Switzerland, known for its economic stability and banking discretion, is a destination of choice for investors, expats and international workers. If you are a non-resident and are considering opening a bank account in Switzerland, you will find in this article valuable information to guide you.

Whether you are a cross-border worker, an investor seeking security or an expat looking for quality financial services, Switzerland offers you a range of suitable options. Here is everything you need to know to navigate the Swiss banking landscape.

Bank Account for Non-Residents in Switzerland – Which Bank to Choose?

If you don’t have time to read this article, here is a comparison of the 3 solutions for opening a bank account for non-residents in Switzerland:

| Criteria | Neobanks | Traditional Banks | Multi-currency accounts |

|---|---|---|---|

| Opening fees | ✅ Free | ❌ Paid | ✅ Free |

| Account maintenance fees | ✅ Free or low | ❌ High | ✅ Free or low |

| Swiss IBAN | ✅ Yes (Yuh, Yapeal) | ✅ Yes | ❌ No |

| Debit card | ✅ Yes | ✅ Yes | ✅ Yes |

| Investments | Limited | Wide Range | Limited |

| Opening conditions | Simple | Strict | Simple |

| Opening remotely and without appointment | ✅ Yes | ❌ No | ✅ Yes |

Why open a bank account in Switzerland?

Before diving into the practical details, it is crucial to understand why so many people and businesses choose to open an account in Switzerland. Here are some of the most common reasons:

Receiving your salary

As a cross-border commuter, this is one of the main reasons why you might want to open a Swiss bank account. This makes it easier to have your salary paid directly in Swiss francs (CHF), which saves you the fees and delays associated with currency conversions.

- Neobanks for Cross-Border Workers in Switzerland

- Yuh Banque: The free Swiss bank account for cross-border workers and non-residents

Ensure your financial security

The Swiss franc is considered a safe haven in times of economic uncertainty, thus offering protection against currency fluctuations and economic crises. For example, during the global financial crisis of 2008, the Swiss franc showed remarkable resilience, providing protection against currency fluctuations and economic crises.

Make your international transactions easier

Swiss banks are well equipped to handle transactions in multiple currencies, offering competitive exchange rates and quality services.

Benefit from top-notch banking services

This allows you to enjoy personalized management, specialized financial advice, and unparalleled discretion as an account holder.

Open a non-resident bank account in Switzerland in 3 steps

To open a bank account in Switzerland as a non-resident, here are the steps you will need to follow to make the process as smooth as possible.

1. Choose the bank and account type

You will need to select a bank that meets your specific needs, whether it is a large international bank like UBS or a neobank.

It is also important to choose the type of account that suits you: current account, savings account, or multi-currency account. Yuh for example, is ideal for a multi-currency account and accessible online.

2. Prepare the required documents

Generally, you will need to provide the following documents to open a non-resident account in Switzerland:

- A ID: ID card or passport, for example

- A proof of address less than 3 months old

- A G permit and proof of employment in Switzerland for cross-border workers

- A proof of income

- and sometimes a letter of banking recommendation.

Requirements may vary from one bank to another.

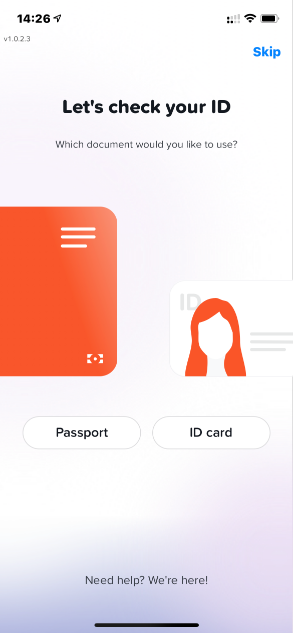

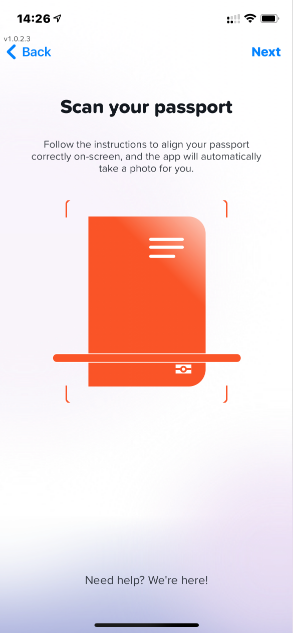

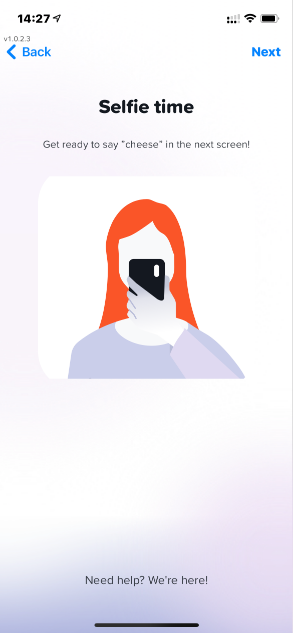

Everything is simplified with Swiss neobanks which allow you to remotely verify your identity from your smartphone and do not ask for proof of income.

