If you’re hesitating between Yuh Bank and Neon Bank, and you do not know which neobank is the most advantageous for you, here is a comparison that will help you choose.

In our ranking of the best Swiss mobile banks you can see that Yuh and Neon Bank are neck and neck, being equal on almost all criteria, but there are some differences that may be important for you.

Yuh vs Neon – Which neobank is best for you

If you don’t have time to read this article, here is which neobank to choose according to your use:

| Use | Yuh | Neon |

|---|---|---|

| Free bank account with free debit card | 👍 | 👍 Free MasterCard with our promo code |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 | |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 250 SWQ+50 CHF Trading Credits with our promo code |

To find out how each criterion is judged, read on: we review important options for Switzerland (IBAN CH, transfers in CHF, TWINT) and abroad (withdrawals with the card, SEPA transfer fees, transfers in designs).

YUH Promo Code

YUH Promo Code

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

Yuh vs Neon – 1 point all around

| Yuh | Neon | |

|---|---|---|

| Free debit card | ✅ Mastercard | ✅ Mastercard |

| Quick account opening | ✅ 15 min. with the app | ✅ 15 min. with the app |

| Safe | ✅ Subsidiary of Swissquote and Postfinance | ✅ Partner of Hypothekarbank Lenzburg |

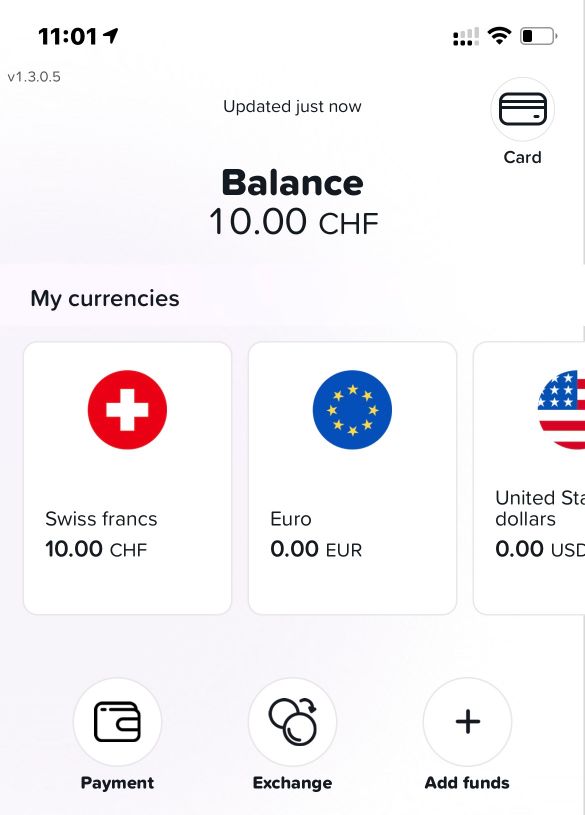

| IBAN (CH) | ✅ | ✅ |

| eBill | ✅ | ✅ |

| Free CHF transfers | ✅ | ✅ |

| Push Notifications | ✅ | ✅ |

| Compatible with Apple Pay, Google Pay | ✅ | ✅ |

Yuh and Neon are equal on these criteria, even though sometimes the experience can be different during account opening the 2 neobanks allow for a quick and easy opening in 15 minutes.

Yuh vs Neon – TWINT

| Neon | Yuh | |

|---|---|---|

| TWINT | ✅ UBS or TWINT Prepaid | ✅ Yuh TWINT |

Unlike Yuh TWINT, Neon does not offer a dedicated TWINT application but asks you to use the TWINT application from UBS or TWINT Prepaid, which is less practical.

1 point for Yuh

Yuh vs Neon – Free bank account

Yuh and Neon offer free bank accounts with IBAN CH.

But beware of inactivity and reactivation fees at Yuh, it could cost you a lot of money: “dormant” account = 100 CHF/year, reactivation = 100 CHF

1 point for Neon

Yuh vs Neon – Promo code

When you open an account with Yuh or Neon, you receive a welcome gift (cash) in your account, which is always nice.

The advantage goes to Yuh that offers a bigger welcome bonus.

