Radicant Bank Review – 5 CHF Free in July 2024

| Account opening | 8 |

|---|---|

| Usability | 8 |

| Features | 7 |

| Credit Card | 9 |

| Plans & Pricing | 7 |

| Speed | 9 |

| Customer Service | 8 |

July 2024 Radicant Promo code: Get 5 CHF Free with the promo code 20b2e4 when opening your Radicant bank account.

Radicant Bank is a Swiss neobank that allows Swiss residents to open a mobile bank account and benefit from the services offered by the bank using a mobile application.

The opening of the bank account is fast and easy, with identity verification done within the app.

Description

Radicant Bank: The green neobank

Radicant Bank is a Swiss neobank founded in 2021 with the mission of making sustainable banking accessible to everyone. The bank offers a range of products and services, including savings accounts, current accounts and investments, all aligned with sustainability principles.

Radicant Bank is a subsidiary of the cantonal bank BLKB.

Radicant Bank offers a mobile account that allows customers to hold and manage funds in CHF.

Radicant Bank’s main features include:

- Focus on Sustainability: Radicant Bank is committed to using its capital to support sustainable businesses and projects. The bank has its own impact rating system that evaluates companies based on their environmental, social and governance (ESG) performance.

- Digital Banking: Radicant Bank offers a fully digital banking experience, with all of its products and services available through a mobile app or web platform.

- Transparent pricing: Radicant Bank pricing is simple and transparent, with no hidden fees.

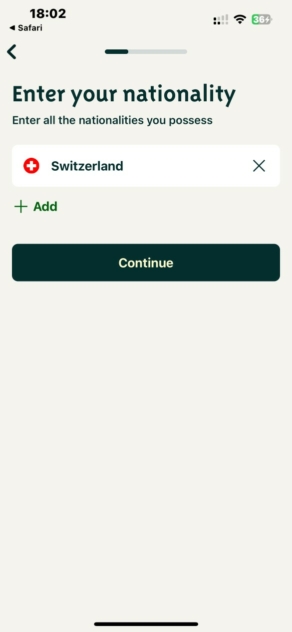

You only need to be a Swiss resident – regardless of nationality – to open an account with Radicant Bank.

Here’s what to remember from Radicant Bank’s offer:

- Free CHF account

- Virtual debit card included

- App that allows you to invest

We have tested the Radicant Bank application for you and compared the rates in detail.

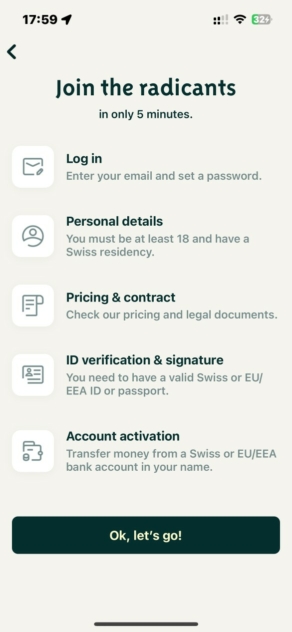

Opening an account at Radicant Bank – 8/10

Radicant Bank allows you to open a mobile account for free from your smartphone.

What are the conditions for opening an account at Radicant Bank

- Be at least 18 years old (15 years old at Zak)

- Residing in Switzerland

- Have a smartphone compatible with the app

- No proof of income to provide

- No minimum balance to maintain

You can absolutely use Radicant Bank to receive your salaries and make bank transfers in Switzerland or abroad. As a subsidiary of BLKB, Radicant Bank guarantees the security of CHF deposits up to CHF 100,000, in accordance with strict FINMA regulations.

How to open your account at Radicant Bank

Account opening with Radicant Bank begins in the app:

- Download the Radicant Bank app in App Store or Google Play

- Answer the questions

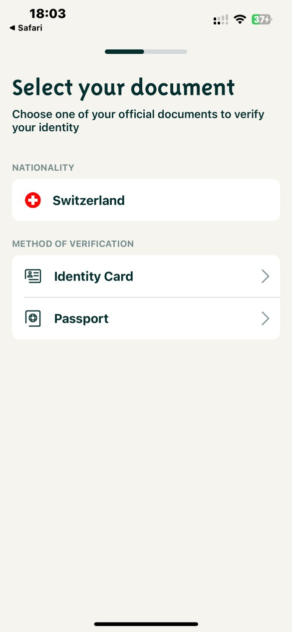

- Verify your identity

- It’s done! Your account is open 🙌

It only took us 8 minutes to open our Radicant Bank account.

Radicant Promo Code

Radicant Promo Code

Don't have a Radicant Bank account yet? Use our referral code to open your free Radicant Bank account!

Use the promo code 20b2e4 before 31 July 2024 to get CHF 5 for FREE 🙌

Get CHF 5 Free with Radicant ➡️

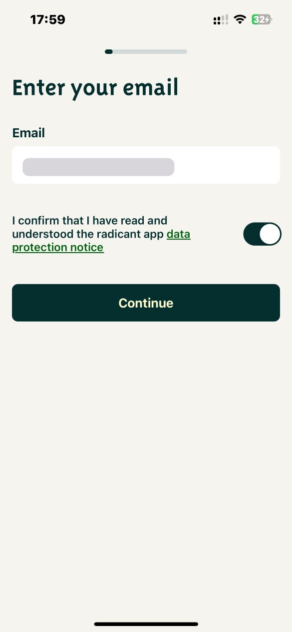

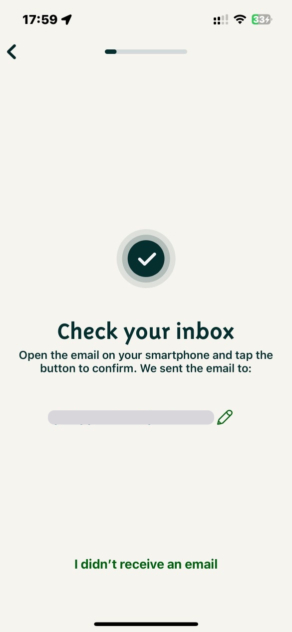

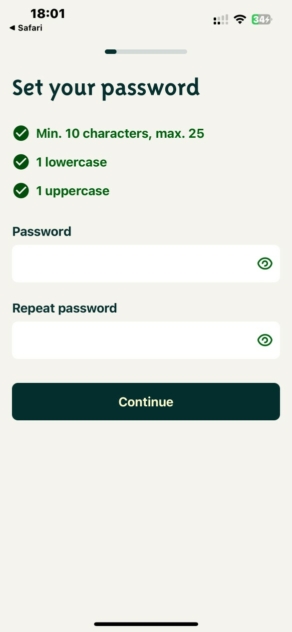

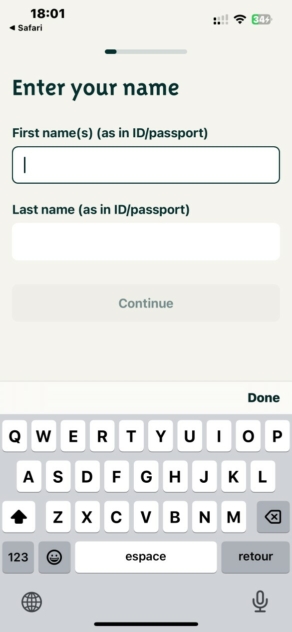

