FlowBank Review (2024)

| Account opening | 7 |

|---|---|

| User experience | 7 |

| Features | 6 |

| Credit Card | 0 |

| Plans & Pricing | 8 |

| Speed | 10 |

| Customer service | 4 |

FlowBank is a Swiss online bank (neobank) that allows you to open a free multi-currency bank account and benefit from trading services. strong> offered by the bank via a mobile application.

Account opening is quick and easy, with identity verification performed directly in the mobile app.

Description

The FINMA appointed Walder Wyss SA, succursale de Genève, 14 rue du Rhône, P.O Box, 1211 Geneva 3 as bankrupcy liquidators (the Liquidators). The place of jurisdiction for the bankrupty is the Bank’s head office in Geneva.

The commercial activities of the Bank stopped at the opening of the bankruptcy. The Bank is no longer authorised to carry out banking transactions or to act as securities dealer. In this regard, all payments, purchases and sales of securities can not longer be made. The Bank and its governing bodies are strictly prohibited from carrying out any legal act without the approval of the Liquidators.

FlowBank is a Swiss neobank created in 2020 by Charles-Henri Sabet. The bank is based in Geneva and benefits from a Swiss banking license.

FlowBank is first and foremost a trading platform and does not compete – for now – with other classic neobanks such as Neon or Zak Bank.

In Switzerland, the main competitor of FlowBank is SwissQuote. This also makes Yuh Bank (subsidiary of PostFinance and SwissQuote) a competitor.

Flowbank multi-currency bank account

FlowBank offers a multi-currency account with an IBAN CH attached to the bank’s SWIFT code: FLOKCHGGXXX.

This multi-currency account currently supports 20 currencies:

- CHF: Swiss Franc

- EUR: Euro

- USD: American Dollar

- AED: Emirati Dirham

- AUD: Australian Dollar

- CAD: Canadian Dollar

- CZK: Czech Koruna

- DKK: Danish Krone

- GBP: British Pound

- HKD: Hong Kong Dollar

- HUF: Hugarian Forint

- ILS: Israeli New Shekel

- JPY: Japanese Yen

- MXN: Mexican Peso

- NOK: Norwegian Krone

- NZD: New Zealand Dollar

- PLN: Polish Zloty

- RUB: Russian Ruble

- SEK: Swedish Krona

- SGD: Singapore Dollar

- THB: Thai Baht

- TRY: Turkish Lira

- ZAR: South African Rand

FlowBank only offers investment services: you will not have a bank card and can only make outgoing transfers to an account in your name.

Opening a bank account at Flowbank – 8/10

Account opening is done from the website of Flowbank.

You can at any time (24 hours a day and 5 days a week) reach an advisor at any time (24 hours a day and 5 days a week) in Chat or by phone. From our experience, they respond very well and very quickly in several languages.

To open an account with FlowBank, you must present the following documents:

1 – Proof of identity: passport, identity card or driver’s license

2 – Proof of residence dated less than 6 months:

- An electricity/water/gas bill

- Bank statement

- Landline phone bill

When your registration is validated (count 24 to 72 hours) you have access to smartphone and desktop applications to be able to start investing.

Important note: FlowBank does not open an account for American citizens (US).

Ergonomics and functionalities of FlowBank App – 6/10

FlowBank offers 2 smartphone applications: FlowBank App and FlowBank Pro.

But unlike Yuh Bank, Flowbank cannot replace your private account: bank card and private account options are not offered.