1 point for Yuh

Yuh vs Neon – Debit card & Withdrawals

All banks try to limit cash withdrawals at the ATM, but some allow you to do so for free within certain limits.

| Yuh | Neon | |

|---|---|---|

| Free Debit card | ✅ | ✅ 20 CHF or FREE with our promo code |

| Free CHF Withdrawals | ✅ 1/week, then 1.90 CHF, up to 10,000 CHF/mo. | ✅ 2/month then 2 CHF |

| Free Withdrawals Abroad | ❌ 4.90 CHF each | ❌ 1.5% |

So Yuh offers you 4 free CHF withdrawals per month while Neon limits to 2.

1 point for Yuh

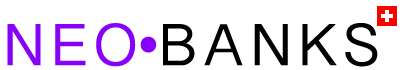

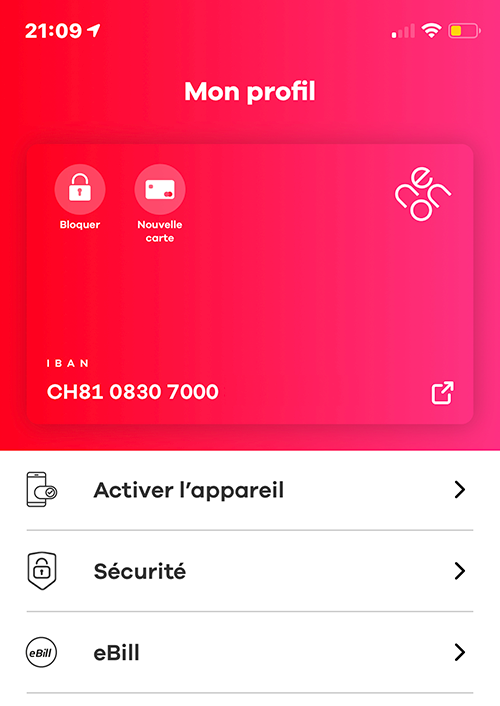

Yuh vs Neon – Which app is more ergonomic?

Discussing usability can be very subjective, but it comes down to which app is more intuitive and easier to use, for example:

- How many clicks to access an important function?

- How many clicks to complete a transaction?

- Does the app crash often?

- Is the app fast?

Without doing a complete ergonomic analysis (it’s not the purpose of this article), we think that the Yuh app is overall better than the Neon app:

The designs of the 2 apps are very modern, close to N26 and Revolut which are the references in terms of neobanks, but there are some differences:

With Yuh:

- the application is fluid and fast

- it is possible to change the monthly limit of the card (it is not as good as CSX)

- all functions are directly accessible

With Neon:

- the application is slower, there are sometimes “crashes” when connecting to the account

- the application does not allow to manage the card limits

- all functions are directly accessible

The 2 applications have a very good ergonomics and it is difficult to decide between them at this point.

1 point each

Yuh vs Neon – Banking Licenses

Although Neon is a partner of a Swiss bank (Hypothekarbank Lenzburg) and Yuh is a subsidiary of Swissquote and Postfinance, neither has a banking license (Yuh uses the banking license of Swissquote Bank SA).

In both cases your deposits are protected up to 100,000 CHF.

0 point each

Yuh vs Neon – Account in EUR

Neon offers a CHF account which means that any payment in EUR or other currencies will be subject to an exchange rate and possible fees. Neon uses Wise for foreign currency transfers and we have seen in our article on the Best CHF/EUR Exchange Rates that Revolut and Wise offer the best exchange rates and Neon – due to the Wise partnership – is just behind.

Yuh bank offers a multi-currency account with the choice of the main currency: CHF, EUR or USD which makes it an ideal bank account for cross-border commuters and non-residents.

Yuh allows you to create sub-accounts in 13 different currencies: CHF – USD – EUR – GBP – JPY – AUD – CAD – SEK – HKD – NOK – DKK – AED – SGD

Incoming bank transfers are free of charge on the available currencies, which is an advantage over Neon, which can only accept CHF without fees.

But, because there is a but! Yuh applies 0.95% exchange rate fees, so crediting your Yuh account in CHF to convert them to EUR or another available currency will cost you 0.95%, which is not always advantageous compared to Neon.

To avoid exchange fees on EURO, the trick is to fund your Yuh account in EUR from another account in EUR (an account at UBS for example), you will then benefit from free payments in EURO zone.

1 point for Yuh

Yuh vs Neon – Trading Account

Yuh was the first Swiss neobank to offer a Stocks / ETFs / Trading Themes trading account and 32+ Crypto-currencies such as Bitcoin.

But since July 2023, Neon also allows offers Trading from their App.

| Trading | Yuh | Neon |

|---|---|---|

| Custody fee | ✅ | ✅ |

| Trading of Swiss Stocks | 0.50% | 0.50% |

| Trading of Swiss ETF | 0.50% | 0.50% |

| Trading of Foreign Stocks | 0.50% | 1.00% |

| Trading of Foreign ETF | 0.50% | 1.00% |

| Trading of Themes | 0.50% | ❌ |

| Trading of crypto-currencies | 1.00% | ❌ |

Yuh and Neon therefore come to compete with Revolut or Flowbank, but with different prices that we will be able to compare in a future article.

Since Neon’s fee are higher than Yuh’s, the point is for Yuh.

1 point for Yuh

Yuh vs Neon – Swissqoins Loyalty Program (SWQ)

While Neon doesn’t offer a loyalty program yet (except for a carbon offset with Neon Green), Yuh offers a loyalty program that pays you in Swissqoins (SWQ): the crypto-currency created by Yuh.

At the launch of the program the rate was 1 Swissqoin = 0.01 CHF, so 500 SWQ = 4 CHF, today we are rather on 1 Swissqoin = 0.015 CHF, that is to say an increase of 50% in 2 years.

Yuh pays you on the following operations:

- Single deposit of 500 CHF at the opening of the account = 250 SWQ

- Each trade with Yuh = 10 SWQ

- Each payment with Yuh Mastercard = 2 SWQ

1 point for Yuh

Yuh vs Neon – SPACES

SPACES is a feature originally launched by N26: it’s similar to a shared sub-account at N26, but Yuh Bank and Neon are not yet on the same level.

Called SPACES at Neon and SAVE at Yuh, this feature is similar to a piggy bank without the possibility of sharing with other users, unlike Zak for example:

- SPACES is a personal piggy bank

- SPACES cannot be shared

- SPACES does not have a dedicated IBAN (option offered by Bunq.com)

We remain on our hunger as well at Yuh as at Neon. If you need this feature, check out Zak.

0 points everywhere

Yuh vs Neon – Travel and Exchange Rates

As said above: Yuh bank offers a multi-currency account, while Neon offers a CHF account which implies that any payment in EUR or any other currency will be subject to an exchange rate and possible fees.

Both neobanks are very transparent on the issue of exchange fees:

- Yuh applies a 0.95% fee on currency exchange, as well as 4.90 CHF/withdrawal abroad

- Neon does not apply any surcharge on the interbank rate and 1.5% fee on EUR withdrawals in Switzerland or abroad.

Yuh is strongly penalised by the 4,90 CHF fixed fee. Indeed, unless you withdraw 1,000 EUR – which is usually not possible – Neon Bank will always be cheaper on foreign withdrawals.

Yuh is also penalised on card payments because of the 0.95%, so Neon remains better positioned than Yuh on travel and exchange rates

1 point for Neon

Neon Bank

Neon Bank

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the promo code NEONEO before 31 July 2024 to receive up to 30 CHF cashback on the trading fees of your first 3 trades + your FREE debit card 🙌

Get CHF 30 Free with Neon ➡️

Yuh vs Neon – Customers ratings and reviews

Yuh is rated 4.7 in the App Store (7.4k reviews) and Neon is rated 4.6 in the App Store (4.5k reviews) , it means that customers are quite happy with both neobanks.

1 point everywhere

Yuh vs Neon – Which neobank is the best one

If we consider all of these criteria:

- Yuh Bank gets 9 points

- Neon Bank gets 5 points

Yuh therefore clearly has the advantage, but Neon remains an excellent neo-bank.

- if you want an account in EUR or USD, choose Yuh

- if you make withdrawals once a week, choose Yuh

- if you want an account that offers a Mastercard and a trading account, choose Yuh

Otherwise, do not hesitate to test the 2 because these neobanks are free and are complementary: