Being a student often means juggling studies, a part-time job and an active social life. Managing your finances is then added to the pile and can quickly become a headache, especially when faced with the limitations of traditional bank accounts.

These accounts often do not meet the specific needs of students, leading to frustrations and difficulties.

Traditional banks: not always adapted to the needs of students in Switzerland

High fees, a lack of useful features, difficulty accessing and a lack of financial education are all challenges students face.

- Bank fees: Account maintenance, withdrawal and transfer fees can quickly eat into students’ tight budgets.

- Limited features: Traditional accounts often do not offer practical features such as cashback , common pots to share expenses between friends, or even transfers of ‘instant money.

- Accessibility: Finding a bank account accessible online and via a mobile app can be a barrier for mobile and connected students.

Finally, the lack of financial education leaves many students helpless when it comes to managing their money.

A bank account adapted to the needs of students in Switzerland

What students are looking for is a bank account that meets their specific needs:

- Free or low cost.

- With useful features: cashback, pools, instant transfers.

- Easy to use and accessible online and via mobile application.

- Offering educational resources on personal finance.

Fortunately, solutions exist to meet the specific needs of students. A free or low-cost bank account is crucial to avoiding excessive monthly fees.

Access to useful features is also important: cashback allows you to recover part of your expenses, pools make it easier to share expenses with friends, and instant money transfers allow you to quickly pay bills and debts .

An easy-to-use bank account, accessible online and via a mobile app, is also essential for day-to-day financial management.

Finally, access to educational resources on personal finance allows students to develop healthy skills and make informed financial decisions.

Zak: a banking solution designed for students in Switzerland

Zak is positioned as a banking solution adapted to students. This free bank account offers a wide range of features to meet their needs: a cashback program, common pots, instant money transfers and electronic bill payment . The Zak application is intuitive and easy to use, accessible on smartphone and tablet.

In short, Zak offers a simple, affordable and complete solution to students looking for a bank account that adapts to their daily life. He offers :

- A free account.

- A cashback program.

- Common pots to share expenses.

- Instant money transfers.

- Payment of electronic invoices.

- An intuitive application accessible on smartphones and tablets.

ZAK Bank Promo Code

ZAK Bank Promo Code

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before 31 July 2024 to get CHF 50 for FREE 🙌

Get CHF 50 Free with ZAK ➡️

What are the advantages of Zak’s Cashback offer

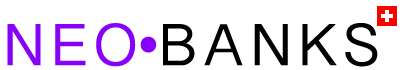

Zak Banque’s cashback program differs from traditional loyalty programs by offering the possibility of earning money directly after each purchase made with a partner brand, thus eliminating the need to accumulate points. This system allows you to receive a cash amount of a fixed value or a percentage of the purchase, directly credited to the Zak account. The program’s partner stores, accessible via shopmate, belonging to the German RTL group, cover a variety of categories, ranging from pharmacies to travel.

Some Swiss partner stores, such as Booking.com, Jelmoli, Jumbo, Media Markt, and Ochsner Sport, offer attractive cashback rates, which can be combined with other loyalty programs. For example, being Genius 3 at Booking.com not only allows you to benefit from discounts on reservations, but also to receive cashback on the net value of the reservation.

A complete list of partner stores is available for viewing.

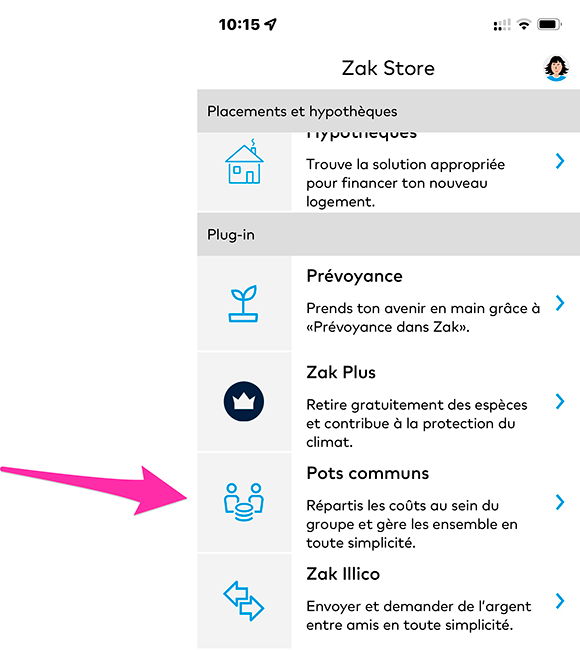

How do common pots work at Zak

Zak Banque’s shared pots offer an effective solution for managing shared expenses between friends, roommates or family members, with a capacity of up to 10 people.

Using the app, it’s easy to create a common pot, add group members, and distribute expenses between them.

Each participant can thus pay their share, thus simplifying the reimbursement process. Compared to the Split tool of TWINT, the common pots functionality of Zak Banque stands out by its ability to manage and monitor a greater number of expenses over the long term for the same group, unlike TWINT which is limited to instantaneous and one-off uses, such as the immediate reimbursement of an amount owed to several people.

Here are some examples of using common pots:

- Share common bills and shopping with a pot dedicated to your roommate.

- Split the restaurant or bar bill in just a few clicks without having to worry about bills and reimbursements between friends.

- Plan and finance your group trips with ease thanks to a common pool centralizing all expenses and avoiding endless calculations.

About instant transfers at Zak

Instant transfers at Zak Banque offer a fast and convenient solution for money transfers. You can make instant transfers without needing an IBAN number at any time of the day or night. This functionality, called “Zak Illico“, represents an alternative to TWINT, positioning Zak Banque as a pioneer among Swiss neobanks in offering such an option.

To activate Zak Illico, you must go to the Zak Store. Once the plugin is activated, you can select a contact from your address book to make an instant transfer, whether to send or request money. In particular, for amounts less than 1000 CHF, it is not necessary to enter an mTAN, making the process simpler and faster than traditional transfers.

This feature allows you to stay on the same app for all your financial transactions, eliminating the need to go through TWINT and providing the convenience of instant receipt of funds without delay. However, it is important to note that, as with other similar services, the recipient must also be a Zak Bank customer to use this instant transfer feature.

In conclusion

In conclusion, access to suitable bank accounts constitutes a major challenge for students in Switzerland, faced with the disadvantages of traditional banks. High fees, limited functionality, difficulties in online access, and lack of financial education are all obstacles hindering peaceful financial management.

Fortunately, alternatives are emerging, including Zak Bank. This free account not only offers features such as cashback, pools, and instant transfers, but also an intuitive mobile application, thus simplifying the daily life of students.

Overall, Zak Bank appears to represent a comprehensive response tailored to the specific needs of students, offering a promising alternative to the constraints often encountered with traditional bank accounts in Switzerland.

Say what you think in the comments.

ZAK Bank Promo Code

ZAK Bank Promo Code

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before 31 July 2024 to get CHF 50 for FREE 🙌

Get CHF 50 Free with ZAK ➡️