Here are, for example, the 3 steps for opening an account with Yuh, directly from your smartphone:

While major Swiss banks may require large deposits, a neobank like Yuh requires a very small amount to activate your account.

3. Receive confirmation of your account opening

This includes receiving your banking information and the associated card after your application is approved and the initial deposit is made. You will then be able to use your account to manage your finances, invest, or make transactions in Switzerland.

Solution 1: Open an account with a Swiss neobank that accepts non-residents

Yuh and Yapeal are currently the only Swiss neobanks that allow non-residents to open a bank account in Switzerland.

Yuh is a Swiss-based neobank that offers a bank account with IBAN CH and allows you to have a main account in CHF, EUR or USD, as well as sub-accounts in several currencies (13 in total). Yuh also offers a Yuh Card, a prepaid Mastercard for online and offline purchases.

Yapeal, founded in 2018, is a Swiss neobank that stands out for its fully digital approach to banking services. It is licensed by FINMA (Swiss Financial Market Supervisory Authority) to offer online banking services. Yapeal offers current accounts with simplified management via a mobile application, allowing you to easily manage your finances and make payments in Swiss francs (CHF) with reduced fees.

Yapeal Promo Code: YAPS-311-WZ4WL

Yapeal Promo Code: YAPS-311-WZ4WL

Yapeal: the alternative to Yuh for cross-border workers and non-residents!

Don't have a Yapeal account yet? Use our referral code to open your FREE Yapeal Bank account!

Use the promo code YAPS311WZ4WL by September 30, 2024 to receive 30 CHF for FREE 🙌

Get 30 CHF with Yapeal ➡️

What are the conditions for opening an account for non-residents:

- Be at least 18 years old

- Reside in Switzerland or in one of these countries: Germany, Austria, France, Italy, Liechtenstein

- Have a smartphone compatible with the app

- No proof of income required

- No minimum deposit upon opening

- No minimum balance to maintain

What are the advantages and disadvantages of Swiss neobanks for non-residents :

- Easy registration in 15 minutes, from your smartphone

- Attractive rates: free account, free bank card

- No proof of income to provide

- No deposit required after opening an account

- No minimum balance to maintain

- Fully accessible from your smartphone

- Notifications for each expense or income

- No branch (for those who need one)

- No dedicated advisor

- A more limited banking offer

Comparison of Yuh vs Yapeal services:

| Yuh | Yapeal | |

|---|---|---|

| CHF bank account | ✅ | ✅ |

| Personal IBAN CH | ✅ | ✅ |

| Free bank account | ✅ | ❌ |

| Mobile application | ✅ | ✅ |

| Free debit card | ✅ | ❌ |

| Free withdrawals in CHF | ✅ | ❌ |

| Free withdrawals in EUR, overseas | ❌ | ❌ |

| Free CHF deposits | ✅ | ✅ |

| 0% exchange fee | ❌ | ❌ |

| Free SEPA transfers in EUR | ✅ | ❌ |

| Free international wire transfer | ❌ | ❌ |

| No extra fee for non-residents | ✅ | ✅ |

| TWINT | ✅ | ❌ |

| eBill | ✅ | ✅ |

Comparison of Yuh vs Yapeal rates:

| Yuh | Yapeal | |

|---|---|---|

| Personal CH IBAN | ✅ | ✅ |

| Free bank account | ✅ | ❌ The paid plan at 4.90 CHF/m. is required to make transfers |

| Free debit card | ✅ | ❌ 7.00 CHF delivery fee |

| Free withdrawals in CHF | ✅ 1 free per week, then 1.90 CHF each | ❌ 2.00 CHF each |

| Free withdrawals in EUR, overseas | ❌ 4.90 CHF each | ❌ 1.50% |

| 0% exchange fee in EUR | ❌ 0.95% fee | ❌ 0,75 – 1,65% fee |

| Free SEPA transfers in EUR | ✅ | ❌ 0,75 – 1,65% fee |

| Free international wire transfer | ❌ 4.00 CHF each | ❌ 0,75 – 1,65% fee |

Yuh offers more comprehensive banking services than Yapeal, with lower fees. We recommend Yuh without hesitation.

