Yapeal has just posted its new rates for 2021 and after only 6 months of activity, the neobank has become the most expensive on the Swiss market.

The new Yapeal tariffs

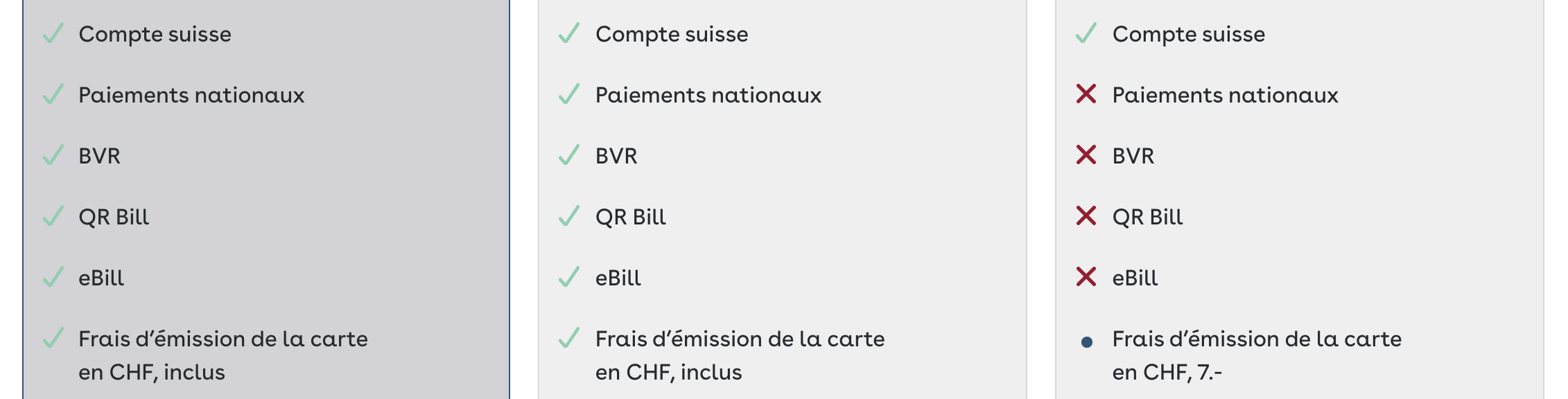

Yapeal goes from 1 to 3 offers and renames it: Loyalty, Private and Private+

At first glance it is still possible to have a free bank account with the neobank, but in Looking at the rates in more detail, we see that the Loyalty plan does not allow you to make domestic payments!

It is therefore possible to have a free account, with a free Visa card, but impossible to make a transfer in CHF 🧐

Without saying so, Yapeal has just transformed its free account – Loyalty – into a “pseudo account” Visa prepaid: if you fund this account in CHF , the only option is to spend it with the Visa. This is very disappointing from the neo-bank and it means that you will now have to pay CHF 4.90 per month to have a real bank account.

In Marketing, the Loyaly plan is a decoy: it exists, but it is built so that no one takes it and to make the Private plan more attractive.

What’s wrong with the new Yapeal tariffs

By offering a free plan that no longer offers the basic functionalities of a bank account, Yapeal is trying to manipulate the consumer and force them to take the 4.90 CHF plan.

Unfortunately, this does not take into account the other swiss neobanks such as Neon, ZAK and now CSX of Credit Suisse which all offer free bank accounts.

Neon Bank

Neon Bank

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the promo code NEONEO before 31 July 2024 to receive up to 30 CHF cashback on the trading fees of your first 3 trades + your FREE debit card 🙌

Get CHF 30 Free with Neon ➡️

Loyalty accounts can be expected to turn into ghost accounts with little or no activity.

Yapeal rates lack “fairness” : you have to get on the Private+ plan at 8.90 CHF/month to have real benefits such as free withdrawals. The Private plan at CHF 4.90/month is comparable to neon’s or CSX’s free plan, with the same features.

Yapeal is certainly looking for profitability, but in an increasingly competitive market with also foreign neobanks present in Switzerland (N26, Revolut) we believe that Yapeal wants to go too fast without having reached a sufficient size to support this movement.

It wouldn’t be surprising if Yapeal revamped its copy quickly.

To be continued…