Planning for retirement is a crucial step in securing your financial future. Switzerland offers a three-pillar system, where the third pillar allows voluntary saving to supplement state and employer pension benefits.

In a previous article we talked about the offer from 3rd Pillar of Zak Bank, it It is now the turn of Yuh Bank to offer its 3a plan. Let’s take a detailed look at the pros and cons of Yuh 3a to help you decide if it’s the right option for your retirement savings.

What are the advantages of Yuh 3a

- Competitive fees: Yuh 3a charges an annual management fee of 0.50%, which is lower than the average for third pillars in Switzerland. Additionally, these fees include all costs related to the underlying funds, providing a transparent solution. Here is what is included in the Yuh 3a rate:

Custody fees ✅ Investment fees (TER) ✅ Currency exchange fees ✅ Administration fees ✅ Transaction fees ✅ 3a foundation fees ✅ Unlimited strategy changes ✅ Deposits and withdrawals ✅ Account opening and closing ✅ - Ease of use: The Yuh mobile app is intuitive and user-friendly, ideal for investment beginners. Opening an account and managing your investments is done in just a few clicks directly from the application.

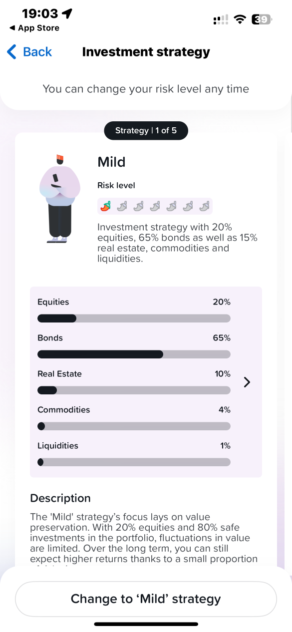

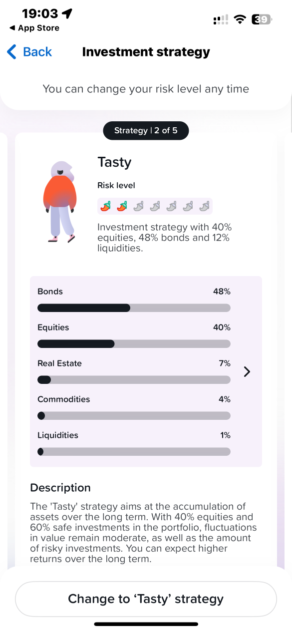

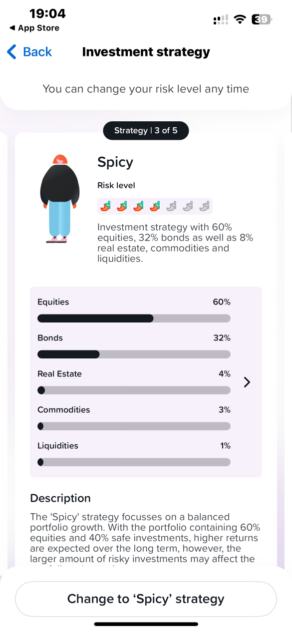

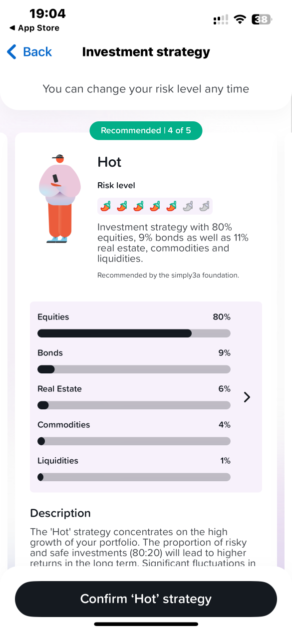

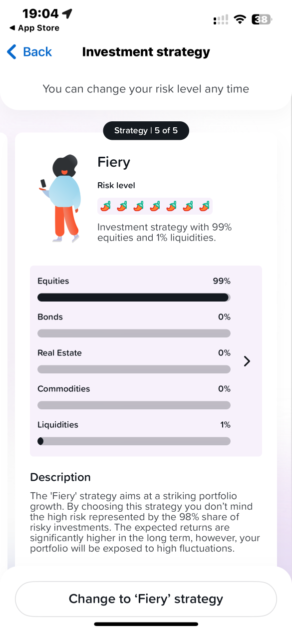

- Diversified investment strategies: Yuh 3a offers five predefined investment strategies, ranging from 20% to 98% stocks. This allows you to choose the level risk level that matches your tolerance and long-term retirement goals:

- Mild: 20% in shares

- Tasty: 40% in shares

- Spicy: 60% in shares

- Hot: 80% in shares

- Fiery: 98% in shares