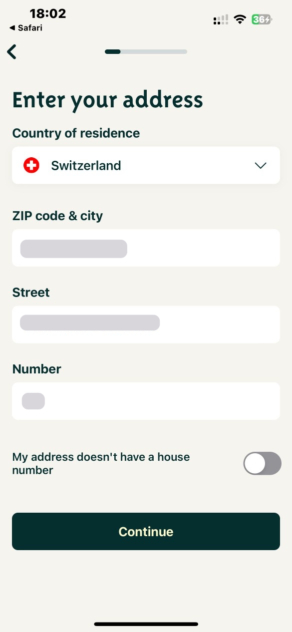

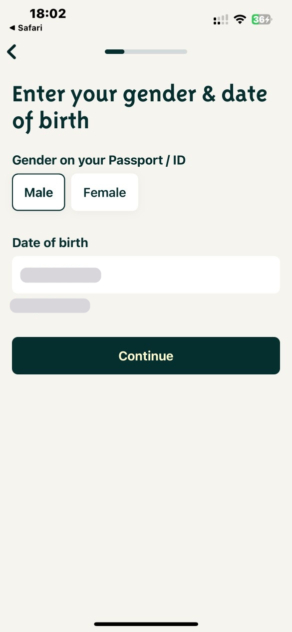

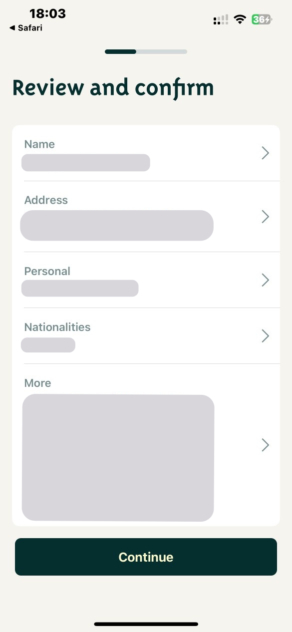

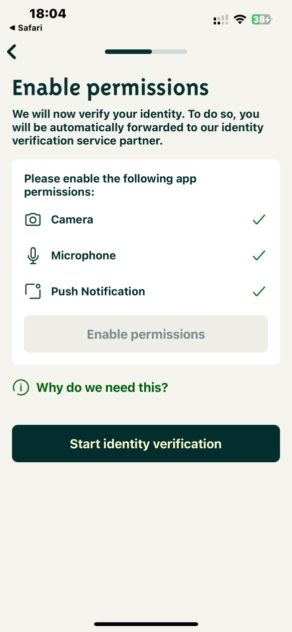

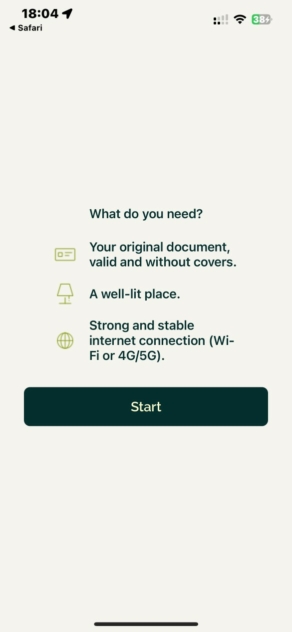

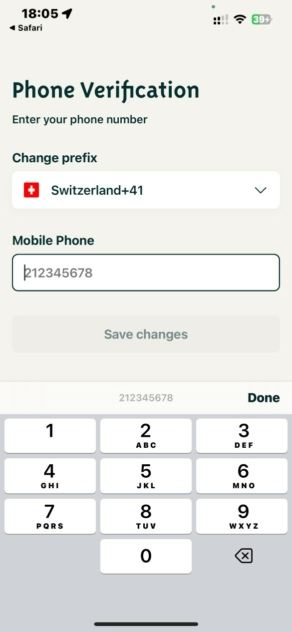

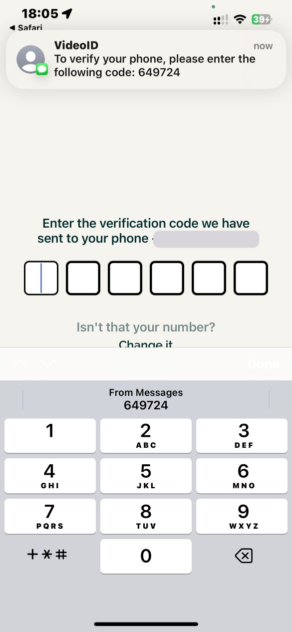

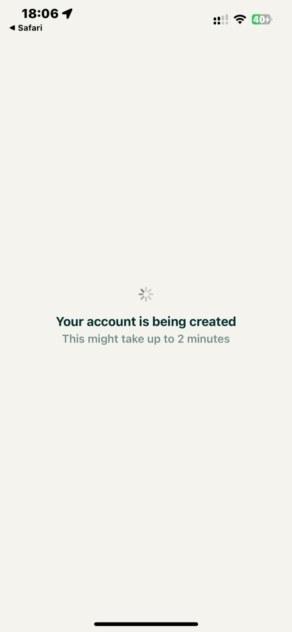

Here are the different stages of opening an account at Radicant Bank:

The app is available in German 🇩🇪 and English 🇬🇧

#1 You enter your email and confirm in your inbox

#2 You create your password

#3 You enter your name

#4 You enter your personal information then confirm

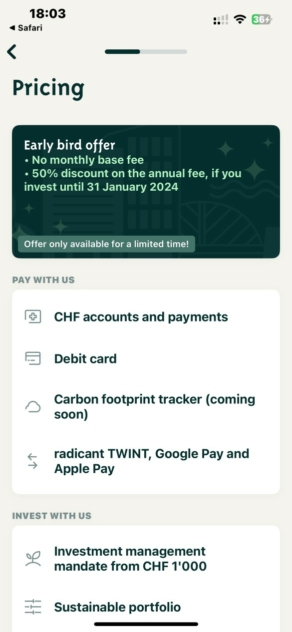

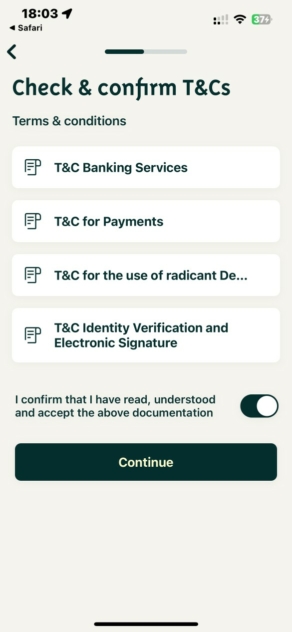

#5 You accept the pricing and general conditions

#6 You verify your identity

#7 You enter and verify your phone number

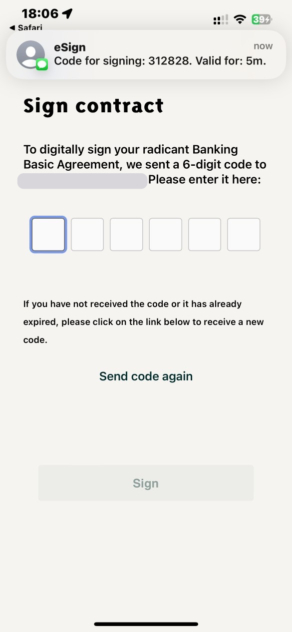

#8 You accept the user agreement and sign virtually

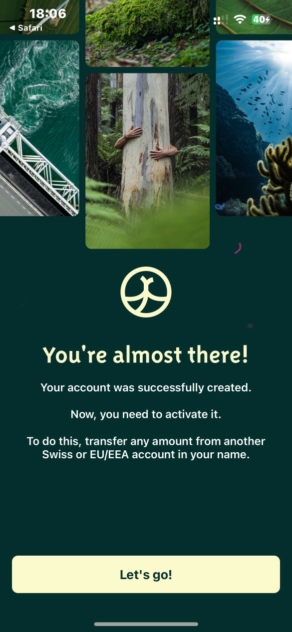

#9 Your account is created, all you have to do is transfer a small amount from another account (10 CHF is enough)

It’s done, your account is open.

The Radicant Bank account allows you to carry out all classic operations (transfers, direct debits, etc.) like any Swiss bank account.

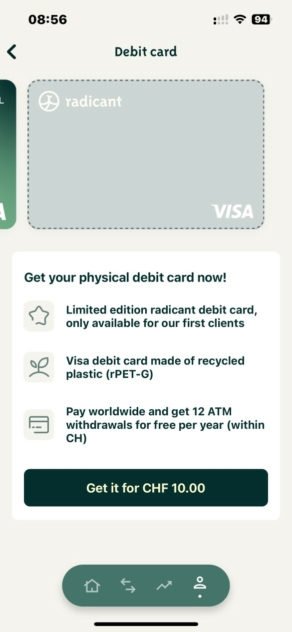

Radicant Bank offers a free virtual VISA debit card as well as a recycled plastic VISA debit card, this costs 10 CHF.

Our opinion on opening a Radicant Bank account

- Opening in less than 10 minutes

- No income requirement

- Swiss Banking License from BLKB

- Free CHF account

The plastic VISA debit card costs 10 CHF

We appreciate the quick and easy account opening. Cons: There are a lot of documents to accept and it is a little frustrating to have to make a transfer before all the functions of the account are accessible.

Radicant Bank account opening process scores 8/10Ergonomics of the Radicant Bank application – 8/10

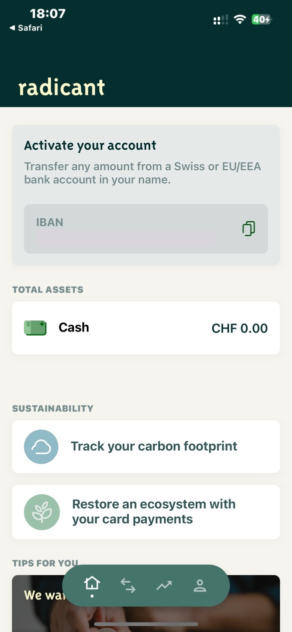

The Radicant Bank app is generally very user-friendly with information placed on every page.

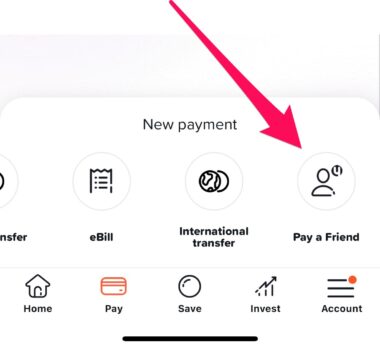

- The bottom menu displays 4 small icons to directly access payments and investments

- The essential functions are all directly accessible

- Navigation is quite smooth but not perfect

We are not yet at the level of the best neobanks like N26 or Revolut but it remains a good application and by consulting the radicant roadmap we can read that a new App will be put online soon. To be continued.

The Radicant Bank app is rated 4.4 on the Apple Store and 4 on Google Play.

Radicant Bank app features – 7/10

Being a neobank, Radicant Bank offers most of its services via the mobile application:

- Consult your banking transactions

- Enter transfers in CHF

- Pay with Radican TWINT

- Pay with eBill

- Scan invoices with the QR code

- Virtual bank card (like Yuh, N26 or Revolut)

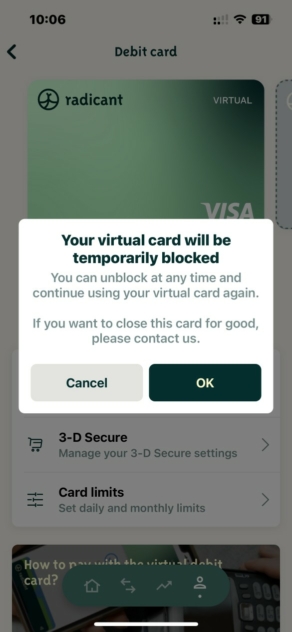

- Block and replace debit card

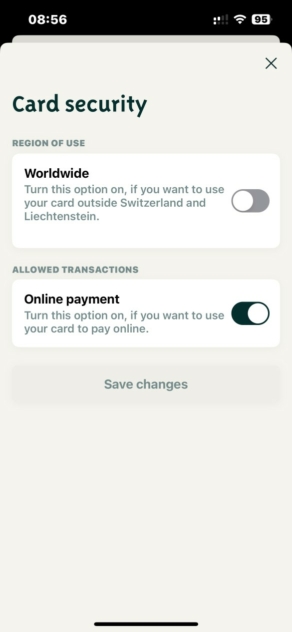

- Authorize the card abroad or in Switzerland only

- Authorize online payments

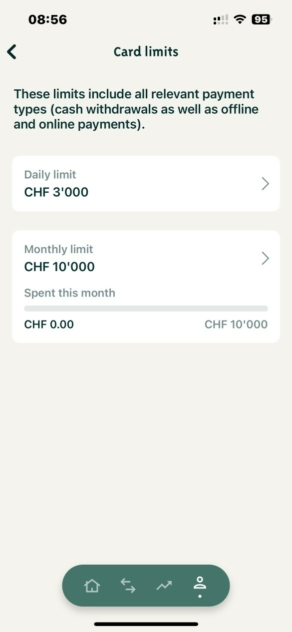

- Change VISA card daily and monthly spending limits

However, here is what is missing:

- It is possible to update your telephone number and personal information, you must contact Radicant

- No transfers abroad

- Not possible to change the card PIN

- It is not possible to delete the virtual card, you must contact Radicant

- Not possible to share sub-accounts with individual IBANs (Spaces)

The function for scanning QR codes or invoices in Swiss format is very practical. A real plus compared to Revolut.

Radicant Promo Code

Radicant Promo Code

Don't have a Radicant Bank account yet? Use our referral code to open your free Radicant Bank account!

