CSX by Crédit Suisse Review – 25 CHF Free in July 2024

| Account opening | 8 |

|---|---|

| Usability | 7.5 |

| Features | 8 |

| Credit Card | 8 |

| Plans & Pricing | 7 |

| Speed | 9 |

| Customer Service | 7 |

Use the promo code PA1289 to receive 25 CHF when opening a CSX Bank account.

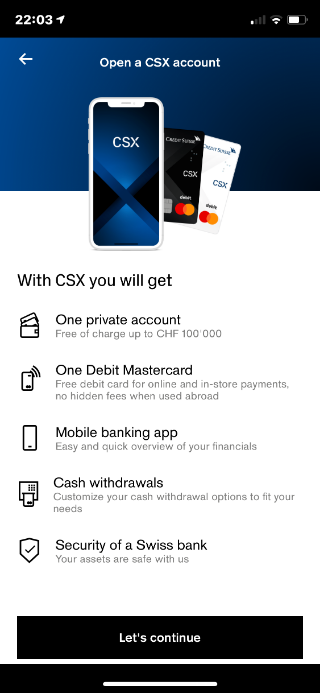

CSX by Crédit Suisse is a Swiss neobank that allows Swiss residents to open a mobile bank account and benefit from the services offered by the bank using a mobile application.

It includes a free Debit Mastercard.

The opening of the bank account is fast and easy, with identity verification done within the app.

Description

CSX by Crédit Suisse review – A free bank account in CHF with Crédit Suisse

Crédit Suisse has launched its Neobank in Switzerland: CSX

The main objective of Crédit Suisse is certainly to compete with other Swiss neobanks: Neon, Zak, Yuh and Yapeal

The account is only available in CHF

Here is a summary of the CSX offer:

- Free bank account in CHF

- Free Debit MasterCard

- Premium account from 3.95 CHF

CSX also offers a bank account for teenagers and young adults from 12 to 25 – CSX Young. It includes free cash withdrawals at any ATM in Switerland.

We have tested the CSX app for you and compared features and pricing.

Bank account opening with CSX by Crédit Suisse – 7/10

Yuh Bank allows you to open a free mobile bank account from your smartphone.

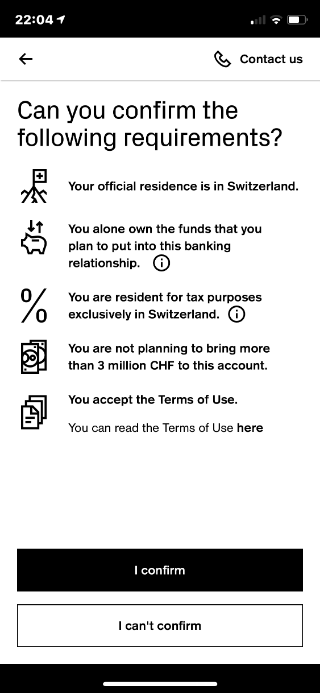

What are the CSX bank account requirements

- Be at least 12 years old (15 years with Zak)

- Be a Swiss resident

- Have a smartphone compatible with the app

- No need to provide proof of revenue

- No minimum deposit

- No minimum balance

CSX inherits the security standards and reputation of Crédit Suisse. You can use this bank account to receive your salaries and make bank transfers in Switzerland or to your Revolut card.

How to open a bank account with CSX by Crédit Suisse

To open an account with CSX you just need to follow these steps:

- Download the Yuh app from the App Store or Google Play

- Answers the usual questions

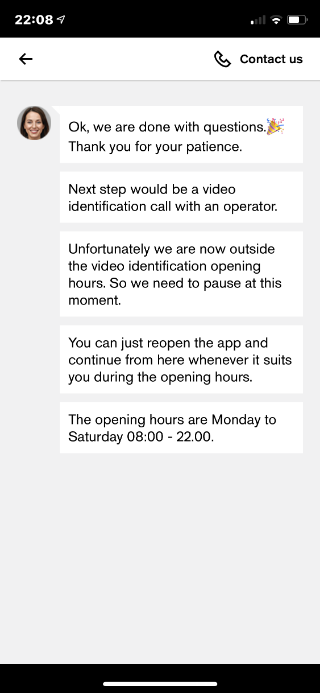

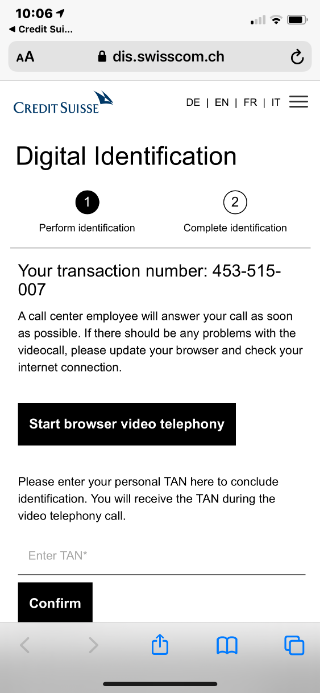

- Verify your identity through the app (CSX use Swisscom for the verification service)

