If you are hesitating between CSX by Credit Suisse and Neon Bank, you don’t know which neobank is the most advantageous for you, here is a comparison that will help you choose.

In our ranking of the best Swiss neobanks you can see that the difference between CSX and Neon Bank is not very important, being equal on many criteria, but there are some differences that may be important for you.

CSX vs Neon – 1 point each

| CSX | Neon | |

|---|---|---|

| Free bank account | ✅ | ✅ |

| Code Promo | ✅ | ✅ |

| Free debit card | ✅ Mastercard | ✅ Mastercard |

| Quick account opening | ✅ 15 min. with the app | ✅ 15 min. with the app |

| IBAN (CH) | ✅ | ✅ |

| Free CHF transfers | ✅ | ✅ |

| Push Notifications | ✅ | ✅ |

| eBill | ✅ | ✅ |

| Compatible with Apple Pay, Google Pay | ✅ | ✅ |

CSX and Neon are equal on these criteria, even though sometimes the experience can be different during account opening the 2 neobanks allow for a quick and easy opening in 15 minutes.

CSX vs Neon – The missing features

CSX and Neon are also equal on some missing features:

| CSX | Neon | |

|---|---|---|

| EUR account | ❌ | ❌ |

| Multi-currency account | ❌ | ❌ |

None of these neobanks offer EUR or multi-currency accounts, you have to turn to Yuh, N26 or Revolut

CSX vs Neon – Promo code

When you open an account with CSX or Neon, you get a welcome gift of cash on your account, which is always nice.

If it’s the welcome gift that motivates you first, open an account with CSX, and you can enjoy 25 CHF on top of their current 50 CHF promo.

1 point for CSX

CSX vs Neon – Free withdrawals

All banks seek to limit cash withdrawals at the ATM, but some allow you to do so for free within certain limits.

The advantage clearly goes to Neon. although Yuh has an even better offer.

1 point for Neon

YUH Promo Code

YUH Promo Code

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

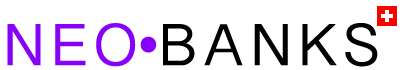

CSX vs Neon – Which app is more ergonomic?

Discussing usability can be very subjective, but it comes down to which app is more intuitive and easier to use, for example:

How many clicks to access an important function?

How many clicks to complete a transaction?

Does the app crash often?

Is the app fast?

Without doing a full ergonomic analysis (which is not the purpose of this article), we believe that the Neon app is better overall than the CSX app:

With CSX:

- the homepage is often a bit slow to load, and you have to force the update after a transaction

- all functions are available, but sometimes you have to navigate through the menus

- the style of the app is that of a classic mobile bank, quite far from N26 or Revolut

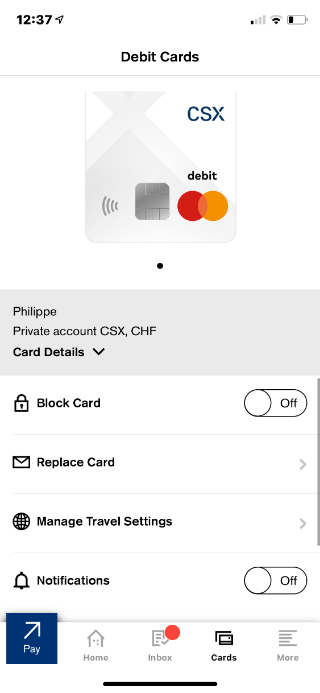

With Neon:

the design of the Neon application is very modern, close to N26 and Revolut which are the references in terms of neobanks the application is sometimes slow and there are crashes when connecting to the account the application does not allow you to manage the card’s limits all functions are directly accessible

On the one hand we have a pure player style application that takes care of the user experience and on the other hand a very complete application that benefits strongly from the contributions of Credit Suisse.

1 point for Neon

CSX vs Neon – Banking Licences

Although Neon is a partner of a Swiss bank (Hypothekarbank Lenzburg), Neon does not have a banking license, but deposits are protected up to CHF 100,000.

CSX is a Credit Suisse product, so the Credit Suisse banking license applies.

1 point for CSX

CSX vs Neon – TWINT

Neon allows you to use TWINT via the UBS TWINT app or via the TWINT Prepaid app. Neon therefore does not offer a dedicated TWINT app.

CSX uses the much better integrated Credit Suisse TWINT app.

1 point for CSX

CSX vs Neon – SPACES

SPACES is a feature originally launched by N26: it is similar to a shared sub-account at N26.

Chet Neon, this feature is similar to a piggy bank without the possibility of sharing with other users, unlike Zak for example:

- SPACES is a personal piggy bank

- SPACES cannot be shared

- SPACES does not have a dedicated IBAN (option offered by N26)

Even if this is basic in Neon, CSX does not offer this feature.

1 point for Neon

Neon Bank

Neon Bank

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the promo code NEONEO before 31 July 2024 to receive up to 30 CHF cashback on the trading fees of your first 3 trades + your FREE debit card 🙌

Get CHF 30 Free with Neon ➡️

CSX vs Neon – Travel and Exchange Rates

None of these accounts are multi-currency, which means that any payments in EUR or other currencies will be subject to an exchange rate and possible fees.

Neon Bank is very transparent on the issue of exchange fees:

- Neon does not apply any mark-up on the interbank rate

- and a 1.5% fee on EUR withdrawals in Switzerland or abroad.

At CSX it is much less clear:

The Credit Suisse exchange rate applies and is not publicly available, unlike the interbank rate

a fee of CHF 4.75 plus 0.25% on foreign withdrawals.

1 point for Neon

CSX vs Neon – Personalised IBAN

Of all the Swiss neobanks, only Yapeal and CSX allow you to have a personalized IBAN.

You have to pay a one-off fee of CHF 2 to get a personalised IBAN at CSX.

1 point for CSX

CSX vs Neon – Customer reviews and ratings

CSX Credit Suisse is rated 4.6 on the App Store (63k reviews) and Neon is rated 4.7 on the App Store (3.3k reviews). The customer reviews are therefore comparable in terms of rating and suggest that customers are generally satisfied with both neobanks.

0 points everywhere

CSX vs Neon – Which neobank to choose

Taking all of these criteria into account, Neon Bank and CSX are equal, but your decision should depend on your own selection criteria:

- if you want the security of a big bank, choose CSX

- if TWINT is important to you, choose CSX

- if you make withdrawals twice a month, choose Neon

- if you want a personalised IBAN, choose CSX

- if you want a card for travelling, choose Neon

And if you have any doubts, test the 2 because these neobanks are free and are possibly complementary: