Yuh Bank Review – 50+4 CHF Free in July 2024

| Account opening | 8 |

|---|---|

| Usability | 9 |

| Features | 8 |

| Credit Card | 9 |

| Plans & Pricing | 9 |

| Speed | 9 |

| Customer Service | 8 |

July 2024 Yuh Promo code: Get 50 CHF Trading Credit + 250 SWQ (about 4 CHF) with the promo code YUHNEO when opening your Yuh bank account.

Yuh Bank is a Swiss neobank that allows Swiss residents to open a mobile bank account and benefit from the services offered by the bank using a mobile application.

The opening of the bank account is fast and easy, with identity verification done within the app.

Description

Yuh Bank review – The neobank of PostFinance & Swissquote

PostFinance and Swissquote have just launched their neobank: Yuh

The objective of PostFinance and Swissquote is certainly to compete with other Swiss neobanks such as Neon, ZAK and Yapeal as well as non-Swiss neobanks that have a strong foot in Switzerland like N26 and Revolut!

Yuh Bank is indeed a multi-currency bank, having CHF or EUR as default currency, the ability to open sub-accounts for other currencies (USD for example), and the ability to trade shares or even buy Bitcoins and other crypto-currencies.

Here is a summary of the Yuh offer:

- Free bank account in 13 currencies, with CHF, EUR or USD as default

- Free Debit MasterCard

- Extensive App features with trading enabled

We have tested the Yuh app for you and compared features and pricing.

Updates:

- YUH Bank now offers eBill.

- YUH Bank is now compatible with Apple Pay.

- Yuh TWINT is now available

- Take advantage of interest rates at Yuh

- YUH Bank launches its 3rd Pillar offer: Yuh 3A

Bank account opening with Yuh Bank – 8/10

Yuh Bank allows you to open a free mobile bank account from your smartphone.

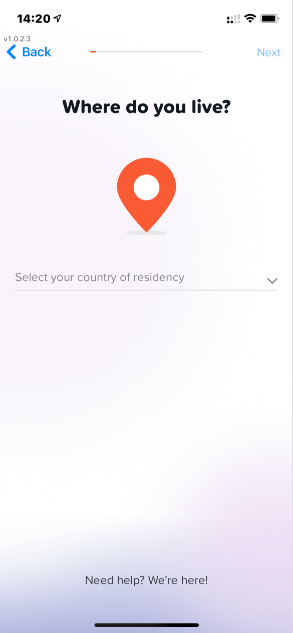

What are the Yuh bank account requirements

- Be at least 18 years old (15 years with Zak)

- Be a Swiss resident or in one of the following countries: France, Germany, Austria, Italy, Liechtenstein

- Have a smartphone compatible with the app

- No need to provide proof of revenue

- No minimum deposit

- No minimum balance

Yuh Bank inherits the security standards and reputation of SwissQuote. You can use this bank account to receive your salaries and make bank transfers in Switzerland or to your Revolut card.

The footprint of SwissQuote is quite obvious: mails and emails are sent by SwissQuote. The account opening process is also guided by the SwissQuote process.

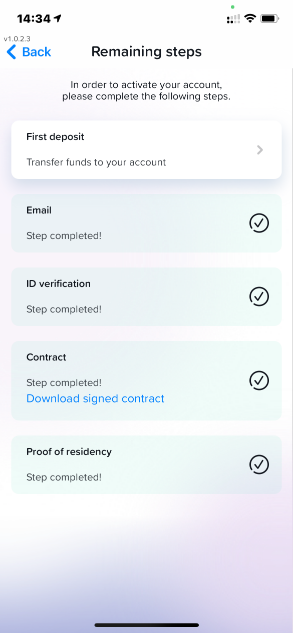

How to open a bank account with Yuh Bank

To open an account with Zak you just need to follow these steps:

- Download the Yuh app from the App Store or Google Play

- Answer to – many – questions

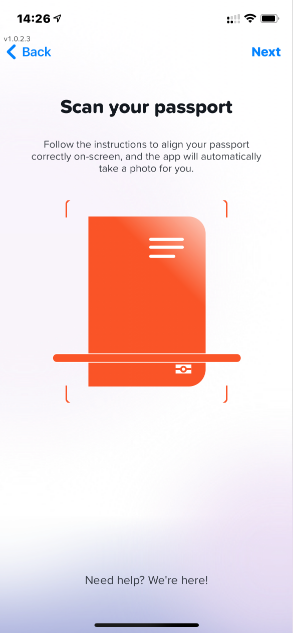

- Verify your identity through the app

- Transfer a small amount to the account

- It’s done! Your Yuh account is opened

YUH Promo Code

YUH Promo Code

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

In practice, you may have to wait about 5 minutes to have your documents verified, then your account is opened!

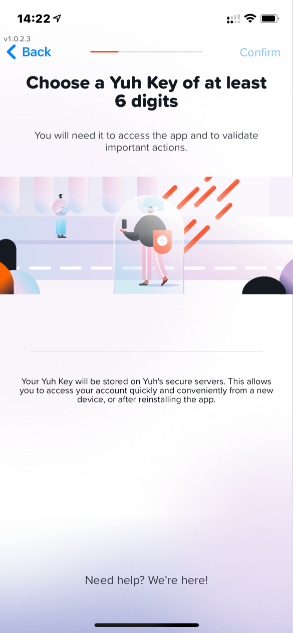

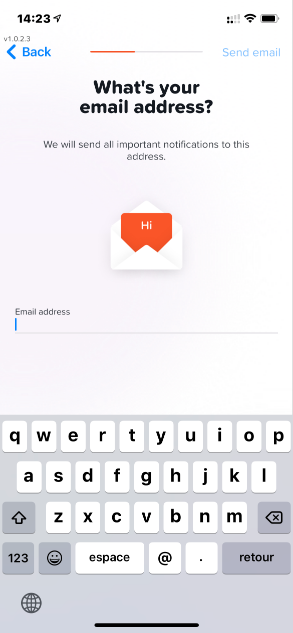

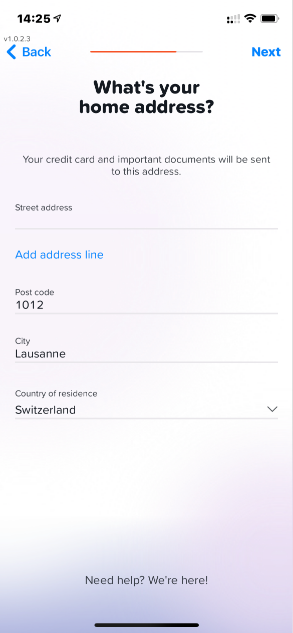

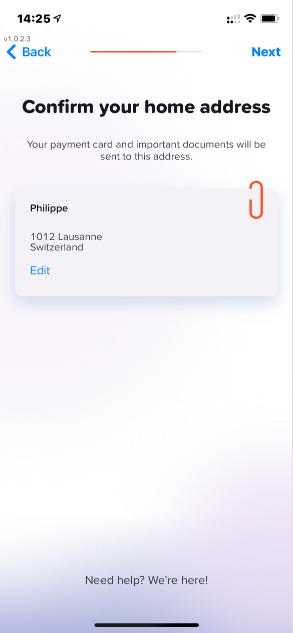

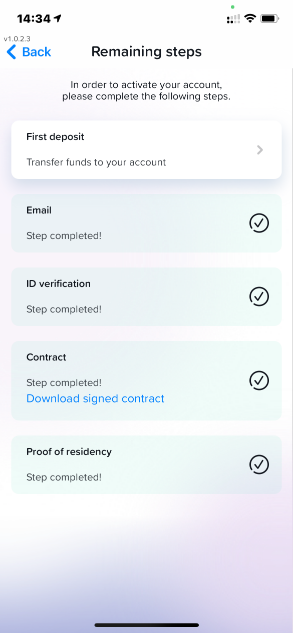

Yuh will not ask you to provide any paper documents, which makes the account opening process very fast.Here are the steps of the account opening process with Yuh Bank:

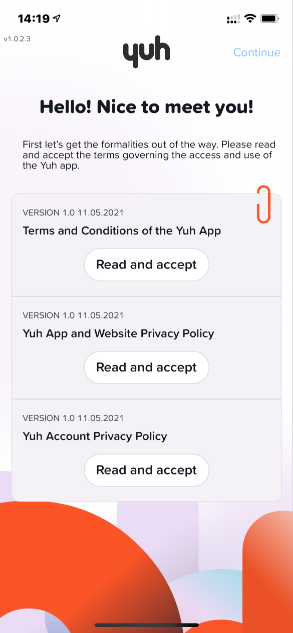

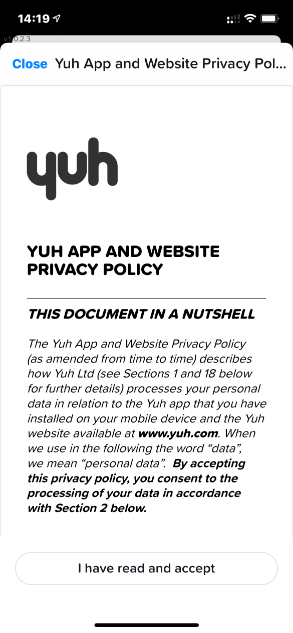

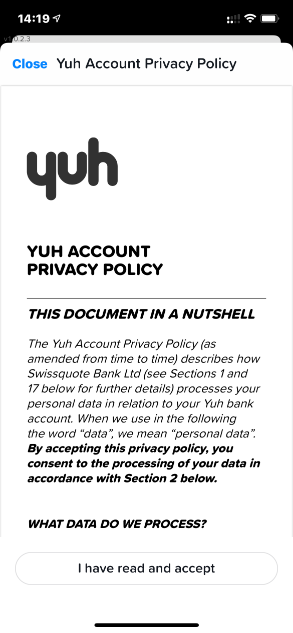

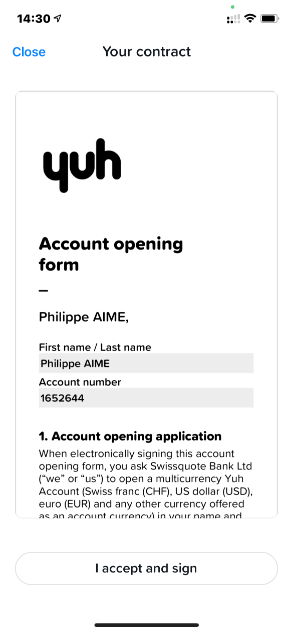

#1 Accept the legal terms

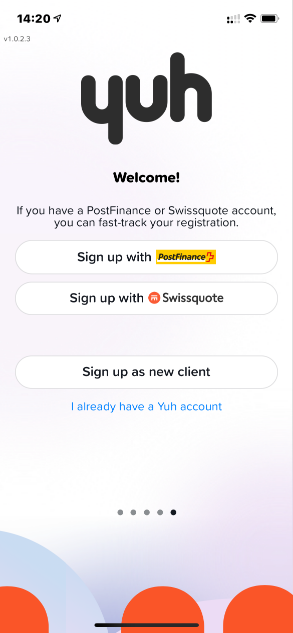

#2 You can sign up with your PostFinance/SwissQuote credentials or create a new account

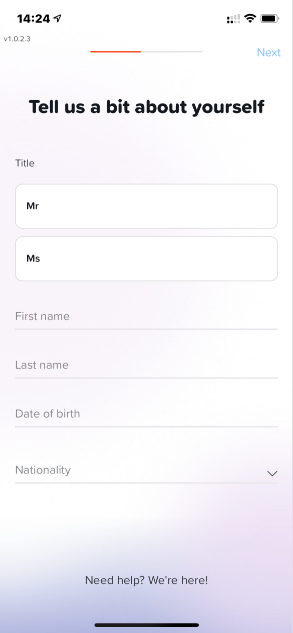

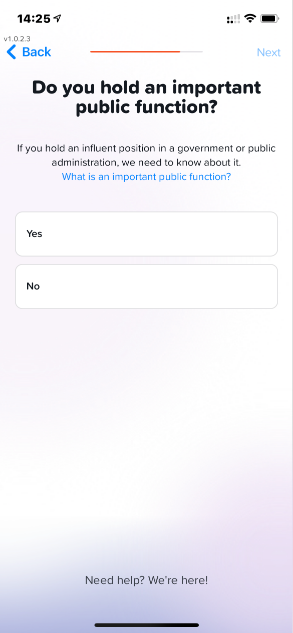

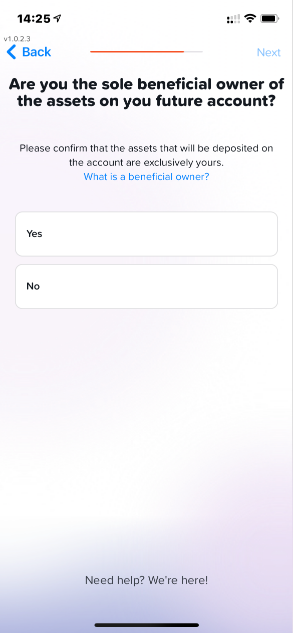

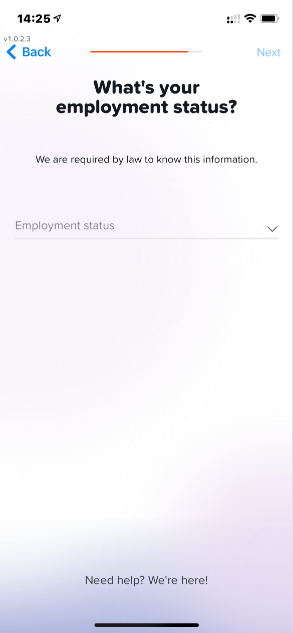

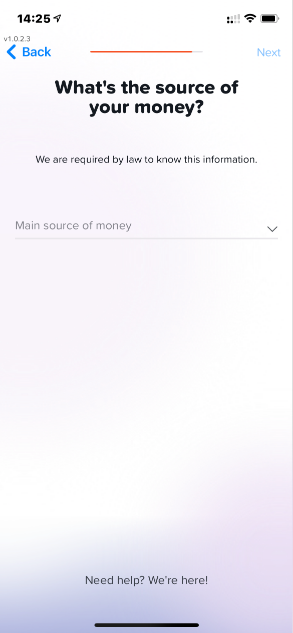

#4 When signing up, you have to answer several questions: a mix PostFinance and SwissQuote requirements

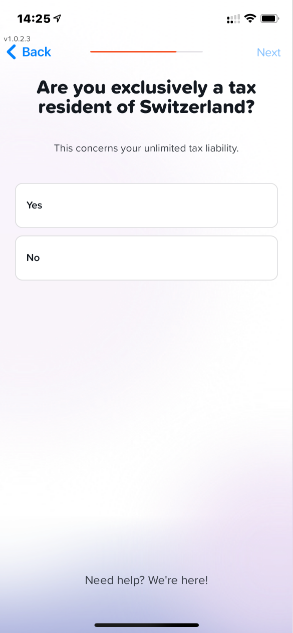

#5 You must declare your country of residence AND whether or not you are American

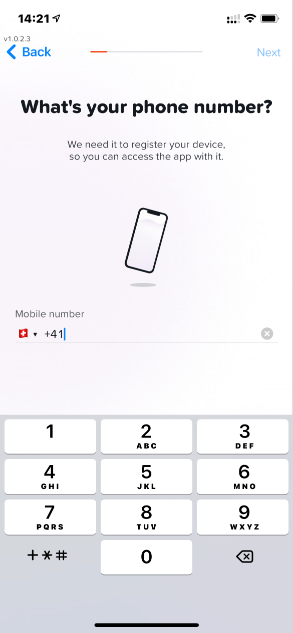

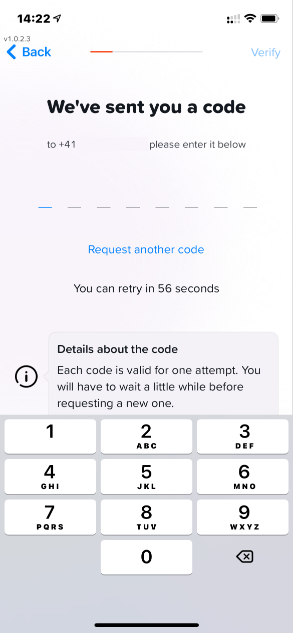

#6 Verify your phone number

#7 Enter your Name and choose a password (Yuh key)

