Yapeal Review – 30 CHF Free in July 2024

| Account opening | 9 |

|---|---|

| Usability | 9 |

| Features | 7 |

| Credit Card | 8 |

| Plans & Pricing | 4 |

| Speed | 9 |

| Customer Service | 7 |

July 2024 Yapeal Promo code: Get CHF 30 Free when opening a Yapeal account with the promo code YAPS311WZ4WL

Yapeal is a Swiss neobank that allows Swiss residents and foreigners from neighbouring coutries to open a mobile bank account and benefit from the services offered by the bank using a mobile application.

The opening of the bank account is fast and easy, with identity verification done within the app.

Description

Yapeal review – The Fintech neobank in Switzerland

Yapeal launched its offer in July 2020.

Unlike Neon – that use the services of Hypothekarbank Lenzburg – Yapeal has its own banking licence, a Fintech banking licence.

The bank account is only available in CHF

Here is a sumary of the Yapeal offer:

- Free bank account (Loyalty) in CHF, that does not allow bank transfers

- Free Visa Debit

- Premium offer (Private) from 4 .90 CHF

We have tested the Yapeal app for your and compared features and pricing.

Bank account opening with Yapeal – 9/10

Yapeal allows you to open a free mobile bank account from your smartphone.

What are the Yapeal bank account requirements

- Be at least 18 years old (15 years with Zak)

- Be a Swiss resident

- Have a smartphone compatible with the app

- No need to provide proof of revenue

- No minimum deposit

- No minimum balance

Yapeal has a strong focus on security and transparency. You can use this bank account to receive your salaries and make bank transfers in Switzerland or to your Revolut card.

How to open a bank account with Yapeal

To open an account with Yapeal you just need to follow these steps:

- Download the Yapeal app from the App Store or Google Play

- Download the Yapeal Shield app from the App Store or Google Play

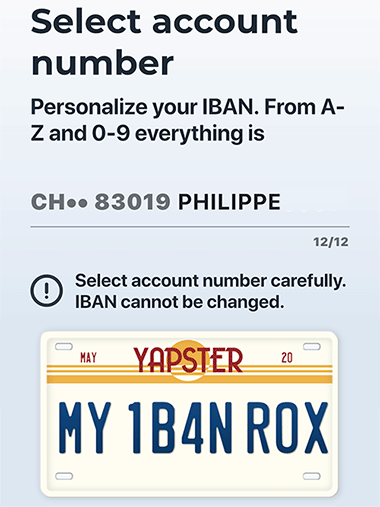

- Answer a few questions and choose your IBAN

- Verify your identity

- It’s done! Your Yapeal account is opened

Yapeal Promo Code

Yapeal Promo Code

Don't have a Yapeal account yet? Use our referral code to open your FREE Yapeal Bank account!

Use the promo code YAPS311WZ4WL before 31 July 2024 to receive CHF 30 for FREE 🙌

Get CHF 30 Free with Yapeal ➡️

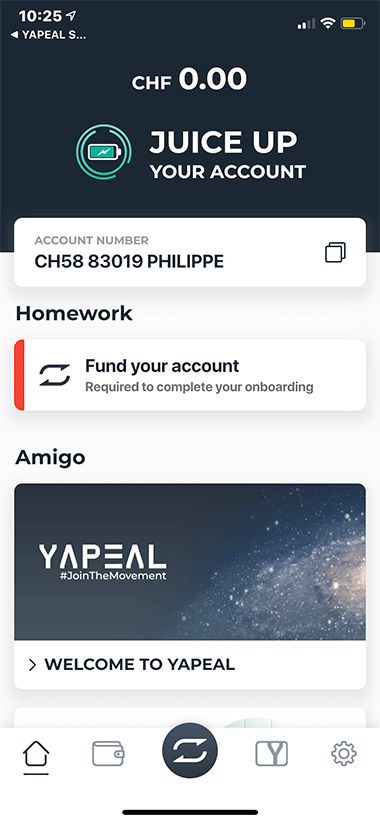

Personal touch: you can choose your own IBAN during the opening process:

The Yapeal account allows you to make all the standard transactions (bank transfer, direct debit, etc.) like with any Swiss bank account.

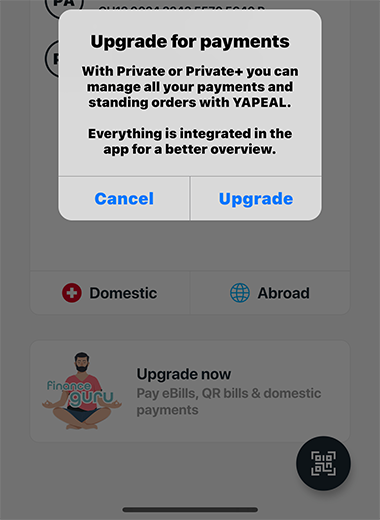

But be careful with fees and limitations: the free account (Loyalty) does not allow bank, which is really restricting the use of the account. If you try to make a bank transfer, Yapeal will push you to upgrade:

The Visa Debit card is free but you there is a 7-CHF delivery fee.

You receive a single letter with your card on it, which makes a real difference with CSX, Neon and Zak and their 2 to 4 letters: 1 for the card, 1 for the PIN code, 1 for the 3D PIN code and 1 for SecureSign (with CSX).

The Yapeal experience is closer to N26, but we would like a more polished packaging rather than a simple letter. Here is the N26 packaging for example:

Our opinion on the bank account opening with Yapeal

- Quick opening process completed in 10 minutes

- No revenue requirement

- Swiss neobank (Fintech licence)

- Account in CHF

We like the quick opening process, even we would prefer a single app. -1 point

The Yapeal opening process gets a 9/10Usability of the Yapeal app – 9/10

Like neon, Yapeal is a new neobank, the app has been developed “from scratch”.

Although the app is not using “happy colours”, the user interface is intuitive and reminds us leading neobanks app N26 and Revolut :

- The mobile app is fluid and intuitive

- Menus are clear and well organised

- Essential features are always visible

The home screen doesn’t not display your transactions and feels more like a Yapeal news feed to promote their new features. We would like an option to customise that home screen. That would avoid some extra clicks to reach the transactions for example. –1 point

The Yapeal app usability gets a 9/10Yapeal app features – 7/10

As a neobank, Yapeal offer all their services through a mobile application. That means it’s possible to do almost everything from your smartphone:

- Access your payment history

- Make new payments (only on the Premium paid plans)

- Scan invoices in Swiss format

- Activate eBill (only on the Premium paid plans)

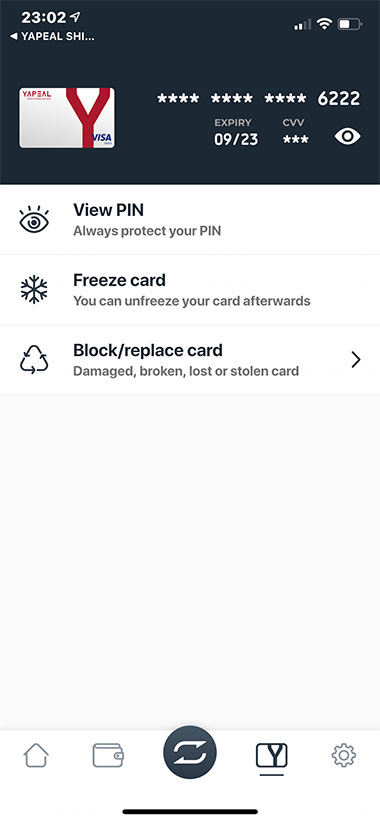

- Display your Visa card number and PIN code

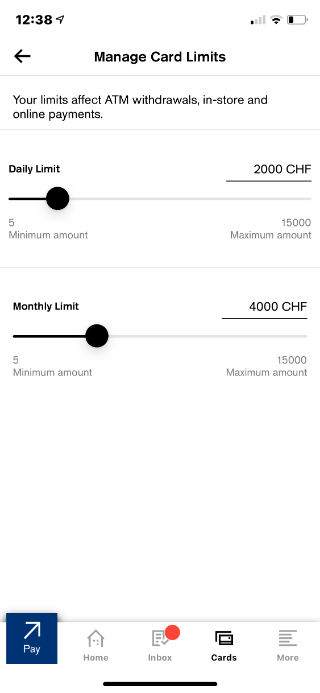

- Change your monthly limits

- Block your card

- Update your phone number

- Update your address

- Manage push notifications

Yapeal Promo Code

Yapeal Promo Code

Don't have a Yapeal account yet? Use our referral code to open your FREE Yapeal Bank account!

Use the promo code YAPS311WZ4WL before 31 July 2024 to receive CHF 30 for FREE 🙌

Get CHF 30 Free with Yapeal ➡️

But it’s not possible to:

- Change the PIN code of the card

- Authorise countries

- Create and Share spaces

- Contact customer support by Chat

- Use TWINT

The scanner feature or QR codes and invoices is very useful. A real plus compared to Revolut.