- Currency risk hedging: All Yuh 3a investments are denominated in Swiss francs. This can be an advantage for people who fear currency fluctuations and want to protect their savings from inflation.

What are the disadvantages of Yuh 3a

- Lack of flexibility: Currently you can only open one Yuh 3a account and the investment portfolios are predefined. This limits the customization possibilities for more seasoned investors who wish to adapt their strategy according to their risk profile and objectives.

- Required sustainable investment: Yuh 3a currently only offers sustainable funds. If you are not interested in sustainable investing, you will need to consider other solutions.

- Lack of transparency: Investment portfolio details are not easily accessible on the app. It is important to be able to analyze the underlying funds before investing to ensure they meet your expectations.

What to think of the Yuh 3a offer

Yuh 3a is an attractive option for people who are new to investing for retirement and looking for a simple and affordable solution with currency risk hedging.

The fees are relatively low and the app is easy to use. However, the lack of flexibility and transparency can be a drawback for savvy investors. If you’re looking for more control over your portfolio and greater transparency, it may be wise to consider alternatives.

Remember to consider your retirement goals, risk tolerance and flexibility needs before choosing a third pillar account.

YUH Promo Code

YUH Promo Code

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

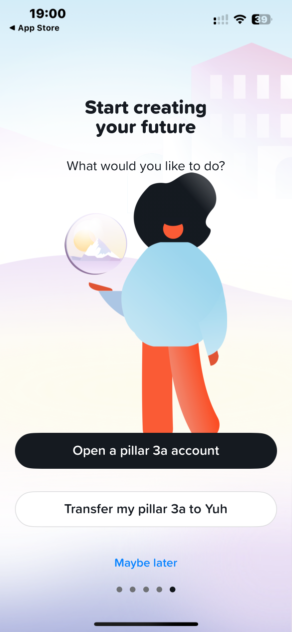

How to open a 3rd pillar Yuh 3a account

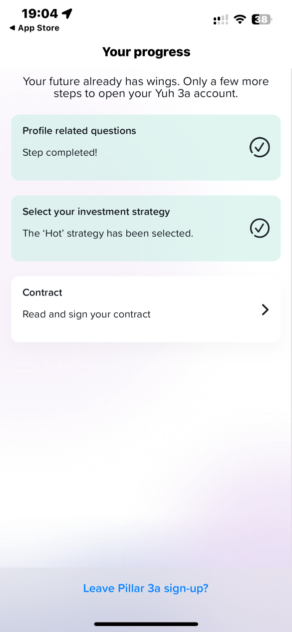

Opening a Yuh 3a account is done directly in the Yuh application, here are the steps:

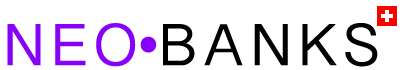

Step 1: Access the “Save” section

In the Yuh app, tap the “Save” tab. At the top left you can see the account Yuh 3a.

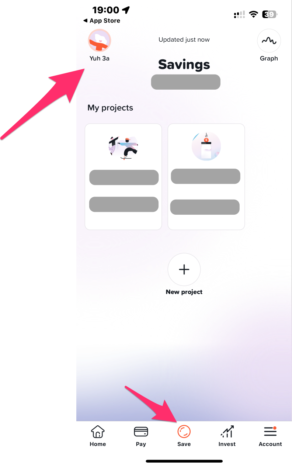

Step 2: Select “Yuh 3a”

Read the information and tax benefits related to the Yuh 3a account. Accept to continue.

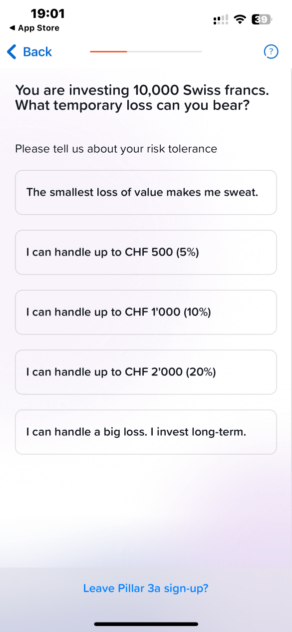

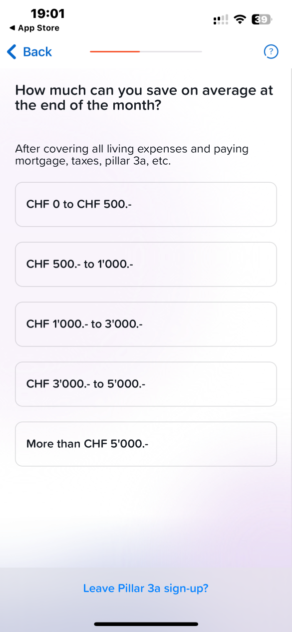

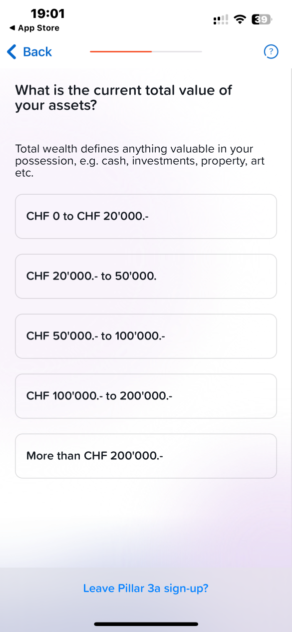

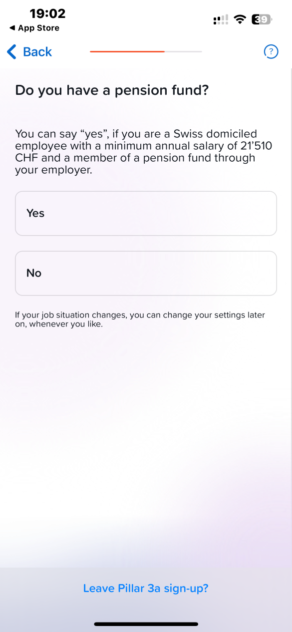

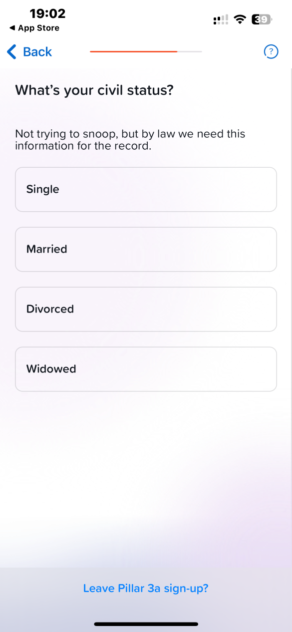

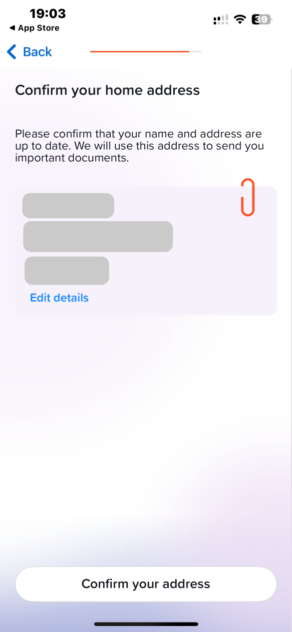

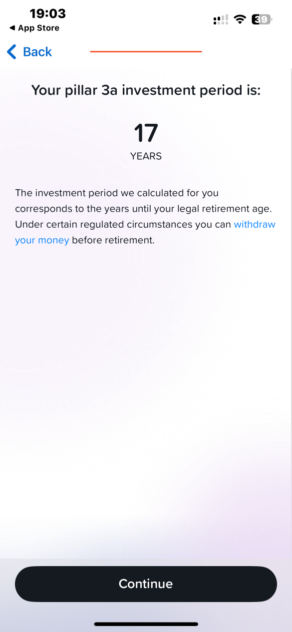

Step 3: Take the questionnaire

This questionnaire aims to assess your investor profile and your propensity for risk:

Step 4: Choose your investment strategy

Yuh 3a offers five predefined investment strategies, ranging from 20% to 98% stocks. The strategy that best suits you is offered by default, but you can select another depending on your retirement objectives and your risk tolerance.

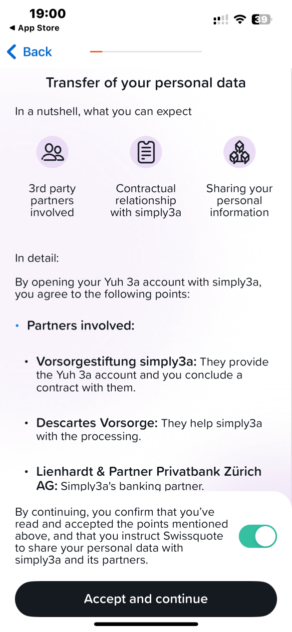

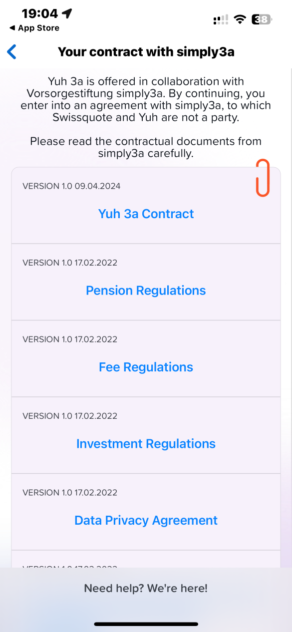

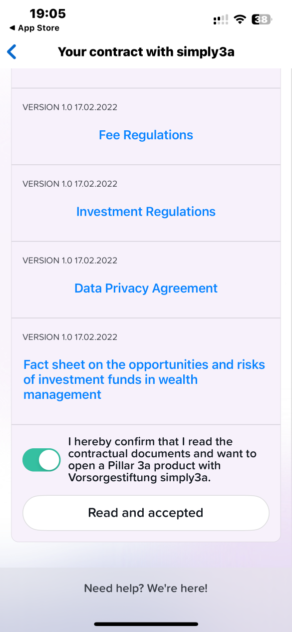

Step 5: Read and accept the Yuh 3a terms and conditions

It is important to read the information and terms and conditions carefully before opening a Yuh 3a account. Make sure you understand the risks and fees associated with this savings product.

Step 6: Make your down payment

Once you have read and accepted all the terms and conditions, you can validate your registration.

You can then pay an initial amount between CHF 100 and the maximum tax deductible amount: CHF 7,056 in 2024.

The maximum deductible amount depends on your income and your professional situation. You can change your down payment amount at any time.

Additional Tips:

- You can change your investment strategy at any time.

- You can deposit money into your Yuh 3a account at any time.

- You can withdraw your money from your Yuh 3a account no earlier than five years before you retire.

YUH Promo Code

YUH Promo Code

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 31 July 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️