We recommend downloading FlowBank Pro rather than FlowBank App: the ergonomics are less attractive (more austere) but day-to-day navigation is more direct and with the essential functions:

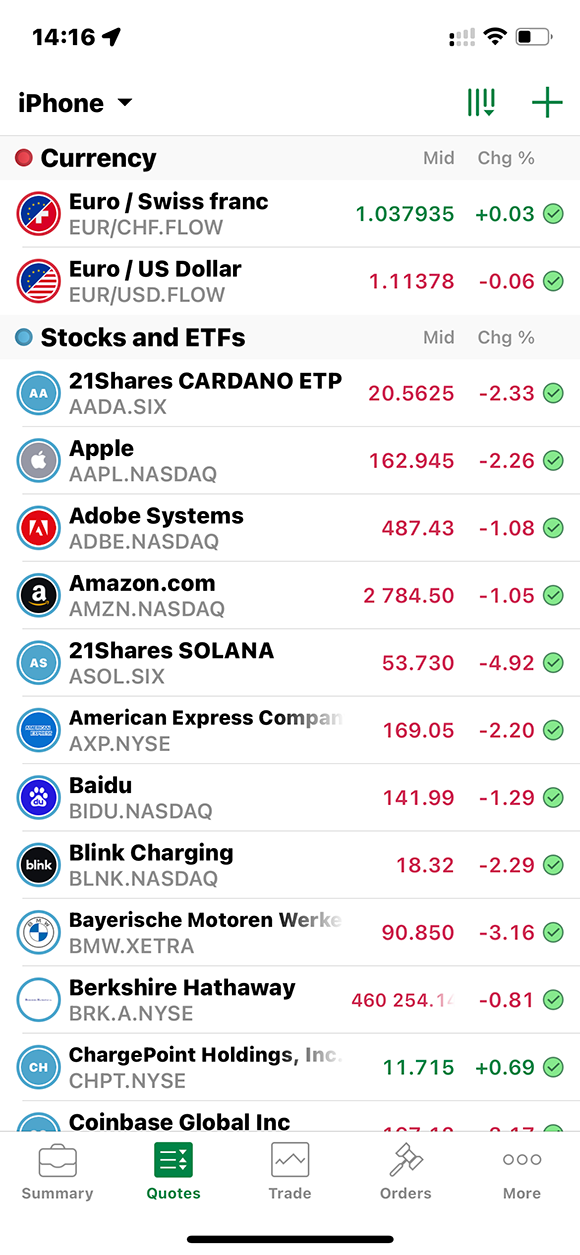

Quotes: to search and track values

The Quotes tab is where you will find and track your values.

If a security or an ETF is missing, you can contact FlowBank support to ask them to add it. They are very responsive and can add it within 1 hour.

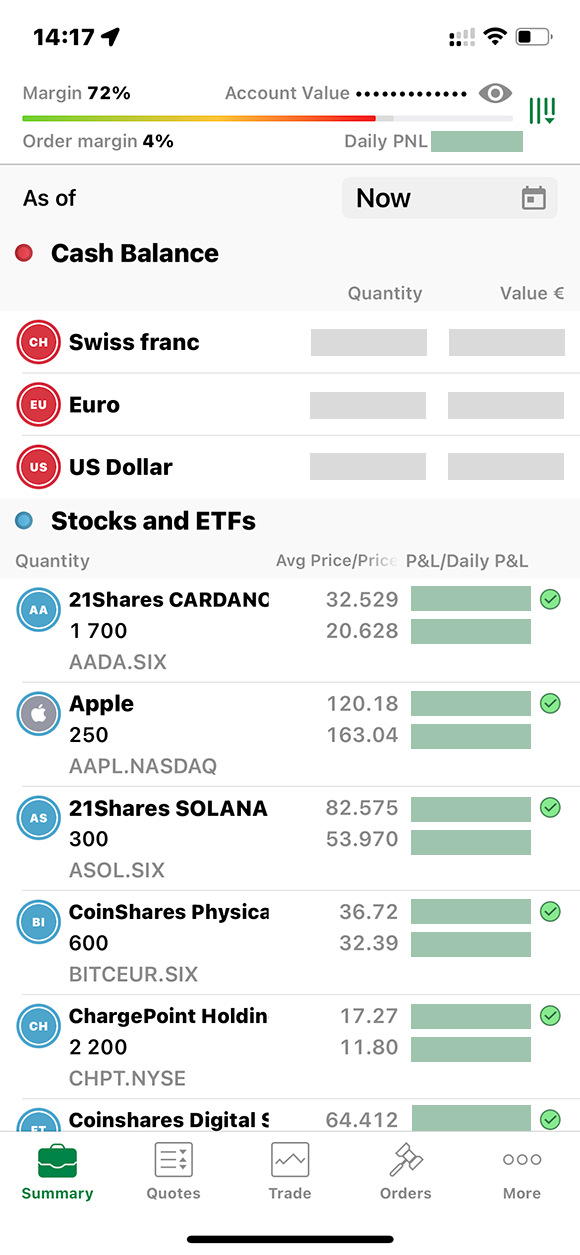

You also have access to Crypto ETFs which track the performance of certain crypto-currencies: Bitcoin, Ethereum (ETH), Cardano (ADA), Solana (SOL)… generally offered by 21Shares or Coinshares .

Trade: to place your orders

You will go to continue in the Trade tab to place your orders.

On a smartphone, you have the classic trading functions: Market, Limit, Stop, Day,…

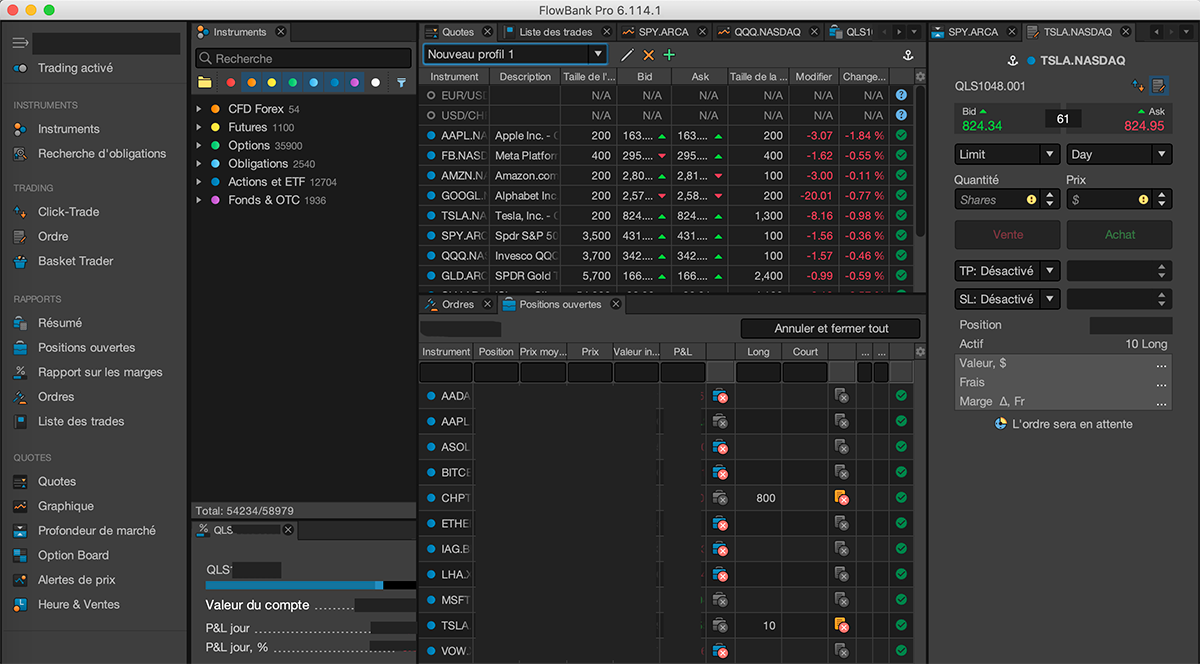

If you are looking for more advanced functions and wish to access the complete history of your trades, you must download the application FlowBank Pro for Desktop:

Summary: the overview

As soon as you have placed your first orders, you can go to Summary to follow the performance of your portfolio on a daily basis:

FlowBank credit card – 0/10

FlowBank currently does not offer any debit card, which is not great when there is the word “bank” in your name

FlowBank tariffs – 8/10

Management fees: Free

FlowBank does not charge account management fees. On the other hand, there are annual custody fees of 0.10% debited each quarter (0.025% per quarter). There is a minimum of CHF 10 per term and a maximum of CHF 50 per term (i.e. CHF 200 per year).

No minimum investment

No inactivity fees

Commissions on Stocks and ETFs

FlowBank offers 2 price levels:

- Classic: 0.15% commission on Stocks and ETFs

- Platinum (minimum initial funding CHF 100,000): 0.10% commission on Stocks and ETFs

A minimum of CHF 6.50 still applies

Foreign exchange commissions (Forex)

Foreign exchange is also relatively expensive, with a 0.5% conversion fee. If you want to buy an ETF in USD, you will have to pay 0.5% for the conversion and then pay the commission fee in addition to this fee. For a Swiss broker, this is relatively cheap.

Commissions on Funds

The commission on the Funds is 0.15% with a minimum of 8 CHF

Other commissions

To know the commissions on Futures, Bonds and CFDs, you can consult the FlowBank pricing on their site.

FlowBank vs. SwissQuote prices?

On the one hand FlowBank applies variable commissions on the Shares, whatever the amount.

On the other hand, SwissQuote applies fixed fees on Shares per tranche and by market. But for ETFs Swissquote applies a fixed commission of 9 CHF.

Reading the FlowBank tariff is therefore very simple: we know that we pay always 0.10% or 0.15%, depending on the Classic or Platinum tariff.

Here are several examples to understand which is the cheapest:

For an Equity trade of 5,000 CHF

- FlowBank costs 6.5 CHF or 7.5 CHF

- SwissQuote costs 30 CHF

For an Equity trade of 50,000 CHF

- FlowBank costs 50 CHF or 75 CHF

- SwissQuote costs 135 CHF

For an Equity trade of 200,000 CHF

- FlowBank costs CHF200 or CHF300

- SwissQuote costs 190 CHF< /span>

For an ETF trade of 5,000 CHF

- FlowBank costs 6.5 CHF</strong > or 7.5 CHF

- SwissQuote costs 9 CHF

For an ETF trade of 10,000 CHF

- FlowBank costs 10 CHF or 15 CHF

- SwissQuote costs 9 CHF< /span>

For an ETF trade of 50,000 CHF

- FlowBank costs 50 CHF or 75 CHF

- SwissQuote costs 9 CHF< /span>

We can therefore conclude that FlowBank is cheaper than SwissQuote for Equity trades up to 200,000 CHF.

On the other hand, SwissQuote becomes more interesting for ETF trades greater than 10,000 CHF

If you prefer smooth, easy to understand interfaces and the majority of your trades are below 10,000 CHF, choose FlowBank without hesitation.

If, on the other hand, you primarily trade ETFs for amounts greater than CHF 10,000, SwissQuote will be economically more attractive.

Overall our preference is for FlowBank for the ease of opening an account, the quality of interfaces and customer service. All this being accompanied by very competitive prices.

FlowBank vs. Yuh Bank rates?

Yuh Bank also offers trading services, but it is much easier to compare:

- Yuh Bank applies fees of 0.50% on trading stocks, ETFs, with 1 CHF min.

- and 1% on Cyrpto-currency trading

Knowing that FlowBank applies a minimum of CHF 6.50, Yuh Bank will be “interesting” only on Equity and ETF trades less than CHF 1,300. Otherwise prefer FlowBank.

YUH Promo Code

YUH Promo Code

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

FlowBank Customer Service – 4/10

Our experience with Flowbank customer service is very average: Chat generally responds quite quickly but just pastes answers from the FAQ. If you have a technical problem, you have to explain it several times to get the beginning of an answer. And then you have to restart them….

When you try to contact them by phone, no one answers.

Rather disappointing on this point.

Additional information

Specification: FlowBank Review (2024)

| Account | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

| Trading | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

There are no reviews yet.