- It’s done! Your CSX account is opened

Compare CSX with YUH

Compare CSX with YUH

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

Here are the steps of the account opening process with CSX by Crédit Suisse:

#1 Read the welcome message

#1 Accept the CSX bank account requirements

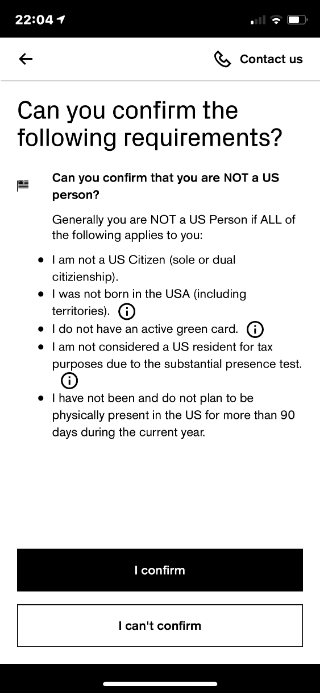

#3 Start the ID verification process

CSX won’t ask for paper documents. But if you’re not of Swiss nationality, the Swisscom agent will check your B permit (or C).

In practice, you may have to wait 5 to 10 minutes before a Swisscom agent takes the video call, but once the verification is done your account is opened immediately!

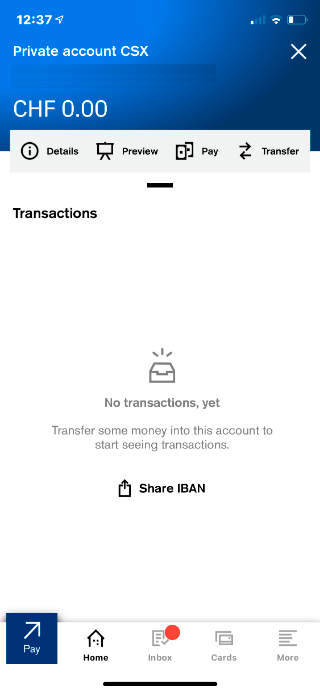

The CSX Bank account allows you to make all standard transactions (bank transfer, direct debit, etc.) like with any Swiss bank account.

The MasterCard Debit card is free and – as usual in Switzerland – your receive 2 letters: 1 for the card and 1 for the PIN code. But wait, there is more: you will also receive 1 letter for the 3D secure PIN code and 1 letter for SecureSign.

Crédit Suisse made the opening process fast and simple, providing a similar experience to leading neobanks such as N26. But the CSX app reminds us a lot of the Crédit Suisse app. You receive the same letter and the customer service phone number is the same: 0848 880 842

Our opinion on the bank account opening with CSX by Crédit Suisse

- Quick opening process completed in 20 minutes (including at least 10 minutes waiting)

- No revenue requirement

- Swiss neobank

- Account in CHF

- The Swisscom integration could be better

- Some bugs may occur during the opening process

- Too many mails

We like the quick opening process (when it works as expected), but we would like a single welcome letter with the Debit Card and a better packinging. -3 points

The CSX opening process gets an 8/10Usability of the CSX app – 7/10

CSX is the neobank of Crédit Suisse and that influenced a lot the design of the mobile application!

We feel that the Crédit Suisse interface has been adapted to create CSX, but we don’t have that modern look and feel of well known Neobanks like N26 or Revolut.

Compare CSX with YUH

Compare CSX with YUH

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

The user interface is not as quick and as intuitive as N26 and Revolut. There is no visual transition between pages, it’s lacking of “polish” and reminds us a bit of Zak.

Despite some usability issues, the application is easy to use. Menus are well organised and key features are accessible in one click.

We remove 3 points because the experience is behind N26 or Revolut.

It’s a 7/10 for the Zak app usabilityCSX app features – 8/10

As a neobank, CSX offers most services directly within the mobile application:

- Access your payment history

- Make new payments

- Scan Swiss invoices

- Block your card

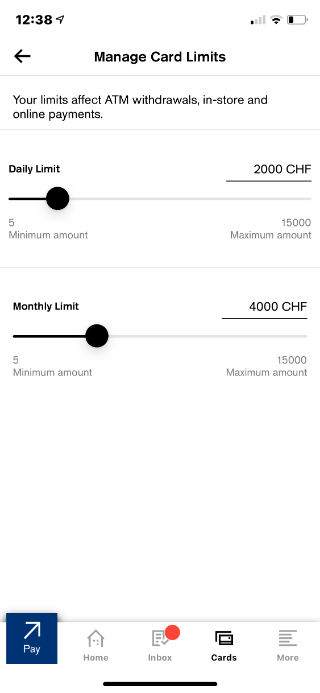

- Set card limits

- Authorise countries

- Change your plan

- Update your phone number

- Manage push notifications

- Use TWINT

But some features are not yet available:

- Freeze the card, like with N26 or Revolut

- Create and share spaces

- Change the card PIN code

- Change your personal details

- Contact the customer service by Chat

The feature to scan QR codes or Swiss invoice is very handy. Which is a significant difference compared to Revolut.

Similar to Yapeal. you can also choose your personalised IBAN (there is 2 CHF setup fee).

Not enough card settings

Unlike Revolut or N26 it is not possible to freeze the debit card or to display the PIN code of the Mastercard.

If you forgot your card PIN number, you must ask for a new one that will be sent by mail.

While essential features are available, the app is lacking comfort options.

We also would like to have business logo for each transaction, like Yapeal and Neon do.

It’s a 7/10 for the CSX app featuresCSX Credit Card – 8/10

CSX offers a free Debit MasterCard.

It comes as white for the basic plan and black for the Premium plan:

The MasterCard is very good for travelling, but is not yet compatible with Apple Pay, Google Pay et Samsung Pay.

CSX getsan 8/10 for the cardCSX by Crédit Suisse plans & pricing – 7/10

The CSX Basic plan is free and includes a free Debit MasterCard. CSX Premium costs 3.95 CHF per month and includes free cash withdrawals at any Crédit Suisse ATM.

CSX being a neobank based in Switzerland, fees are displayed in CHFAvailable plans

The Basic plan packet with a White Debit Mastercard is free

The Premium plan with a Black Debit Mastercard costs 3.95 CHF/month and is billed per quarter. Which seems more competitive than Premium Zak Premium that costs 8 CHF/month, but if you plan to upgrade to get unlimited cash withdrawals are any ATM, Zak Premium is the better option.

Compare CSX with YUH

Compare CSX with YUH

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

CSX MasterCard fees

CSX offers a free Debit MasterCard. It’s white with the Basic plan and black with Premium plan, which reminds us of the Premium cards from N26 and Revolut.

Cash withdrawals in Switzerland in CHF

At Crédit Suisse ATM:

- 2 CHF / cash withdrawal with the Basic plan

- Free with Premium plan

At any other ATM:

- 2 CHF / cash withdrawal

At ATM abroad

- 4.75 CHF plus 0.25% of the transaction amount

Replacement card

CSX takes a 20 CHF if you need to replace your card

Payments and cash withdrawals in foreign currencies

When purchasing in a foreign currency, Crédit Suisse apply their own exchange rate that is slightly higher than interbank rate used by other Neobanks such as Neon and Yapeal.

Transactions’ speed – 9/10

A wire transfer from a Swiss bank to another Swiss bank is instant, it usually takes a few seconds before showing up on the beneficiary account.

CSX is lacking some instant transfer feature like “Beam” (N26) that allows users to pay another N26 accounts in seconds.

This is a 9/10 for transactions’ speedService clients CSX – 7/10

Unlike N26, CSX does not offer Livechat support, but a chatbot and premium-rate phone number opened Monday to Friday from 8:00 to 18:00.

You get the same customer service as other Crédit Suisse customers.

The phone support is very good and support agents pick up the phone very quickly.

With N26, you also get quick access to a LiveChat support agent during a wide time range (until 23:00). The N26 virtual assistant gets you to wait for a minute or so, the time it takes for a human to take over the conversation.

We believe that CSX should take example on N26 and offer in-app Livechat support.

It’s a 7/10 for customer serviceWhich plan is best: CSX Basic or CSX Premium?

If you withdraw cash frequently, you might be interested with the Premium plan, but that only applies to Crédit Suisse ATM, hence a very limited benefit.

Other avantages (cinema ticket for 15 CHF, 20% discount on streaming) are not significant, CSX Basic is clearly the best option.

Compare CSX with YUH

Compare CSX with YUH

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

Additional information

Specification: CSX by Crédit Suisse Review – 25 CHF Free in July 2024

| Account | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

| Trading | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

There are no reviews yet.