

Yapeal apply a 0.75 – 1.65% fee on foreign payments (on their free plan). A fee of 5 CHF is applied to Cash withdrawals abroad. 🚫

Winners : N26, Revolut and WisePUSH: You want instant push notifications

This feature is now offered by all neobanks like N26 and Revolut and also Alpian, CSX, Neon, Radicant, Yapeal, Yuh, Wise and Zak ✅

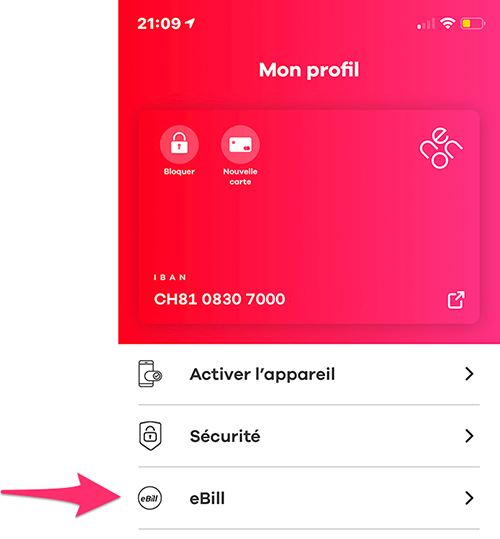

eBill: You need eBill

Currently, only CSX, Neon, Radicant, Zak and Yapeal and Yuh offer eBill from in their mobile app. ✅

As foreign neobanks, N26, Revolut and Wise do not offer eBill 🚫

Winners: CSX, Neon, Radicant, Zak, Yapeal and YuhTWINT: You want to use TWINT

CSX, Radicant and Yuh have a dedicated TWINT app ✅

Neon use the TWINT app of UBS and TWINT Prepaid ✅

ZAK allow you to use TWINT Prepaid but does not have a dedicated app 🚫

Yapeal do not offer TWINT payments yet 🚫

N26, Revolut and Wise will probably never offer TWINT 🚫

Winners: CSX, Neon, Radicant and YuhMOBILE PAY: You want a card for Apple Pay or Google Pay

Alpian offers Apple Pay and soon Google Pay ✅

Neon, Radicant, Yapeal, ZAK, N26, Revolut, Wise and Yuh are compatible with Apple Pay and Google Pay ✅

CSX is now compatible with Apple Pay ✅

Winners: Alpian, CSX, neon, Radicant, Yapeal, Yuh, Zak, N26, Revolut and WiseSPACES: You want share Space

Zak allow you to create pots ✅

Yuh allow you to create projects ✅

N26 and Neon allow you to create spaces ✅

Revolut has vaults ✅

The other neobanks do not offer equivalent features.

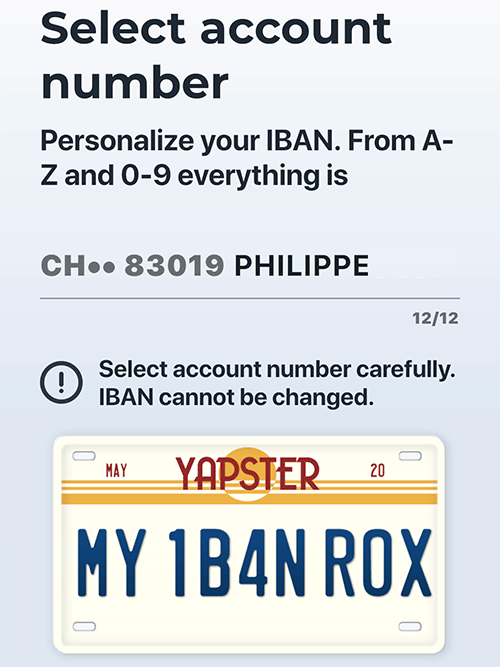

Winners : Yuh, Neon, Zak, N26 and RevolutIBAN: You want a personalised IBAN

This feature is available with CSX (for 2 CHF) and Yapeal. There is no real need to have a personalised IBAN but it’s nice and easier to memorize. ✅

Yapeal Promo Code

Yapeal Promo Code

Don't have a Yapeal account yet? Use our referral code to open your FREE Yapeal Bank account!

Use the promo code YAPS311WZ4WL before 31 July 2024 to receive CHF 30 for FREE 🙌

Get CHF 30 Free with Yapeal ➡️

Ranking summary table

We allocated 2 points to the free account criteria (FREE) and to CHF accounts with IBAN CH and 1 point to each of the other criteria.

We get the following comparison:

| Alpian | CSX | Neon | Radicant | Yapeal | Yuh | Zak | N26 | Revolut | Wise | |

|---|---|---|---|---|---|---|---|---|---|---|

| Free | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | ||

| Promo code | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||

| CARD | 1 | 1 | 1 | 1 | 1 | |||||

| VIRTUAL | 1 | |||||||||

| CASH | 1 | 1 | 1 | 1 | 1 | |||||

| RATES | 1 | 1 | ||||||||

| Fast | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||

| Smooth | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||

| Safe | 1 | 1 | 1 | 1 | ||||||

| CHF | 2 | 2 | 2 | 2 | 2 | 2 | 2 | |||

| CHF Transfers | 1 | 1 | 1 | 1 | 1 | 1 | ||||

| EUR | 1 | 1 | 1 | 1 | 1 | |||||

| SEPA | 1 | 1 | 1 | 1 | ||||||

| Travel | 1 | 1 | 1 | |||||||

| Push | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| eBill | 1 | 1 | 1 | 1 | 1 | 1 | ||||

| Mobile Pay | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| TWINT | 1 | 1 | 1 | 1 | ||||||

| Spaces | 1 | 1 | 1 | 1 | 1 | |||||

| IBAN Perso | 1 | 1 | ||||||||

| TOTAL | 13 | 13 | 16 | 14 | 10 | 18 | 15 | 11 | 11 | 11 |

When choosing a neobank, it’s important to know how you plan to use it, what your needs are: for eBill choose Neon or CSX, for a personalised CH IBAN it will be CSX or Yapeal, for SEPA transfers it’s N26.

Here is the feature and price comparison of Alpian, CSX, Neon, Radicant, Yapeal, Yuh et ZAK