Card settings are not on par with N26 or Revolut

With Revolut and N26 you can temporarily freeze your card instead of blocking it, it’s also possible to change or display your PIN code in the app.

and unlike CSX and N26, it’s not possible to manage your daily limits:

If comfort options are missing, an essential feature is really missing on the free plan (Yapeal Loyalty): bank transfers! The fact that Yapeal is requiring a you to upgrade to be able to do bank transfers is really a drawback compared to other neobanks. It makes their free plan the equivalent of a Prepaid card.

Yapeal app features get a 7/10Yapeal credit card – 8/10

Yapeal offers a free Visa Debit card. But you’ll have to pay 7 CHF for delivery.

The Visa is very good for travelling and it’s compatible with Apple Pay, Google Pay and Samsung Pay.

Yapeal gets an 8/10 for the cardYapeal plans & pricing – 4/10

When they launched, Yapeal was offering a free bank account with all features. But at the beginning of 2021 they introduced a new pricing and that changed the whole package!

The Loyalty plan is still free but you must pay 7 CHF for the “delivery” of the Visa card. It’s not possible to make bank transfers unless you get a Private plan at 4.90 CHF per month or Private+ at 8.90 CHF per month.

Yapeal being a neobank based in Switzerland, fees are displayed in CHFPlans

The free plan: Loyalty with Visa Debit

The Private plan is 4.90 CHF/month and the Private+ plan is 8.90 CHF/month.

Yapeal Promo Code

Yapeal Promo Code

Don't have a Yapeal account yet? Use our referral code to open your FREE Yapeal Bank account!

Use the promo code YAPS311WZ4WL before 31 July 2024 to receive CHF 30 for FREE 🙌

Get CHF 30 Free with Yapeal ➡️

Yapeal Visa card fees

Yapeal offers a free Visa Debit card. There is a 7-CHF “card issuing fee” for Loyalty customers (free plan).

Cash withdrawals in Switzerland in CHF

- 2 CHF / cash withdrawal with the Loyalty and Private plans

- Free with the Private+ plan

Cash withdrawals in Switzerland in EUR

- 5 CHF / cash withdrawal with the Loyalty and Private plans

- Free with the Private+ plan

Cash withdrawals abroad

- 1.5% / cash withdrawal with the Loyalty and Private plans

- Free with the Private+ plan

Replacement card

- 20 CHF with the Loyalty and Private plans

- Free with the Private+ plan

Payments and cash withdrawals in foreign currencies

Yapeal uses Visa’s currency exchange rates – similar to Neon and N26 – and they do not apply extra fee.

Negative interests

If you hold a balance of more than 25,000 CHF, Yapeal will charge you interests of 0.80%:

0.75% per year for the SNB (Swiss National Bank)

+

0.05% for Yapeal admin fees

We remove 6 points from Yapeal because their free plan is not a real bank account and they “force” customers to pay 4.90 CHF/month if they want to have a real bank account: meaning having the ability to do bank transfers.

Yapeal gets a 4/10 for plans & pricingTransactions’ speed – 9/10

A wire transfer from a Swiss bank to another Swiss bank is instant, it usually takes a few seconds before showing up on the beneficiary account.

Yapeal offers YAPSTER-2-YAPSTER Payment which is similar to “Beam” (N26): an instant transfer feature that allows users to pay another Yapeal accounts in seconds.

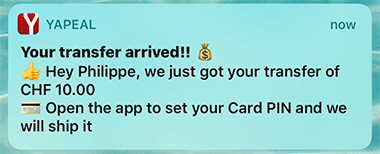

SEPA transfers are also very fast and the push notifications allow you to get an real-time alert when a transaction happens on your account:

Yapeal customer service – 7/10

Unlike N26, Yapeal does not offer Livechat support, but a contact form and phone number.

The phone support is very good and support agents pick up the phone very quickly.

With N26, you also get quick access to a LiveChat support agent during a wide time range (until 23:00). The N26 virtual assistant gets you to wait for a minute or so, the time it takes for a human to take over the conversation.

We believe that Yapeal should take example on N26 and offer in-app Livechat support.

It’s a 7/10 for customer serviceAdditional information

Specification: Yapeal Review – 30 CHF Free in July 2024

| Account | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||

|

||||||||||||||||||||||||

| Trading | ||||||||||||||||||||||||

|

||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||

|

||||||||||||||||||||||||

There are no reviews yet.