Did you know that there is a very simple way to pay less tax in Switzerland?

If you are an employee and pay your taxes in Switzerland, you can reduce your taxes by opening a 3rd pillar account for individual retirement provision, regardless of your age.

Good news: opening a 3rd pillar 3a can be done very simply, in just a few clicks. Read below to find out how to do it.

What is the 3rd pillar?

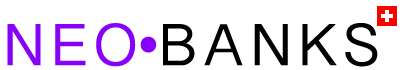

In Switzerland, the pension system is based on the three-pillar system: state pension, occupational pension and private pension. This system aims to guarantee coverage of risks in the event of death, disability and old age.

- The 1st pillar is the responsibility of the State. It is mandatory.

- The 2th pillar depends on the employer. It is mandatory for employees and optional for the self-employed.

- The 3rd pillar is totally optional and individual.

The purpose of the 3rd pillar is to fill any gaps in terms of pension provision that are not covered by pensions AVS/AI and LPP. Indeed, in most cases, the amount of benefits received under the 1st and 2th pillars represents approximately 60% to 70% of the last salary received.

By opening a 3rd pillar account and making regular payments into it until retirement, you can receive post-retirement income that is equivalent to your last salary, or at least , the highest possible in relation to the salary received during your working years.

The 3rd pillar is made up of two elements:

- Tied pension provision: 3a

- Free pension: 3b

Pillar 3a allows you to save for your retirement and protect your family from need. The 3rd pillar is also an easy way to save tax: Pillar 3a payments can be deducted from your income taxable.

Pillar 3b, which broadly pursues the same objectives as pillar 3a, essentially includes bank accounts, securities deposits, life insurance and real estate. In addition, it has lower tax advantages compared to pillar 3a.

How much tax can I save with the 3rd pillar 3a?

3rd pillar 3a pension plans are available from banks (3a accounts, pension funds, 3a life insurance products) and insurance companies.

Your retirement savings and the interest it generates are exempt from withholding tax and wealth tax. You can deduct your voluntary annual payments from your taxable income up to the amount legal maximum, namely:

- In 2022, the maximum deductible amount is CHF 6,883 for people affiliated to a pension fund. In 2023, this amount will be increased to CHF 7,056.

- For working people without a pension fund, the ceiling isCHF 34,416 (but no more than 20% of net income).

Note that you can use the amount saved to finance your main home or to amortize your mortgage.

What do I earn from the amount saved in 3rd pillar 3a?

At Zak, the interest rate for the retirement savings account (3rd pillar) is 0.2%.

If the interest rate is low, the gain is mainly in the reduction of taxes. In addition, Zak allows you to invest your retirement savings in securities. You can do this right in the app after you’ve defined your risk profile and selected your investment strategy (keep reading for the step-by-step process).

Zak is making a promotion until December 31, 2022: for each investment by the end of the year in savings in securities linked to “Foresight in Zak”, Bank Cler will offer you a credit corresponding to 1% of the newly invested amount, of an maximum amount of CHF 100.

ZAK Bank Promo Code

ZAK Bank Promo Code

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before 31 July 2024 to get CHF 50 for FREE 🙌

Get CHF 50 Free with ZAK ➡️

When to start payments to pillar 3a

The earlier you start saving with 3rd pillar 3a, the greater your tax savings and the greater your capital. It is therefore advisable to open a pillar 3a account as soon as you start working. The only condition is that you carry out a gainful activity in Switzerland and that you have an income subject to the AVS.

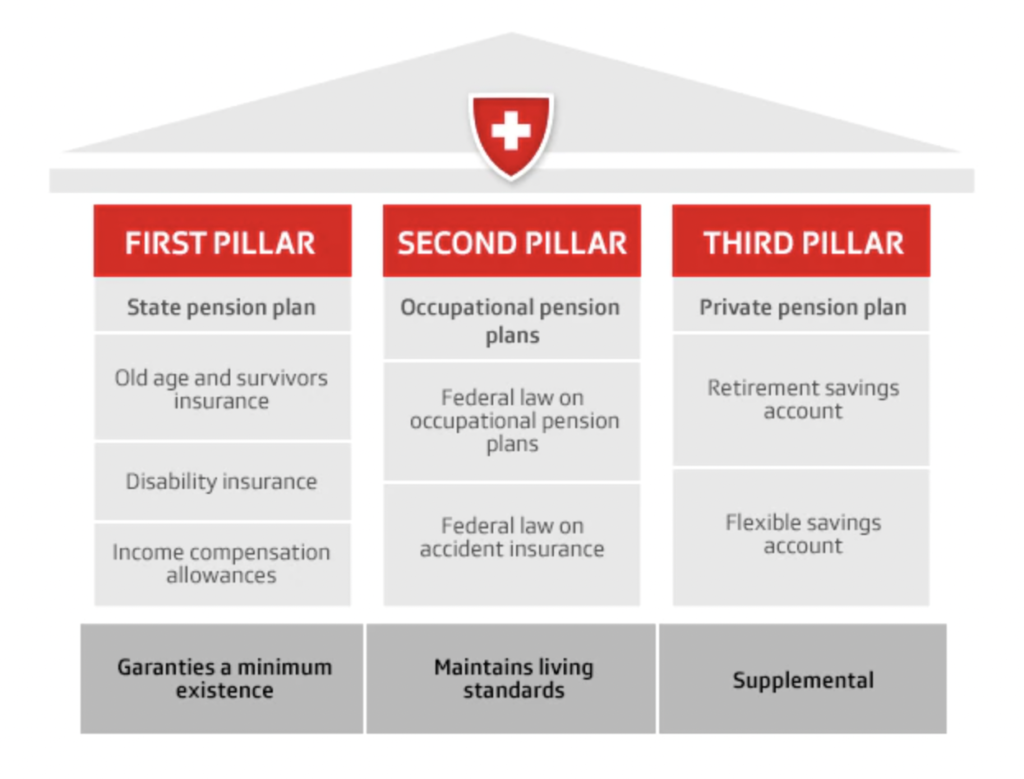

The following graph shows different possible scenarios for the development of your pension assets over 25 years by investing CHF 3,000 in securities each year (with an initial capital of CHF 3,000):

- With a return assumption of 2%, your capital would be CHF 102,000 after 25 years, and up to CHF 157,000 with a return of 5%.

- By investing only in the pension account over the same period, the available capital will be CHF 80,000.

Evolution of wealth after 25 years

If you have been working for several years but have not yet opened a 3rd pillar account, it is not too late. You can contribute money to the 3rd pillar 3a up to 5 years after reaching your AVS retirement age, provided you continue to exercise.

When and how to make a withdrawal on the 3rd pillar 3a?

With a linked 3rd pillar 3a, you have the right to withdraw the capital plus interest in the form of a lump sum or a lifetime annuity at the legal age of retirement. This pension savings mainly covers the income provided for by your 1st and 2st pillars.

However, you can withdraw your capital savings at the earliest 5 years before the ordinary retirement age. You can also delay the withdrawal of your capital for 5 years at the latest after the legal retirement age if you continue your professional activity.

You can also decide to make an early withdrawal from your 3rd pillar 3a in certain situations:

- You buy or build a property for your own use or you want to pay off a mortgage

- You are leaving Switzerland permanently or going to work in Europe

- You start a gainful activity as a self-employed person or you change your activity as a self-employed worker registered with the AVS

- You want to buy back years of contributions to a pension fund (2th pillar)

- You want to transfer your credit to another 3rd pillar

- You are receiving a disability pension

How to open a retirement savings account 3a with Zak?

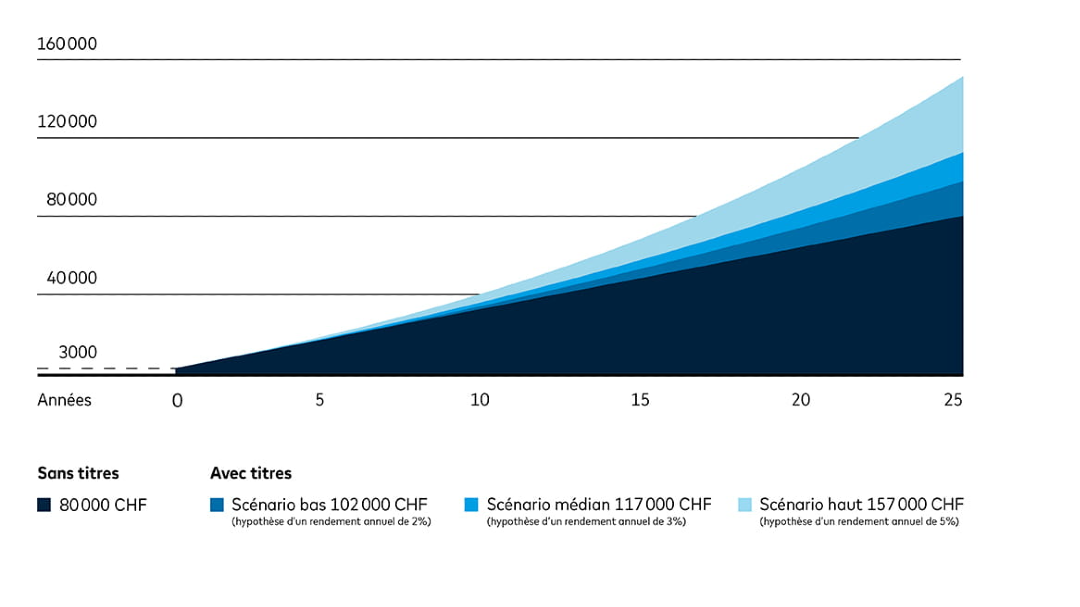

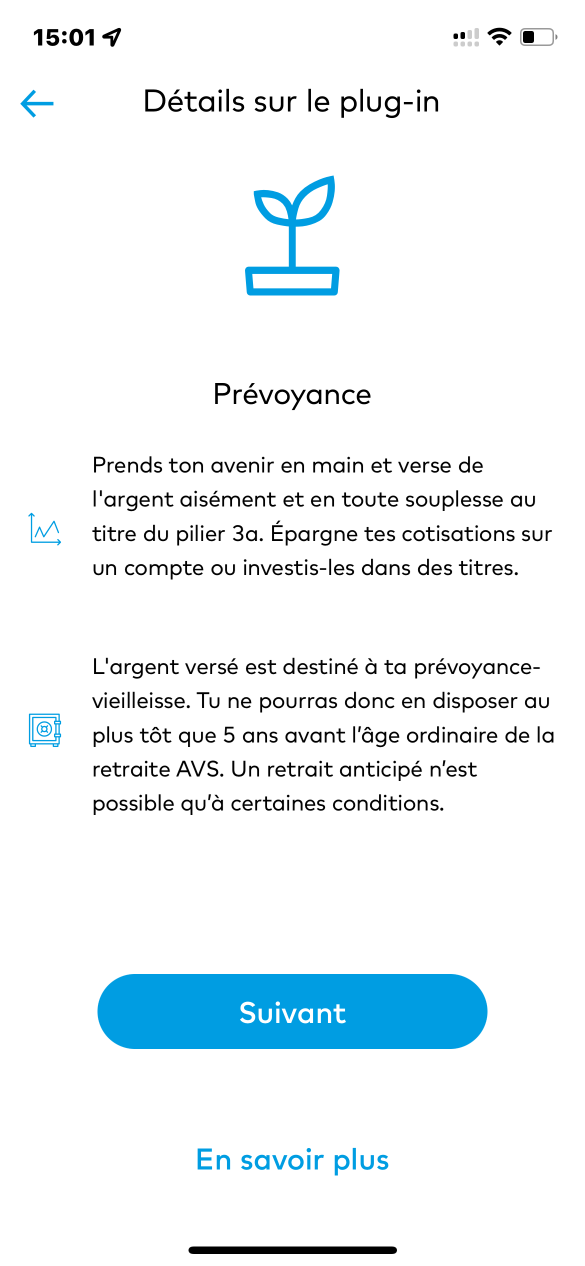

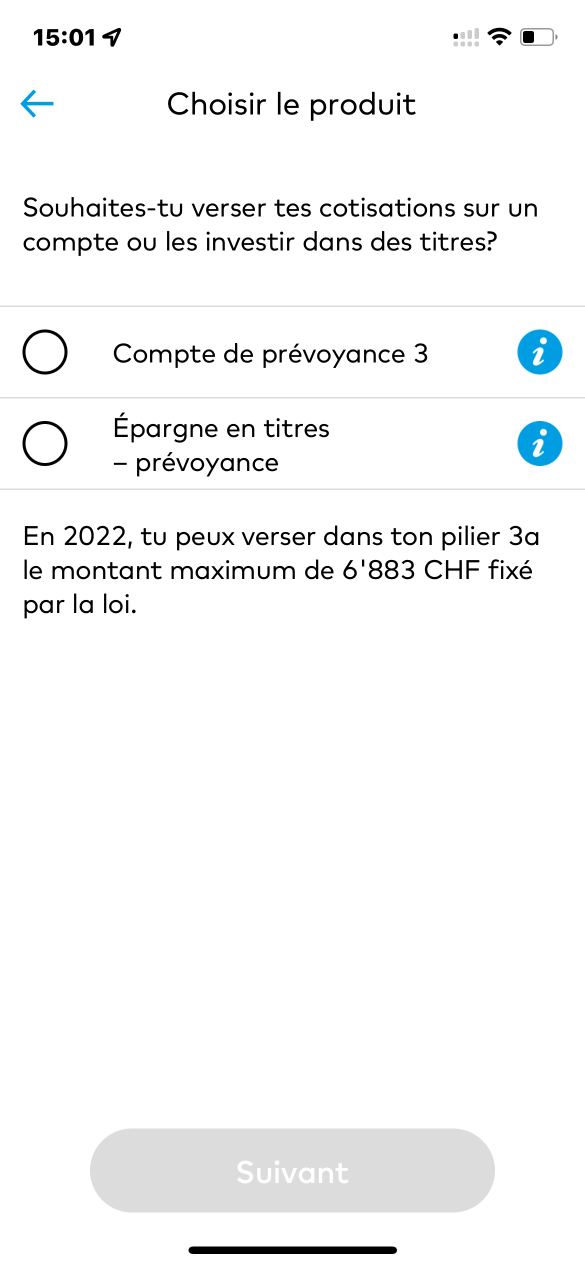

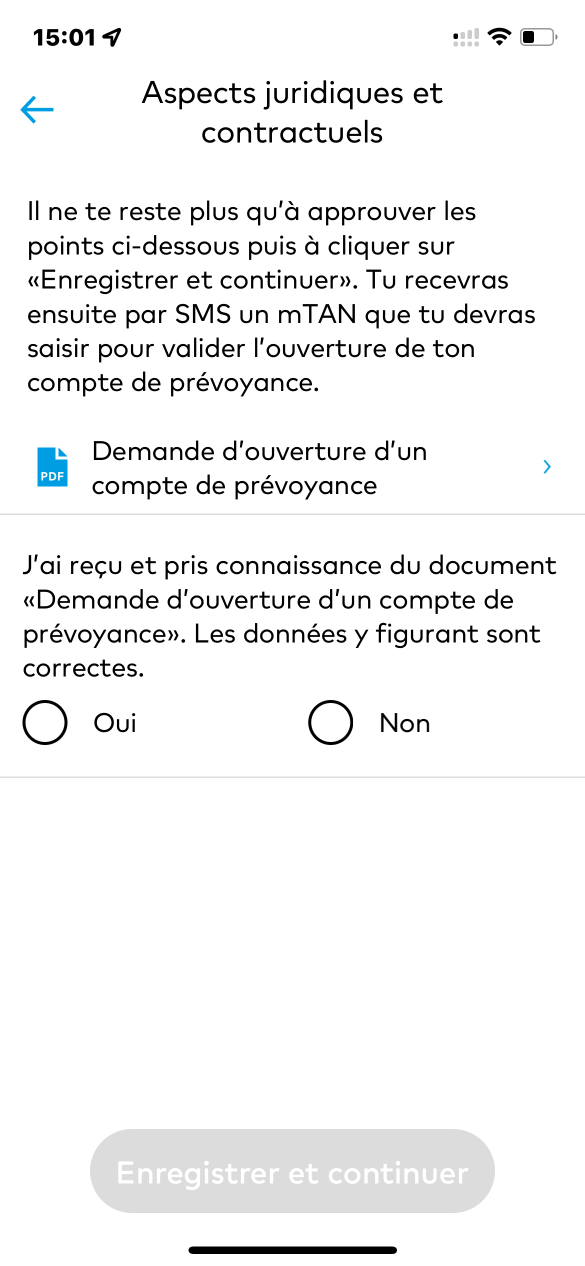

To open your retirement savings account 3a with Zak, nothing could be simpler: activate the “Prévoyance” plug-in in the Zak Store and follow the following steps:

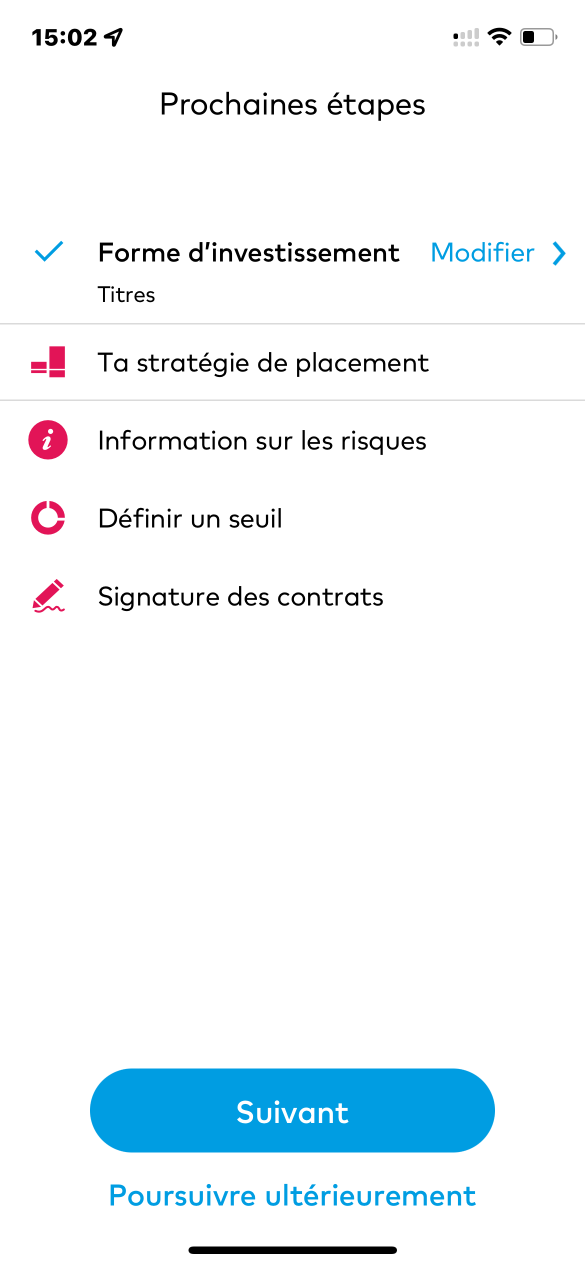

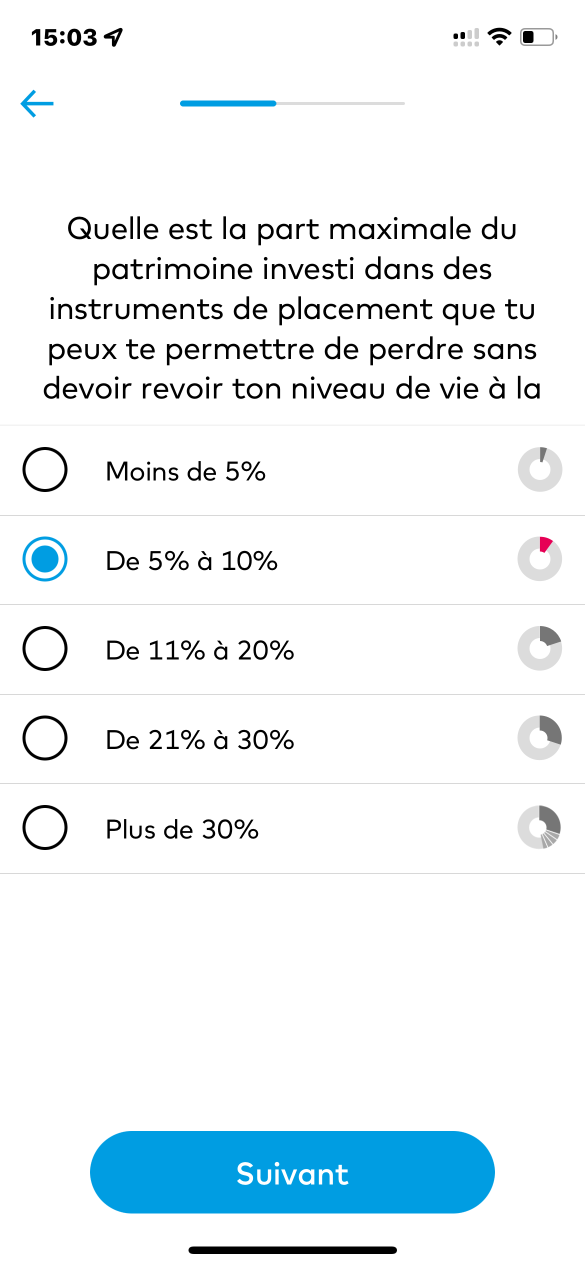

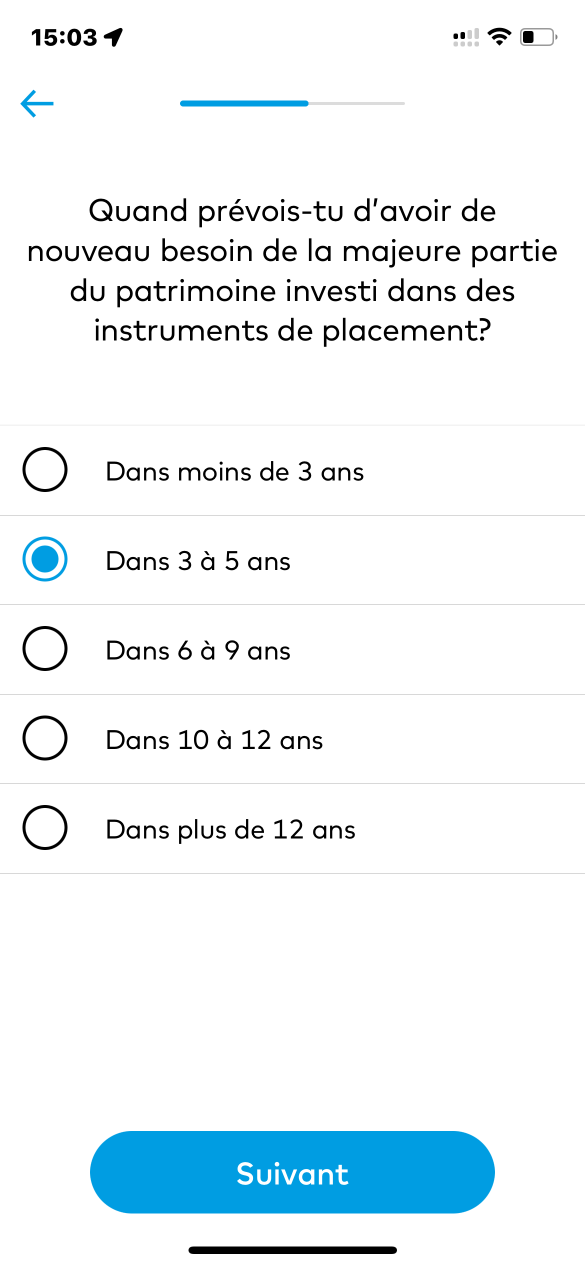

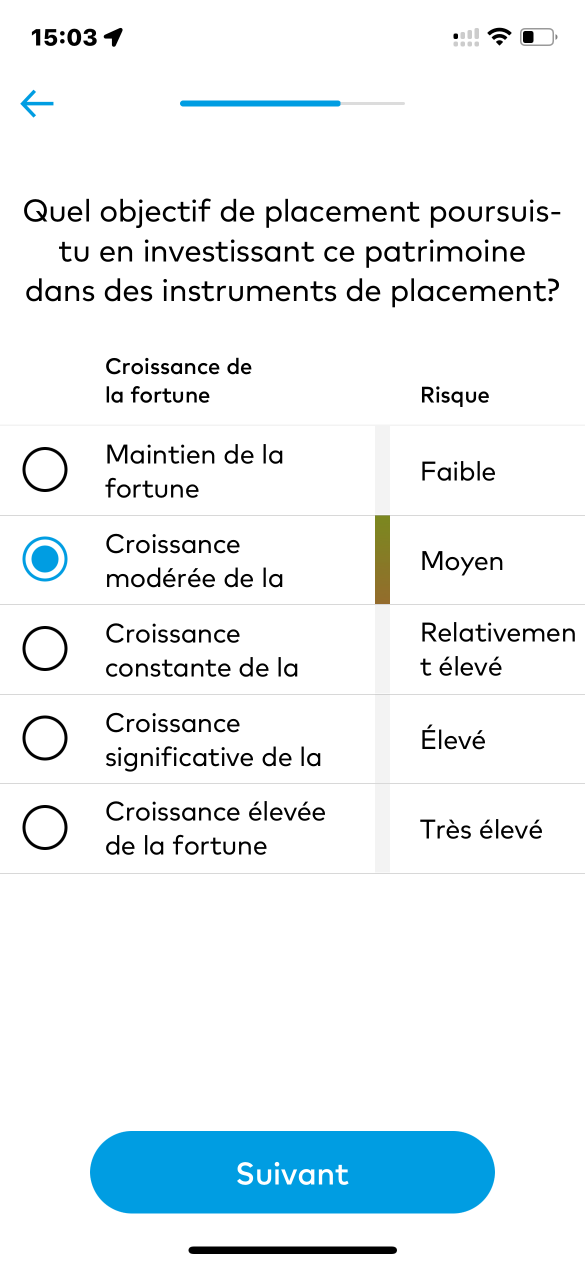

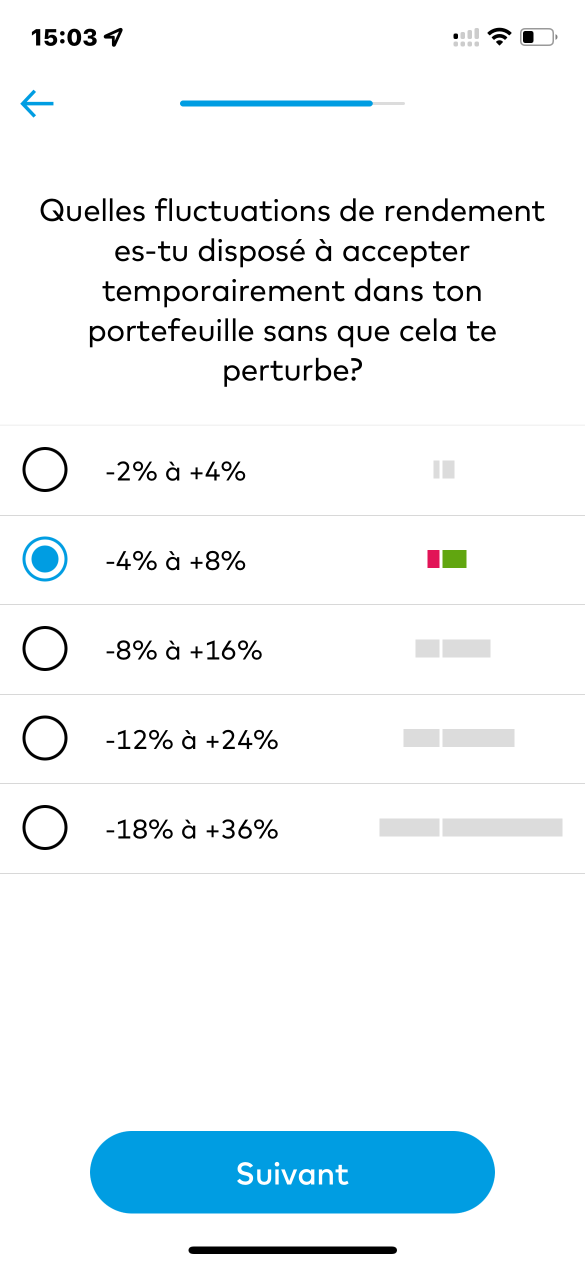

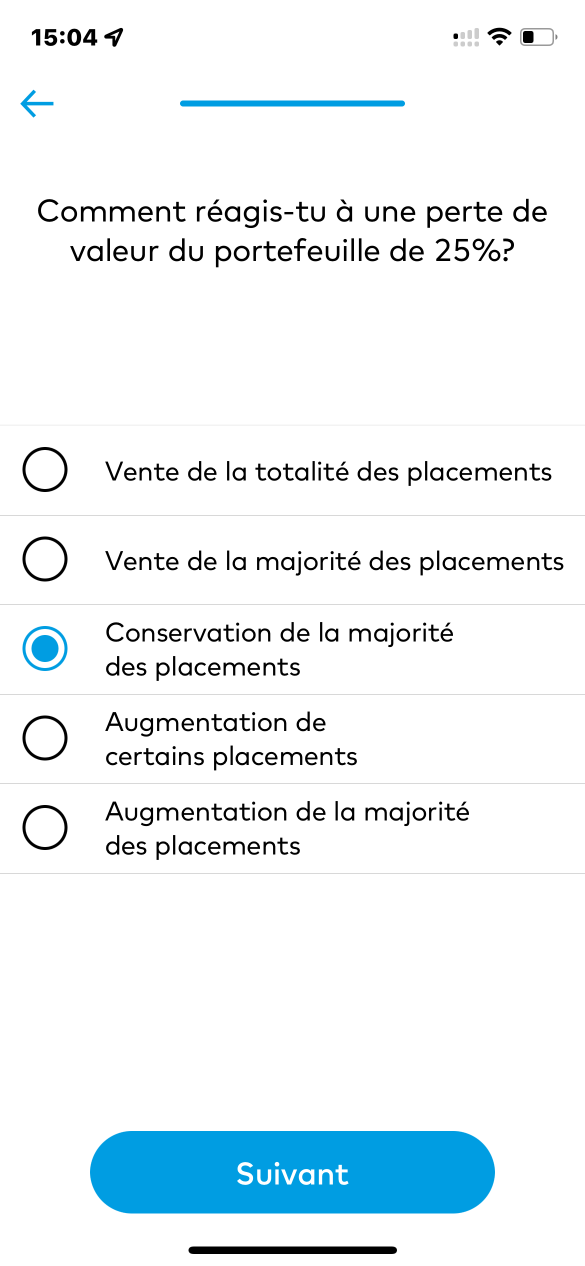

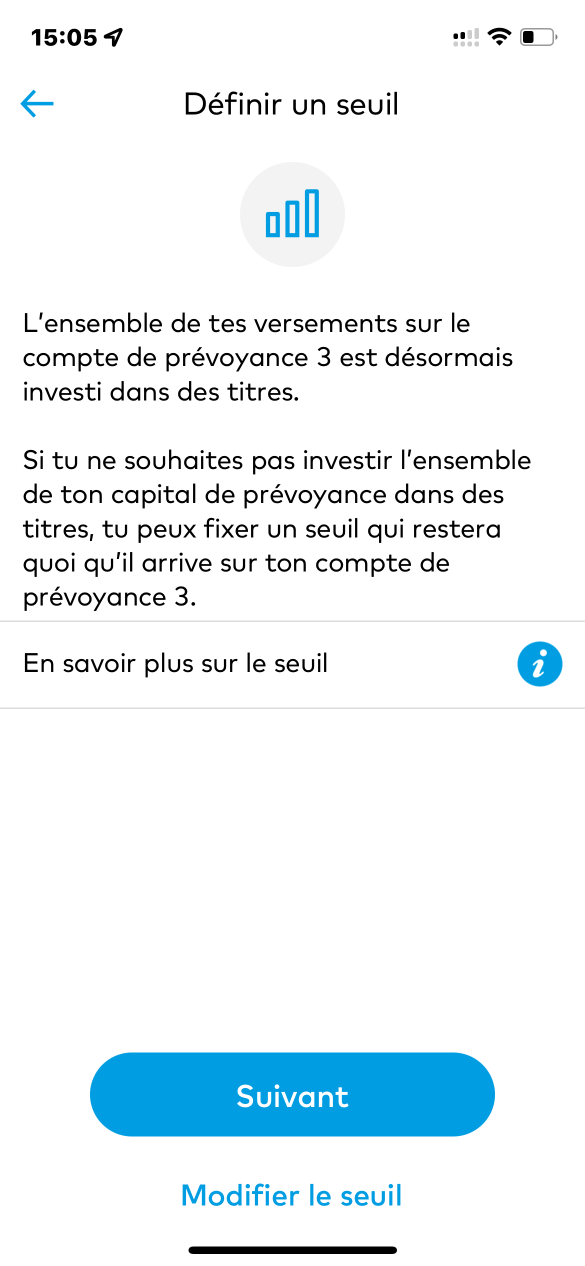

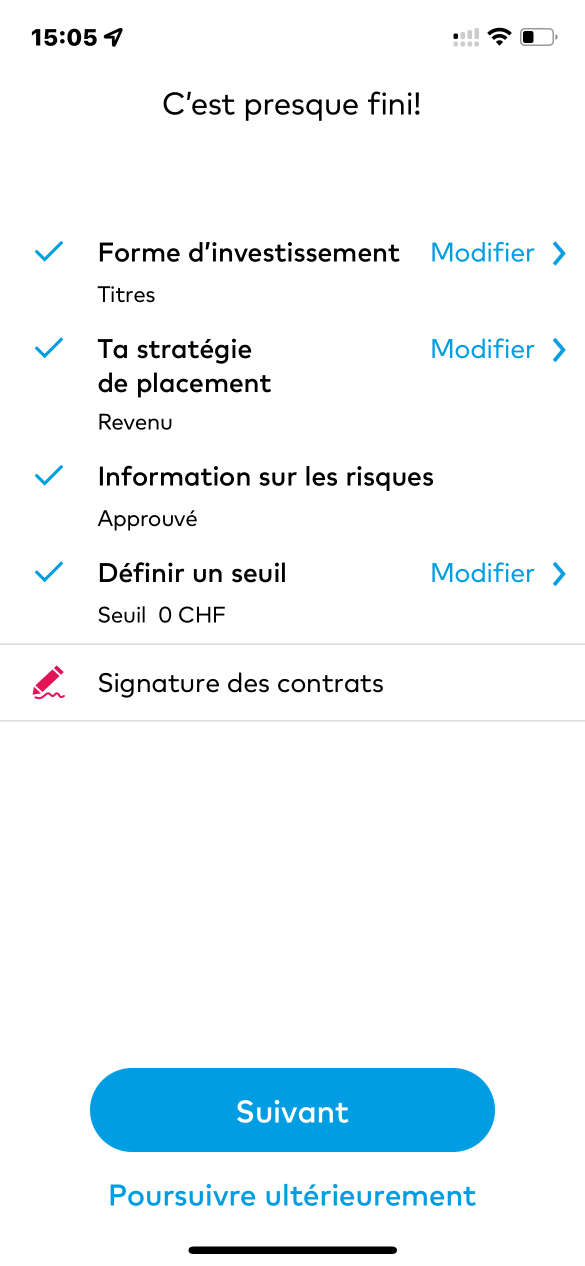

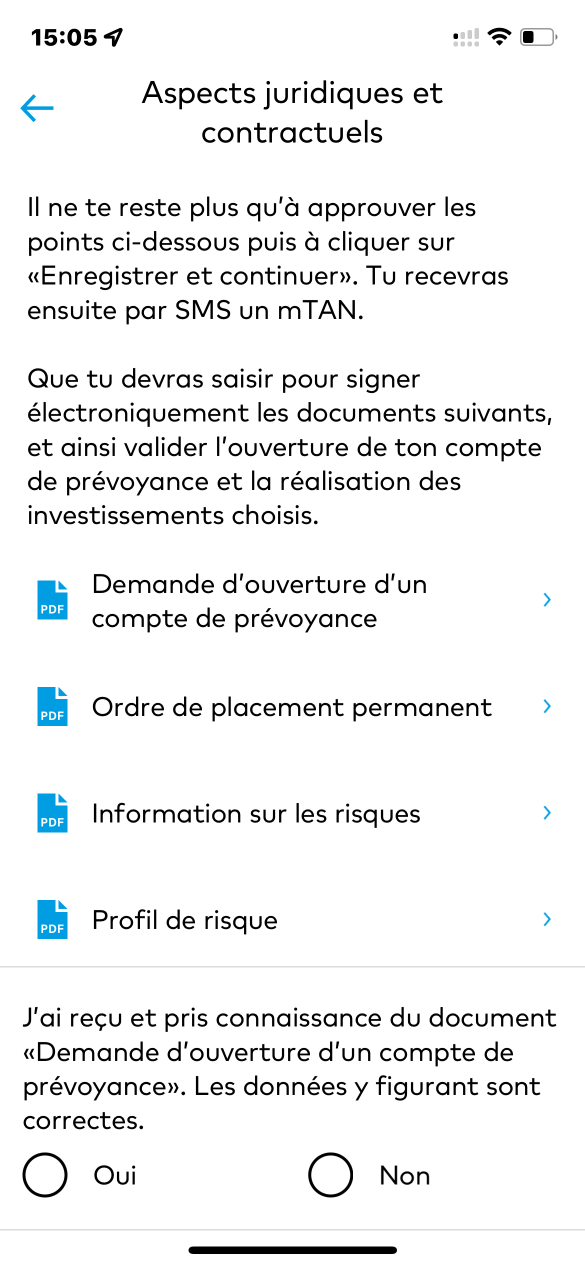

If you choose “Savings in securities – pensions”, the process continues with a questionnaire:

In summary

Zak’s 3rd pillar pension account has the following advantages:

- You can deduct your payments made in the linked 3a pension plan from your taxable income within the limit of CHF 6,883 in 2022

- You determine the amount and time of your payments into your private pension plan.

- You can use the capital saved to finance the acquisition of a main home or amortize your mortgage

- You do not pay wealth tax on the income from your linked 3a pension account.

- You do not pay income tax on the interest on your pension account.

- No fixed duration: you decide yourself if and when you make a payment.

ZAK Bank Promo Code

ZAK Bank Promo Code

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before 31 July 2024 to get CHF 50 for FREE 🙌

Get CHF 50 Free with ZAK ➡️