Use the promo code 20b2e4 before 31 July 2024 to get CHF 5 for FREE 🙌

Get CHF 5 Free with Radicant ➡️

Card settings are incomplete

If like Revolut or N26 it is possible to temporarily lock the card, it is not possible to request replacement in the application.

So if the essential functionalities are present, an important one is missing: transfers abroad.

Radicant Bank app features get 7/10Radicant Bank bank card – 9/10

Radicant Bank offers a free VISA Virtual Debit card.

You can also order a plastic VISA debit card for 10 CHF.

The Radicant Bank VISA card isApple Pay and Google Pay compatible.

Radicant Bank gets a 9/10 for the cardRadicant Bank rates – 7/10

Opening a Radicant Bank account is free and there are currently no monthly fees.

Radicant Bank being a neobank based in Switzerland, the prices are displayed in CHF- Free account

- Account management: via iPhone or Android mobile application

- Bank card: VISA Debit

VISA card

Radicant Bank offers a free VISA Virtual Debit card. The plastic VISA debit card costs 10 CHF.

Card replacement is charged at 20 CHF in the event of loss.

Cash withdrawals in Switzerland in CHF

- 12 free withdrawals per year, then CHF 2.00 / withdrawal with plastic card

Radicant Promo Code

Radicant Promo Code

Don't have a Radicant Bank account yet? Use our referral code to open your free Radicant Bank account!

Use the promo code 20b2e4 before 31 July 2024 to get CHF 5 for FREE 🙌

Get CHF 5 Free with Radicant ➡️

Cash withdrawals in Switzerland in EUR

- 5.00 CHF / withdrawal + 0.8%

Cash withdrawals abroad

- 5.00 CHF / withdrawal + 0.8%

International transfers

This option is currently not available.

Radicant Bank offers rates that are often higher than its competitors (Alpian, Neon, Yuh, Zak) which makes the offer moderately attractive.

We also note that not all prices are displayed, surprising for a bank that talks about Transparency.

Radicant Bank scores 7/10 for rates Radicant Promo Code

Radicant Promo Code

Don't have a Radicant Bank account yet? Use our referral code to open your free Radicant Bank account!

Use the promo code 20b2e4 before 31 July 2024 to get CHF 5 for FREE 🙌

Get CHF 5 Free with Radicant ➡️

Speed of transactions – 9/10

A transfer from one Swiss bank to another Swiss bank is very fast, but it depends on the times: if you make your transfer in the morning, it arrives in a few minutes, but if you make it ‘afternoon, he arrives the next day.

An instant transfer option like “Beam” at N26 or is missing “Pay a friend” at Yuh which allows you to pay another account in a few seconds from his telephone number.

“Pay a friend” at Yuh[/caption ]

“Pay a friend” at Yuh[/caption ]

The push notifications system allows you to be alerted in real time of any movement on the account.

It’s a score of 9/10 on this criterionRadicant Bank customer service – 8/10

Unlike N26, Radicant does not offer Livechat, but a bot or a premium rate telephone number (CHF 0.08 / Minute) open Monday to Friday, 8:00 a.m. to 5:00 p.m.

It is also possible to contact support by email.

The mission of the neobank is not yet fulfilled on this point but the roadmap foresees the arrival of a Livechat

We rate 8/10 for customer serviceWhy open an account with Radicant Bank?

Radicant Bank offers a CHF account which only allows transactions in Switzerland. So move on if you are looking for a neobank for your foreign transactions and prefer Neon, Yuh or Zak

Radicant Bank can be compared to Alpian or FlowBank while knowing that the investments proposed are 100% ecologically oriented.

The management fees displayed start at 0.45% to which you must addouter 0.40% annual cost per product, i.e. a minimum of 0.85%/year compared to 0.75% at Alpian.

Radicant Bank is therefore more expensive than Alpian, with completely different investments and service.

Radicant Promo Code

Radicant Promo Code

Don't have a Radicant Bank account yet? Use our referral code to open your free Radicant Bank account!

Use the promo code 20b2e4 before 31 July 2024 to get CHF 5 for FREE 🙌

Get CHF 5 Free with Radicant ➡️

Additional information

Specification: Radicant Bank Review – 5 CHF Free in July 2024

| Account | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

| Trading | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

There are no reviews yet.