Yuh Bank is a subsidiary of SwissQuote and PostFinance and recently launched in Switzerland.

But unlike other Swiss neobanks such as Neon Bank and ZAK Bank, Yuh allows non-residents and cross-border commuters to open a free bank account in Switzerland in CHF.

A free bank account for non-residents and cross-border commuters in Switzerland

Yuh Bank is a Swiss mobile account, free

Yuh Bank aims at competing with other Swiss neobanks and also with N26 and Revolut.

Most of their services are free:

- Opening a Yuh bank account: Free

- Monthly maintenance: Free

- Transaction on 13 currencies: Free

- 1st debit card & delivery: Free

- Bank transfers in Switzerland in CHF and EUR: Free

- Bank transfers in Europe (SEPA) in EUR: Free

- Peer-to-peer payments: Free

But Yuh Bank apply a 0.95% fee on currency exchange, and they use the SwissQuote exchange rate.

If you want the best CHF to EUR exchange rate, you may have to Revolut Switzerland or Wise (TransferWise) instead.

YUH Promo Code

YUH Promo Code

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 30 April 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️

How non-residents can open a bank account with Yuh

In our complete review of Yuh Bank, we explain in details how to open a fr bank account with Yuh Bank.

There are many questions during the opening process, but in the end it’s quite fast and an account can be opened in 20 minutes.

Account opening requirements with Yuh bank are:

- Be at least 18 years old (15 years with Zak)

- Be a Swiss resident or in one of the following countries: France, Germany, Austria, Italie, Liechtenstein

- Have a smartphone compatible with the app

- No need to provide proof of revenue

- No minimum deposit

- No minimum balance

Non-residents and cross-border commuters can definitely use Yuh Banque to receive their salary and make domestic bank transfers in Switzerland or to their account in Europe.

Yuh Bank: a multi-currency account in Switzerland

With you Yuh Bank account, you get a Swiss IBAN starting with CH.

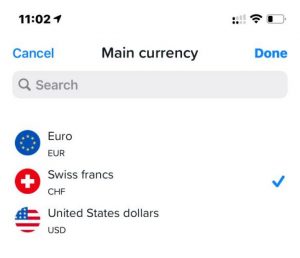

The app sets your default currency based on your country of residence, For example: a French non-resident or cross-border commuter will have EURO as default currency.

It is then possible to change your default currency in the settings:

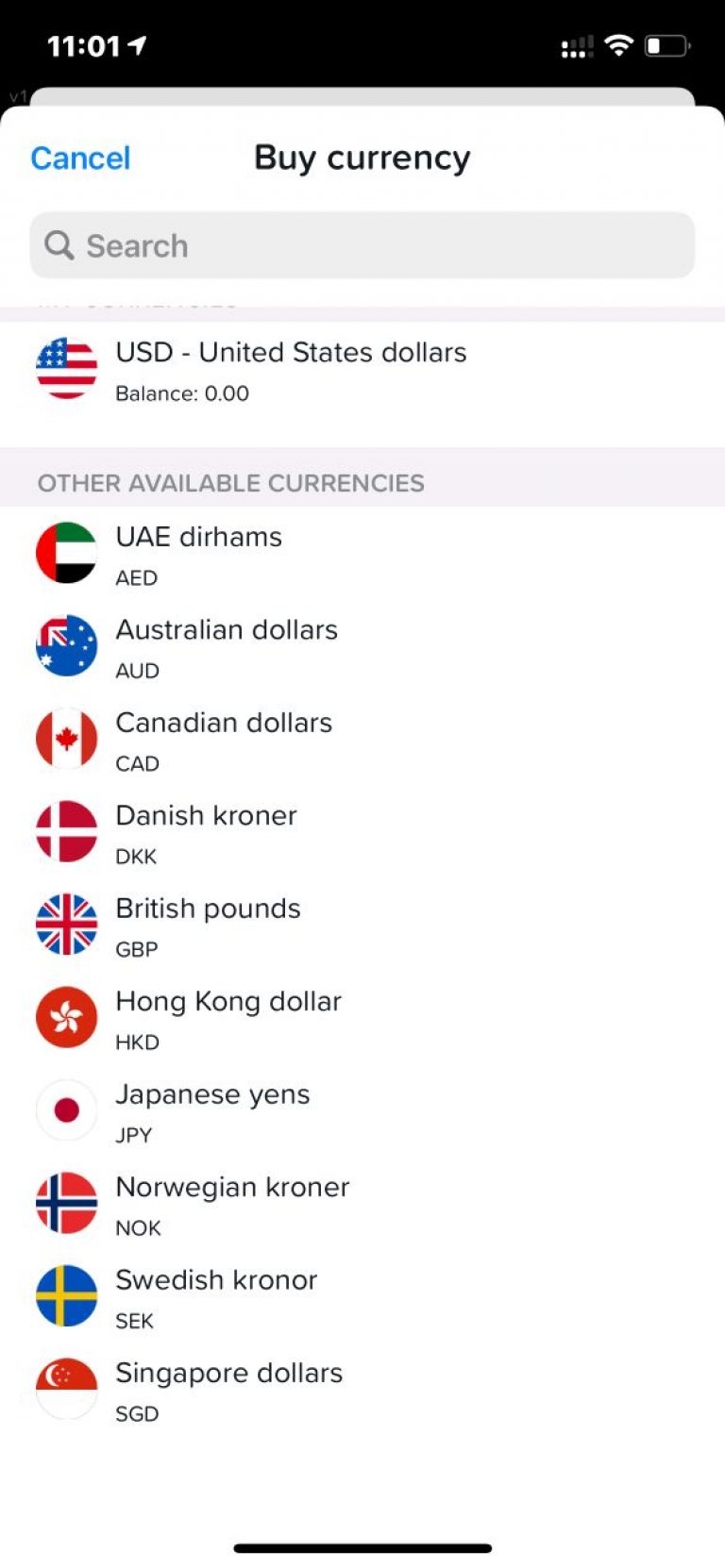

By default, 3 currencies are activated: EUR, CHF and USD, and it’s possible to open balances in 13 currencies: CHF – USD – EUR – GBP – JPY – AUD – CAD – SEK – HKD – NOK – DKK – AED – SGD

Countries of residence accepted by Yuh Bank

Yuh Bank allows residents from several European countries to open a bank account in Switzerland:

- Austria

- France

- Germany

- Italy

- Liechtenstein

- Switzerland

Yuh Ban being free makes it an ideal bank account for non-resident cross-border commuters working in Switzerland.

Is Yuh a Swiss bank?

Yuh is the joint venture of Swissquote and PostFinance. Yuh does not have a Bank status, but all financial services offered by Yuh are provided by Swissquote, that is authorised by FINMA (Swiss Financial Market Supervisory Authority). Customers and bank accounts are protected by Swiss laws up to 100’000 CHF in case of bankruptcy.

YUH Promo Code

YUH Promo Code

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before 30 April 2024 to receive CHF 50 Trading Credits + CHF 4 (250 SWQ) for FREE 🙌

Get CHF 54 Free with YUH ➡️