#8 Enter your Email

#9 Enter your full address

#10 Confirm your fiscal and financial details

#11 Enter your bonus code: we2p08

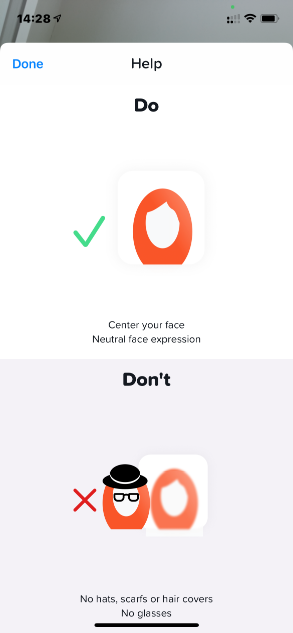

#13 Verify your identity

#14 Digitally sign your contract

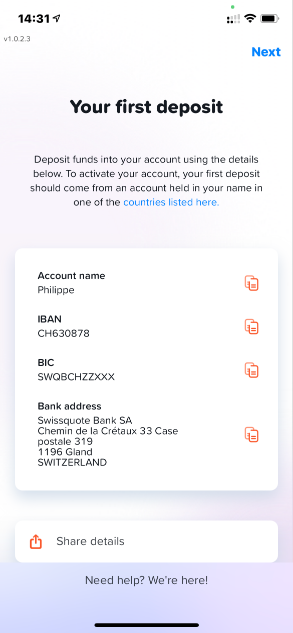

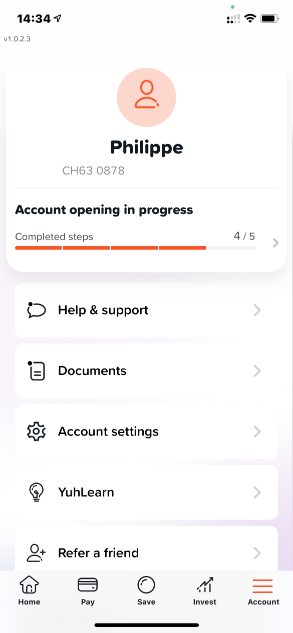

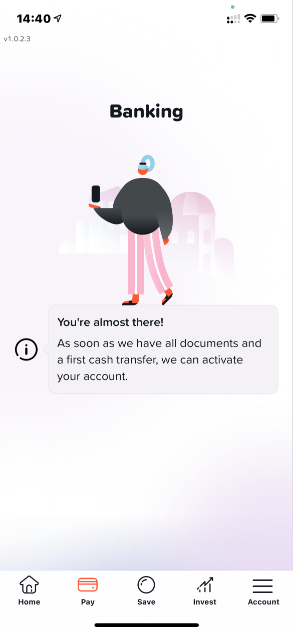

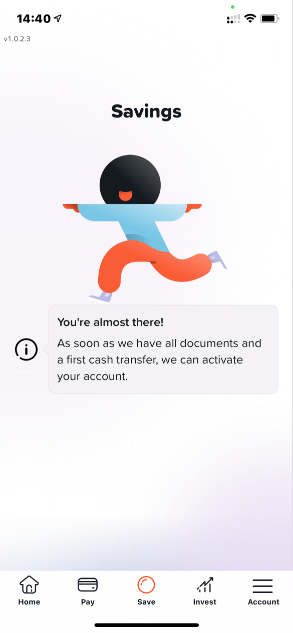

#15 Your account is – almost – opened! You just need to make small deposit: 10 CHF is enough

Your account is opened!

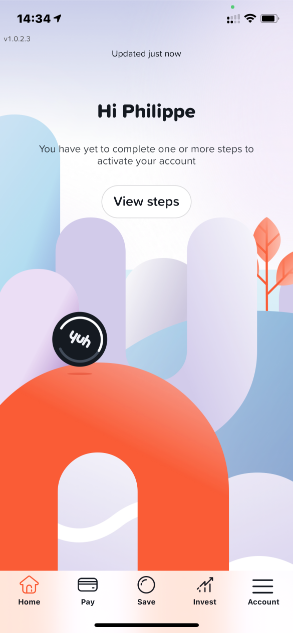

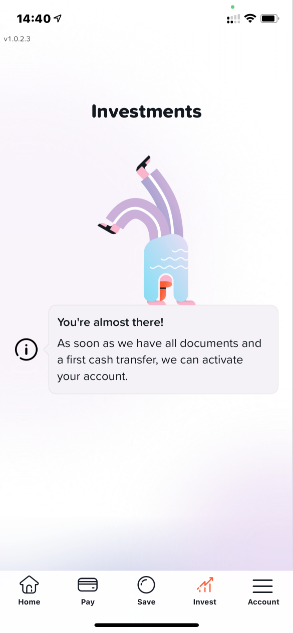

But until your first deposit is done, you will only have a limited access to the Yuh app:

The Yuh Bank account allows you to make all standard transactions (bank transfer, direct debit, etc.) like with any Swiss bank account.

The MasterCard Debit card is free and – as per usual in Switzerland – your receive 2 letters: 1 for the card and 1 for the PIN code.

Our opinion on the bank account opening with Yuh Bank

- Quick opening process completed in 22 minutes

- No revenue requirement

- Swiss neobank

- Account in 13 currencies

- Virtual card

- Too many questions, we feel the SwissQuote process behind

- The card was delivered after 2 weeks (out of stock apparently)

- Too many mails

We like the guided opening process, even though there are many questions and letters. -2 points

The Yuh Bank opening process gets an 8/10Usability of the Yuh app – 9/10

While Yuh has been created by PostFinance and SwissQuote, it is a very modern and intuitive mobile app.

This app is almost on par with leading neobanks such as N26 and Revolut :

- The mobile app is fluid and intuitive

- Menus are clear and well organised

- Essential features are always visible

The Yuh app is currently rated 4.6 on the App Store (3.4k reviews) and 4.4 on Google Play (1k reviews). These ratings are not great but given the small numbers of reviews currently, bad reviews might overweigh the overall score. As Yuh Bank grows we will have more objective ratings.

On the plus side, most reviews tend to confirm the good usability of the app.

We still withdraw 1 point because of some small navigation issues: the BACK button, for example, is annoying: each time you enter a menu, you must click on that Back button instead of having some direct links or overlay like N26 does.

Yuh app features – 8/10

As a neobank, Yuh Bank offers all their services through a mobile application. That means it’s possible to do almost everything from your smartphone:

- Access your payments history

- Make new payments

- Use eBill

- Pay with Yuh TWINT

- Scan and upload invoices in Swiss format

- Block and replace your card for free

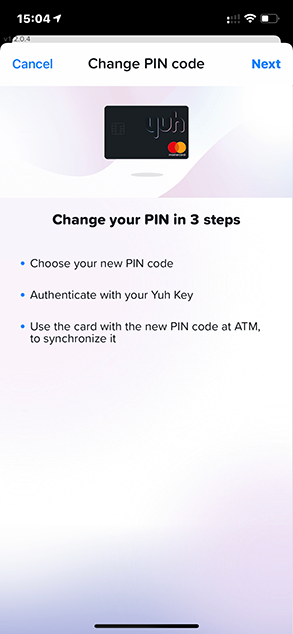

- Change your PIN code

- Update your phone number + all personal details

- Trade shares / ETF’s / Trading Themes

- Buy bitcoins

- Exchange currencies

- Create sub-account in other currencies

- Take advantage of interest rates at Yuh

- Open a 3rd Pillar account with Yuh 3A

But some features are missing:

- No settings for card limits beyond the Monthly limit

- Not possible to create and share space

- No chat support (on the roadmap)

About currencies and crypto-currencies:

- Currency exchange is only available during open hours

- Bitcoin trading is only in USD and EUR (the same for all the other cryptocurrencies), meaning that you have to convert CHF or EUR before buying Cryptos.

The scanner feature or QR codes and invoices are very useful. A real plus compared to Revolut.

YUH Promo Code

YUH Promo Code

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

Yuh Bank also offers a loyalty program with Swissqoin (SWQ) : the crypto-currency created by Yuh Bank.

1 Swissqoin is about 0.015 CHF, so 250 SWQ = 5 CHF

Card settings are not on par with N26 or Revolut

With Revolut and N26 you can temporarily freeze your card instead of blocking it, it’s also possible to display your PIN code in the app.

With Yuh, you must visit an ATM to validate your new PIN code. The old-fashioned way:

If essential features are already available, comfort features are missing

Yuh app features get a 8/10Yuh Bank credit card – 9/10

Yuh Bank offers a free MasterCard Debit card.

It’s delivered in a nice black cardboard sleeve:

The MasterCard is very good for travelling and – since May 2022 – is compatible with Apple Pay, Google Pay and Samsung Pay.

Yuh Bank gets an 9/10 for the cardYuh Bank plans & pricing – 9/10

The Yuh plan is free that includes a free MasterCard Debit card.

Being that Yuh Bank a neobank based in Switzerland, fees are displayed in CHFYuh MasterCard fees

Yuh offers a free MasterCard Debit card. It is black, which reminds us of the Premium cards from N26 and Revolut.

