Wise Switzerland Review (2024)

| Account opening | 9 |

|---|---|

| Usability | 8 |

| Features | 6 |

| Credit Card | 8 |

| Fees | 9 |

| Speed | 7 |

| Customer Service | 7 |

Wise Switzerland is a neobank that allows Swiss residents to open a free multi-currency account and benefit from the services offered by the bank using a mobile application.

Wise also offers a free Debit MasterCard attached to the multi-currency account.

The opening of the bank account is fast and easy.

Description

Multi-currency Borderless account

Wise Switzerland offers a free multi-currency bank account: the Borderless account

This account comes with the following benefits:

- Multi-currency account (more than 50 currencies)

- Account managed via a mobile app or desktop

- Free SEPA transfers

- Free Debit MasterCard

Free WISE account

Free WISE account

Don't have a WISE account yet? Use our link to open your Free WISE account and fee-free transfer of up to 500 GBP. 🙌

Get a Free WISE account ➡️

Wise Switzerland fees

It’s free to create a Wise account and there is no maintenance fee or minimum balance.

Wise Switzerland provides you with bank accounts under your name in several countries. So you can receive money locally, without any surcharge.

You can add money to your Wise account in 19 currencies: AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HRK, HUF, JPY, NOK, NZD, PLN, RON, SEK, SGD, TRY and USD

You can also keep 50 currencies on your multi-currency Borderless account, and convert them at any time.

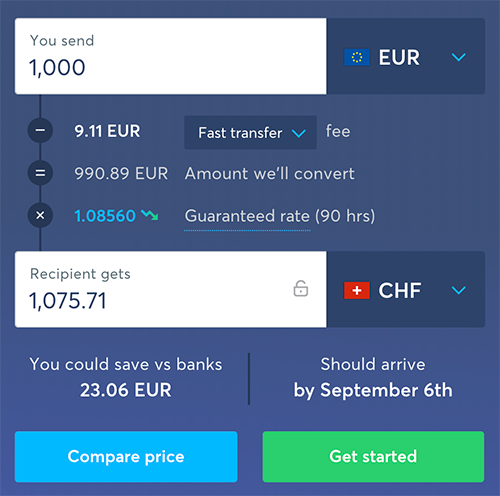

Wise Switzerland use interbank currency rate and apply their fees in full transparency.

| Wise Account | Prices |

|---|---|

| Create an account | Free |

| Get a UK account with account number and sort code | Free |

| Obtain a U.S. account with Account and Routing number | Free |

| Get a European IBAN | Free |

| Obtain an Australian account with Account and BSB number | Free |

| Get a bank account in New Zealand | Free |

| Get a bank account in Hungary | Free |

| Get a bank account in Romania | Free |

| Get a bank account in Singapore | Free |

| Hold 50+ currencies | Free |

| Send money | from 0.43% |

| Receive money AUD, CAD, EUR, GBP, HUF, NZD, RON, SGD, USD (non-wire) | Free |

| Receive USD with ACH or bank debit | Free |

| Receive a transfer in USD | $4.14 |

| Direct Debit in EUR | Free |

| Direct Debit in GBP | Free |

| Direct Debit in AUD | Free |

Wise Switzerland Mastercard Borderless debit card

Unlike CurrencyFair or b-sharpe, Wise Switzerland offers a Debit MasterCard attached to your multi-currency account.

This Debit Mastercard is free and you can use to spend any currency available on your Wise account: USD, EUR, GBP or other currencies, the card will automatically select the currency depending on the country where you are making a purchase.

| Wise Debit Card | Fees |

|---|---|

| Order a Wise card | CHF 8 |

| Card replacement | CHF 4 |

| Spend the currencies in your account | Free |

| 2 free Bancomat withdrawals, up to CHF 200/month | ✅ |

| ATM fees over CHF 200/month | 1.75% + 0.50 / withdrawal |

| Beyond 2 withdrawals per month | 1.75% + 0.50 / withdrawal |

Why use Wise Switzerland rather than Zak or Neon?

Wise Switzerland use the real-time interbank exchange rate: the one displayed in Google when your search “EUR CHF exchange rate” for example. Wise add a small fee that is displayed in full transparency on their website:

Zak and Neon use an exchange rate that is only updated once a day and on average slightly higher than the actual exchange rate (in order to cover exchange rate differences between 2 days):

- Zak use an exchange rate set by Viseca (non available on the web)

- Neon use the Mastercard exchange rate

Wise Switzerland is usually cheaper than Neon and Zak. You can also compare Wise fees with other banks (UBS, BCV, PostFinance,…) on the Monito website.

Neon Bank

Neon Bank

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the promo code NEONEO before 30 April 2024 to receive up to 30 CHF cashback on the trading fees of your first 3 trades + your FREE debit card 🙌

Get CHF 30 Free with Neon ➡️

Additional information

Specification: Wise Switzerland Review (2024)

| Account | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

| Trading | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

There are no reviews yet.