Solution 2: Open a non-resident account with a traditional Swiss bank

Opening a bank account in Switzerland as a non-resident foreigner can be complex. The conditions and fees vary considerably from one bank to another and depend on your profile. Even though some banks offer remote openings, the procedures often remain tedious.

Traditional banks that accept non-residents are:

- AKB (in German)

- BCGE

- Banque Migros

- Crédit Agricole next bank

- UBS

- Postfinance

- Valiant

These Swiss banks that accept non-residents often charge fees for foreign residents: CHF 25/month at PostFinance, Raiffeisen and Migros Bank.

Opening a bank account with a traditional bank in Switzerland as a non-resident can be more complex and expensive than in France. Fees are often high, opening conditions are strict and offers vary from one bank to another. It is essential to compare the different options and to favor online neobanks that offer more competitive rates and simplified procedures.”

- Wide range of financial products and personalized advice

- These banks are recognized for their prestige and international credibility

- Network of agencies

- More documents to provide: bank statements, proof of employment in Switzerland, proof of income and sometimes a letter of bank recommendation

- An interview is often necessary to open the account

- Minimum deposit at opening

- Minimum balance to maintain

- Account maintenance fees

- Foreign resident fees

- Paying debit card (except Banque Migros)

Solution 3: Open a multi-accounti-devises with a foreign neobank

The multi-currency accounts of Revolut and Wise allow you to hold and manage multiple currencies (including CHF) in a single account, which is ideal if you deal with various currencies.

FREE Revolut account

FREE Revolut account

Don't have a Revolut account yet? Use our link to open your FREE Revolut Bank account today and receive benefits 🙌

Get a FREE Revolut account ➡️

If you do not need a Swiss IBAN and simply want to store Swiss francs and make payments in CHF, the optimal solution is to open a multi-currency account.

- Quick and easy opening process.

- Free account and very low management fees

- Very competitive exchange rates. Read our comparison on the best EUR/CHF rates

- No proof of income to provide

- No minimum deposit to open

- No minimum balance to maintain

Solution 4: Open a cross-border account in a French or German bank

For French and German residents with financial needs in Switzerland, cross-border bank accounts via local banks like Sparkasse hochrhein, Crédit Agricole and Crédit Mutuel can be convenient.

- You manage your finances through a local banking interface while having Swiss Francs

- No need to go to Switzerland to open an account

- No CH IBAN

- No access to Swiss services: TWINT, eBill, QR payments,…

- Higher fees than Swiss neobanks for cross-border workers

- Some employers refuse to pay salaries into foreign accounts

Conclusion

As you have understood, opening a bank account in Switzerland means benefiting from enhanced financial security, recognized discretion and access to top-notch banking services. But you still need to choose the solution that suits you best.

Cross-border worker? Neobanks offer you a quick opening and reduced fees. Investor? Traditional banks will put their expertise at your service. Expatriate? Multi-currency accounts simplify the management of your finances internationally.

FREE Revolut account

FREE Revolut account

Don't have a Revolut account yet? Use our link to open your FREE Revolut Bank account today and receive benefits 🙌

Get a FREE Revolut account ➡️

Frequently Asked Questions about Non-resident Bank Accounts

✅ Is it legal to open a bank account in Switzerland as a non-resident?

Yes, it is legal to open a bank account in Switzerland as a non-resident, subject to compliance with local and international laws. Swiss banks must comply with strict standards of compliance and transparency.

✅ What is the minimum deposit required to open an account in Switzerland?

The minimum deposit required may vary depending on the bank and the type of account. Online banks may require a low initial deposit, while major banks and private banks may require higher amounts.

✅ Can I open a Swiss bank account online without visiting the bank?

Yes, many online banks allow you to open an account remotely. However, some traditional banks, especially for wealth management accounts, may require an in-person visit or video conference.

✅ What documents are required to open an account in Switzerland?

Required documents generally include a valid ID, proof of residence, proof of income or employment, and sometimes a bank recommendation letter. Requirements may vary depending on the bank.

✅ How to declare a Swiss bank account to the tax authorities?

Residents must declare all bank accounts held abroad, including in Switzerland, to their tax authorities. In France, this is done during the annual income tax return. It is advisable to consult a tax advisor to ensure compliance with all legal obligations.