Cash withdrawals in Switzerland in CHF

- 1 free cash withdrawal per week, then 1.90 CHF each

- Up to 10,000 CHF per month

YUH Promo Code

YUH Promo Code

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

Cash withdrawals in Switzerland in EUR

- 1 free cash withdrawal per week, then 1.90 CHF each

- Up to 10,000 CHF per month

Cash withdrawals abroad

- 4.90 CHF each

Replacement card

Yuh takes a 20-CHF fee if you need to replace your card

Payments and cash withdrawals in foreign currencies

Yuh does not apply transaction fees on 12 currencies: CHF – USD – EUR – GBP – JPY – AUD – CAD – SEK – HKD – NOK – DKK – AED

But they apply 0.95% exchange fees

Transactions’ speed – 9/10

A wire transfer from a Swiss bank to another Swiss bank is instant, it usually takes a few seconds before showing up on the beneficiary account.

Yuh is lacking some instant transfer feature like “Beam” (N26) that allows users to pay another N26 accounts in seconds.

This is a 9/10 for transactions’ speedYuh customer service – 8/10

Unlike N26, Yuh does not offer Livechat support, but a contact form and phone number opened Monday to Friday from 8:00 to 22:00.

The phone support is very good and support agents answer the phone very quickly.

With N26, you also get quick access to a LiveChat support agent during a wide time range (until 23:00). The N26 virtual assistant gets you to wait for a minute or so, the time that a human takes over the conversation.

We believe that Yuh should take example on N26 and offer in-app Livechat support.

On the plus side: negative reviews on the App Store and Google Pay are always replied.

It’s an 8/10 for customer serviceWhy open a bank account with Yuh?

Yuh has launched with a strong product by offering a free bank account in CHF and EUR, a free MasterCard, a clean mobile app and the option to trade currencies and stocks.

As a consequence, Yuh competes directly with N26 and Revolut. With the recent add of TWINT they also took the lead on our comparison of the Best Swiss Neobanks.

YUH Promo Code

YUH Promo Code

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

Yuh vs Neon – Which is the best for Switzerland?

Have a doubt? Check our 1-to-1 comparisons: we review important options for Switzerland (IBAN CH, transfers in CHF, TWINT) and abroad (withdrawals with the card, SEPA transfer fees, foreign currency transfers).

For a quick decision, here is a comparison table between Yuh and Neon:

| Use | Yuh | Neon |

|---|---|---|

| Free bank account with free debit card | 👍 | 👍 Free MasterCard with our promo code |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 | |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 250 SWQ+50 CHF Trading Credits with our promo code |

To find out how each criterion is judged, read our article Yuh vs Neon – Comparison of July 2024

Yuh vs Revolut – Which is the best multi-currency account?

For a quick decision, here is a comparison table between Yuh and Revolut:

| Use | Yuh | Revolut |

|---|---|---|

| Free bank account with free debit card | 👍 | |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 withdrawals above 300 CHF | 👍 up to 300 CHF/m. |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 250 SWQ+50 CHF Trading Credits with our promo code |

To find out how each criterion is judged, read our article Yuh vs Revolut – Comparison of July 2024

Yuh vs N26 – Which is the best EUR account?

For a quick decision, here is a comparison table between Yuh and N26:

| Use | Yuh | N26 |

|---|---|---|

| Free bank account with free debit card | 👍 | |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 withdrawals above 600 CHF | 👍 up to 600 CHF/m. |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 250 SWQ+50 CHF Trading Credits with our promo code |

To find out how each criterion is judged, read our article Yuh vs N26 – Comparison of July 2024

Additional information

Specification: Yuh Bank Review – 50+4 CHF Free in July 2024

| Account | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

| Trading | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

Xavier –

Through the reviews I can see that I’m not the only one facing security issues with YUH. Indeed, they authorized on my account, without any confirmation or validation from me, an automatic debit for the recovery of a French fine of someone from Spain whereas I am Swiss and with all the evidences on the mistaken identity (date of birth, address, nationality, vehicle, license plate, etc.) and even if they admit there’s a mistake on the identity, they refuse to cancel the transaction and return the funds.

I also use Neon, which is much more reliable, it is Swiss and with an excellent support, as well as Revolut, more complete with many more advantages and with a better management and fees for multi-currency transactions.

David –

It would be important to mention that Yuh is not a reliable App for investments.

If for some reason they delist a crypto, as it happened for example with “Augur” your funds will be blocked for months.

A lot of customers are affected by this unfair activity, funds blocked since 29th March and no solution from Yuh (Only repeating “it will be available as soon as possible”).

So my personal suggestion is not to invest with them, otherwise you are taking a big risk.